Question: corporate finance can you please do it and explain A company currently has no debt. The company's stock has a market capitalization of 280 million

corporate finance can you please do it and explain

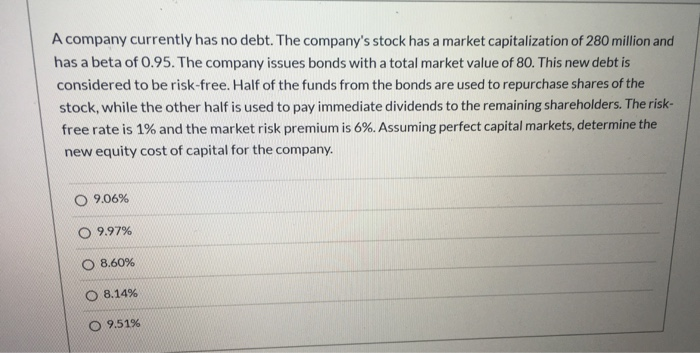

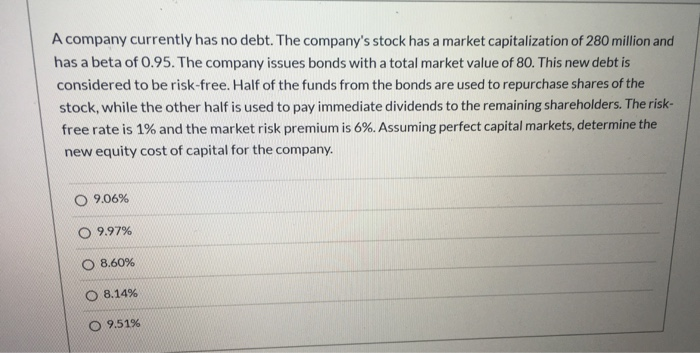

A company currently has no debt. The company's stock has a market capitalization of 280 million and has a beta of 0.95. The company issues bonds with a total market value of 80. This new debt is considered to be risk-free. Half of the funds from the bonds are used to repurchase shares of the stock, while the other half is used to pay immediate dividends to the remaining shareholders. The risk- free rate is 1% and the market risk premium is 6%. Assuming perfect capital markets, determine the new equity cost of capital for the company. 09.06% O 9.97% 8.60% 8.14% 9.51%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock