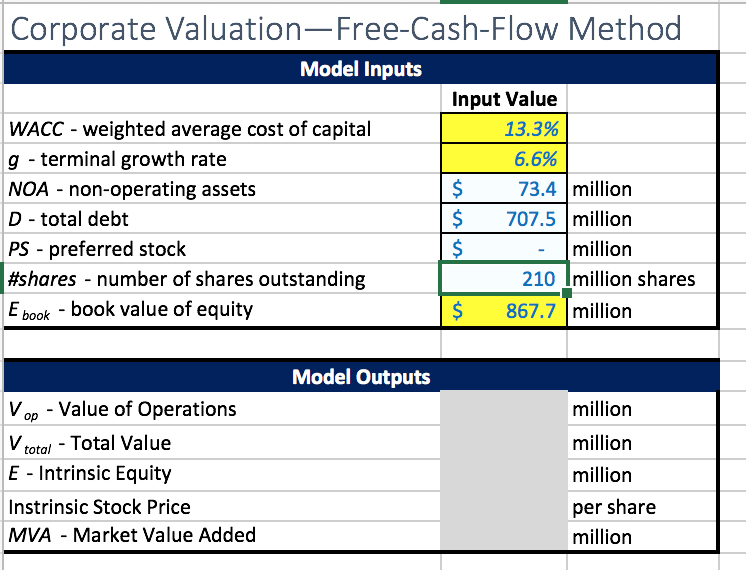

Question: Corporate Valuation-Free-Cash-Flow Method Model Inputs Input Value WACC - weighted average cost of capital 13.3% g - terminal growth rate 6.6% NOA - non-operating assets

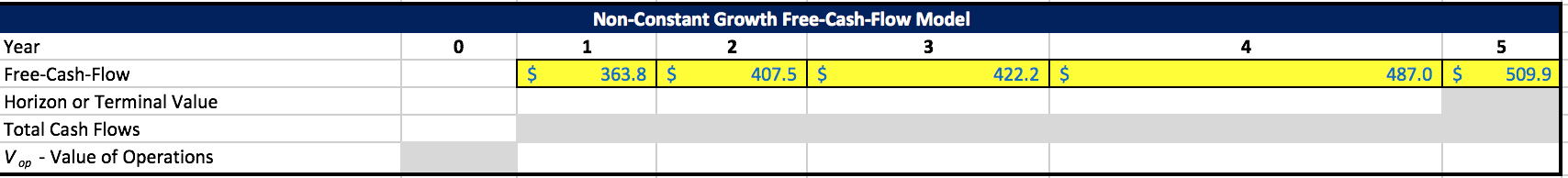

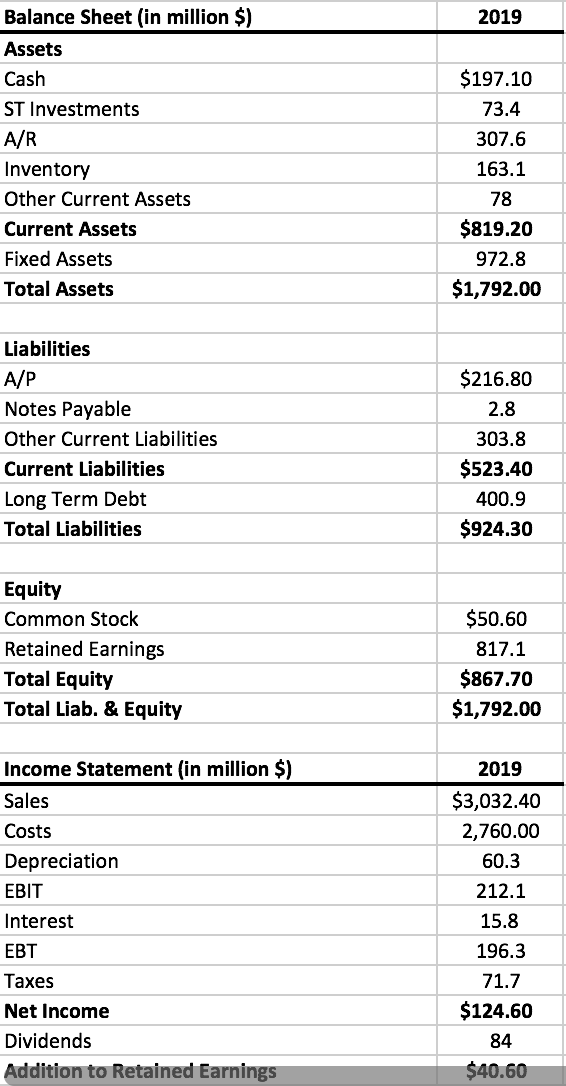

Corporate Valuation-Free-Cash-Flow Method Model Inputs Input Value WACC - weighted average cost of capital 13.3% g - terminal growth rate 6.6% NOA - non-operating assets $ 73.4 million D - total debt $ 707.5 million PS - preferred stock $ - million #shares - number of shares outstanding 210 Imillion shares Ebook - book value of equity $ 867.7 million Model Outputs Vop - Value of Operations V total - Total Value E - Intrinsic Equity Instrinsic Stock Price MVA - Market Value Added million million million per share million 0 Non-Constant Growth Free-Cash-Flow Model 1 2 363.8 $ 407.5 $ 5 509.9 $ 422.2 $ 487.0 $ Year Free-Cash-Flow Horizon or Terminal Value Total Cash Flows Vop - Value of Operations 2019 Balance Sheet (in million $) Assets Cash ST Investments A/R Inventory Other Current Assets Current Assets Fixed Assets Total Assets $197.10 73.4 307.6 163.1 78 $819.20 $1,792.00 Liabilities A/P Notes Payable Other Current Liabilities Current Liabilities Long Term Debt Total Liabilities $216.80 2.8 303.8 $523.40 400.9 $924.30 Equity Common Stock Retained Earnings Total Equity Total Liab. & Equity $50.60 817.1 $867.70 $1,792.00 Income Statement in million $) Sales Costs Depreciation EBIT Interest EBT Taxes Net Income Dividends Addition to Retained Earnings 2019 $3,032.40 2,760.00 60.3 212.1 15.8 196.3 71.7 $124.60 84 $40.60 Corporate Valuation-Free-Cash-Flow Method Model Inputs Input Value WACC - weighted average cost of capital 13.3% g - terminal growth rate 6.6% NOA - non-operating assets $ 73.4 million D - total debt $ 707.5 million PS - preferred stock $ - million #shares - number of shares outstanding 210 Imillion shares Ebook - book value of equity $ 867.7 million Model Outputs Vop - Value of Operations V total - Total Value E - Intrinsic Equity Instrinsic Stock Price MVA - Market Value Added million million million per share million 0 Non-Constant Growth Free-Cash-Flow Model 1 2 363.8 $ 407.5 $ 5 509.9 $ 422.2 $ 487.0 $ Year Free-Cash-Flow Horizon or Terminal Value Total Cash Flows Vop - Value of Operations 2019 Balance Sheet (in million $) Assets Cash ST Investments A/R Inventory Other Current Assets Current Assets Fixed Assets Total Assets $197.10 73.4 307.6 163.1 78 $819.20 $1,792.00 Liabilities A/P Notes Payable Other Current Liabilities Current Liabilities Long Term Debt Total Liabilities $216.80 2.8 303.8 $523.40 400.9 $924.30 Equity Common Stock Retained Earnings Total Equity Total Liab. & Equity $50.60 817.1 $867.70 $1,792.00 Income Statement in million $) Sales Costs Depreciation EBIT Interest EBT Taxes Net Income Dividends Addition to Retained Earnings 2019 $3,032.40 2,760.00 60.3 212.1 15.8 196.3 71.7 $124.60 84 $40.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts