Question: Corporation: Target is also considering structuring its business as a corporation, but is aware that there are a lot of complex issues to consider when

Corporation: Target is also considering structuring its business as a corporation, but is aware that there are a lot of complex issues to consider when accounting for an incorporated entity. The company is concerned about the following key areas: A. Differentiate between various forms of bankruptcy and restructuring that the firm should understand. 1. Summarize the key points of interest if the firm fell on hard times and had to file voluntary bankruptcy. What ethical implications should be considered when debating whether or not to file bankruptcy? 2. Identify the key areas of concern if the firm fell on hard times and their creditors forced them into bankruptcy. What defenses are available in this situation? 3. Illustrate hypothetical calculations that would be done to help creditors understand how much money they might receive if the company were to liquidate. Ensure all information is entered accurately. Please refer to the illustration (Exhibit 13.2) on page 592 from your textbook to view potential calculations.

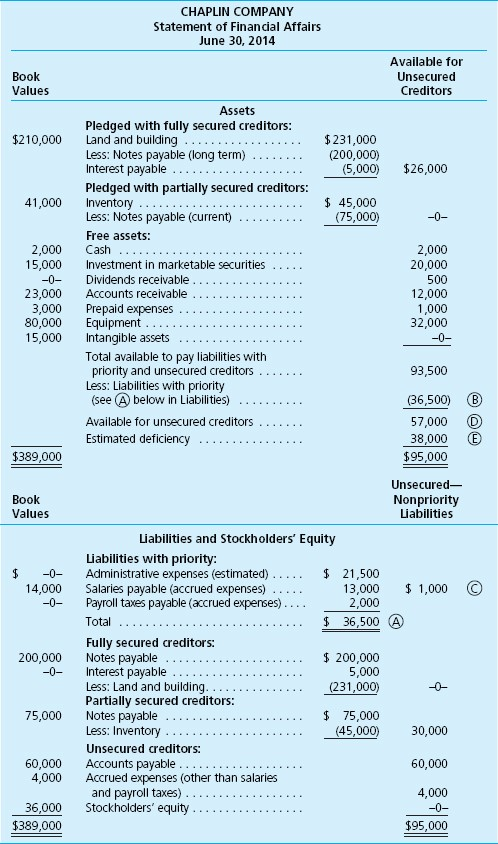

Exhibit 13.2:

| 1. | The current and noncurrent distinctions usually applied to assets and liabilities are omitted from this financial statement. Because the company is on the verge of going out of business, such classifications are meaningless. Instead, the statement is designed to separate secured from unsecured balances. |

| 2. | Book values are included on the left side of the schedule but only for informational purposes. These figures are not relevant in a bankruptcy. All assets are reported at estimated net realizable value, whereas liabilities are shown at the amount required for settlement. |

| 3. | Page 594 Both the dividend receivable and the interest payable are included in Exhibit 13.2, although neither has been recorded to date by the company on its balance sheet. The payroll tax liability also is reported at the amount the company presently owes. The statement of financial affairs is designed to disclose currently updated figures. |

| 4. | Liabilities having priority are individually identified within the liability section (Point A). Because these claims will be paid before other unsecured creditors, the $36,500 total is subtracted directly from the free assets (Point B). Although not yet incurred, estimated administrative costs are included in this category because such expenses will be necessary for a liquidation. Salaries are also considered priority liabilities. However, the $1,000 owed to one employee in excess of the individual $12,475 limit is separated and shown as an unsecured claim (Point C). |

| 5. | According to this statement, if liquidation occurs, Chaplin expects to have $57,000 in free assets remaining after settling all liabilities with priority (Point D). Unfortunately, the liability section shows unsecured claims of $95,000. These creditors, therefore, face a $38,000 loss ($95,000 $57,000) if the company is liquidated (Point E). This final distribution is often stated as a percentage: Unsecured creditors can anticipate receiving 60 percent of their claims. An individual, for example, to whom this company owes an unsecured balance of $400 should anticipate collecting only $240 ($400 60%) following liquidation. However, this is merely an estimation. |

| 6. | If the statement of financial affairs had shown the company with more free assets (after subtracting liabilities with priority) than the total amount of unsecured claims, all of the creditors could expect to be paid in full with any excess money going to Chaplin's stockholders. |

CHAPLIN COMPANY Statement of Financial Affairs June 30, 2014 Available for Book Unsecured Values Creditors Assets Pledged with fully secured creditors: $210,000 Land and building 231,000 Less: Notes payable (long term) 00.000 Interest payable (5,000) $26,000 Pledged with partially secured creditors: 45,000 41.000 inventory Less: Notes payable (currenty 75,000) Free assets 2.000 Cash 2,000 15,000 nvestment in marketable securities 20,000 Dividends receivable 500 23,000 Accounts receivable 12,000 3,000 Prepaid expenses 1,000 80,000 Equipment 32,000 15,000 Intangible assets Total available to pay liabilities with priority and unsecured creditors 93,500 Less: Liabilities with priority see A B6,500) below n Liabilities) 57,000 D Available for unsecured creditors 38,000 Estimated deficiency $389,000 $95,000 Unsecured- Book Non priority Values Liabilities Liabilities and Stockholders' Equity Liabilities with priority: 2 Administrative expenses estimated 1,500 13,000 1,000 14,000 Salaries payable (accrued expenses) -0- Payroll taxes payable (accrued expenses) 2,000 36,500 (A Total Fully secured creditors: 200,000 200,000 Notes payable -0- Interest payable 5,000 Less: Land and building (231,000) Partially secured creditors: 75,000 75.000 Notes payable Less: Inventory 45,000) 30.000 Unsecured creditors: 60.000 Accounts payable 60.000 4,000 Accrued expenses (other than salaries and payroll taxes) 4.000 36,000 Stockholders' equity $389,000 $95,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts