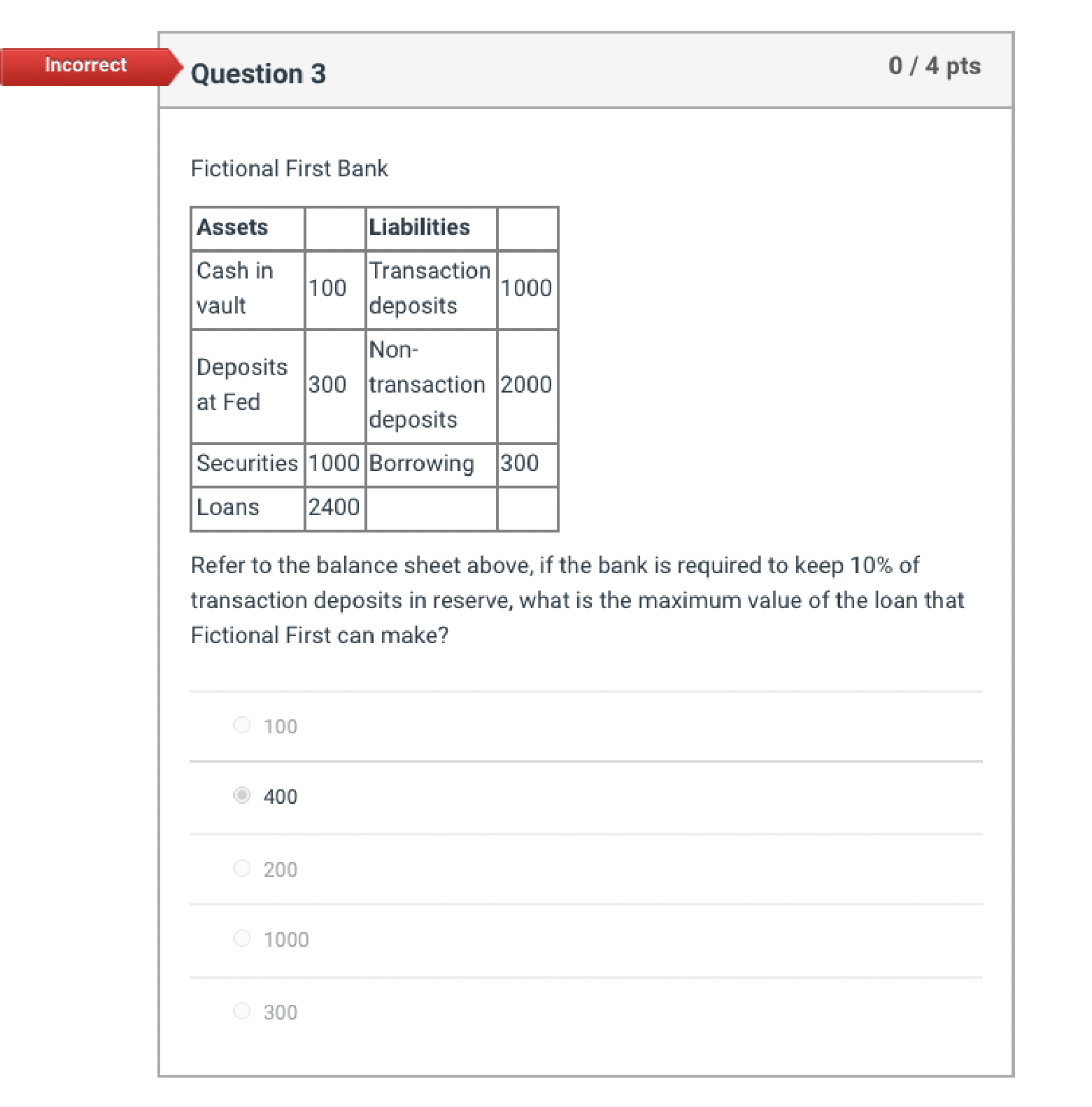

Question: Correct Answer and explain why. Incorrect Question 3 0 / 4 pts Fictional First Bank Assets Liabilities Cash in Transaction 100 1000 vault deposits Non-

Correct Answer and explain why.

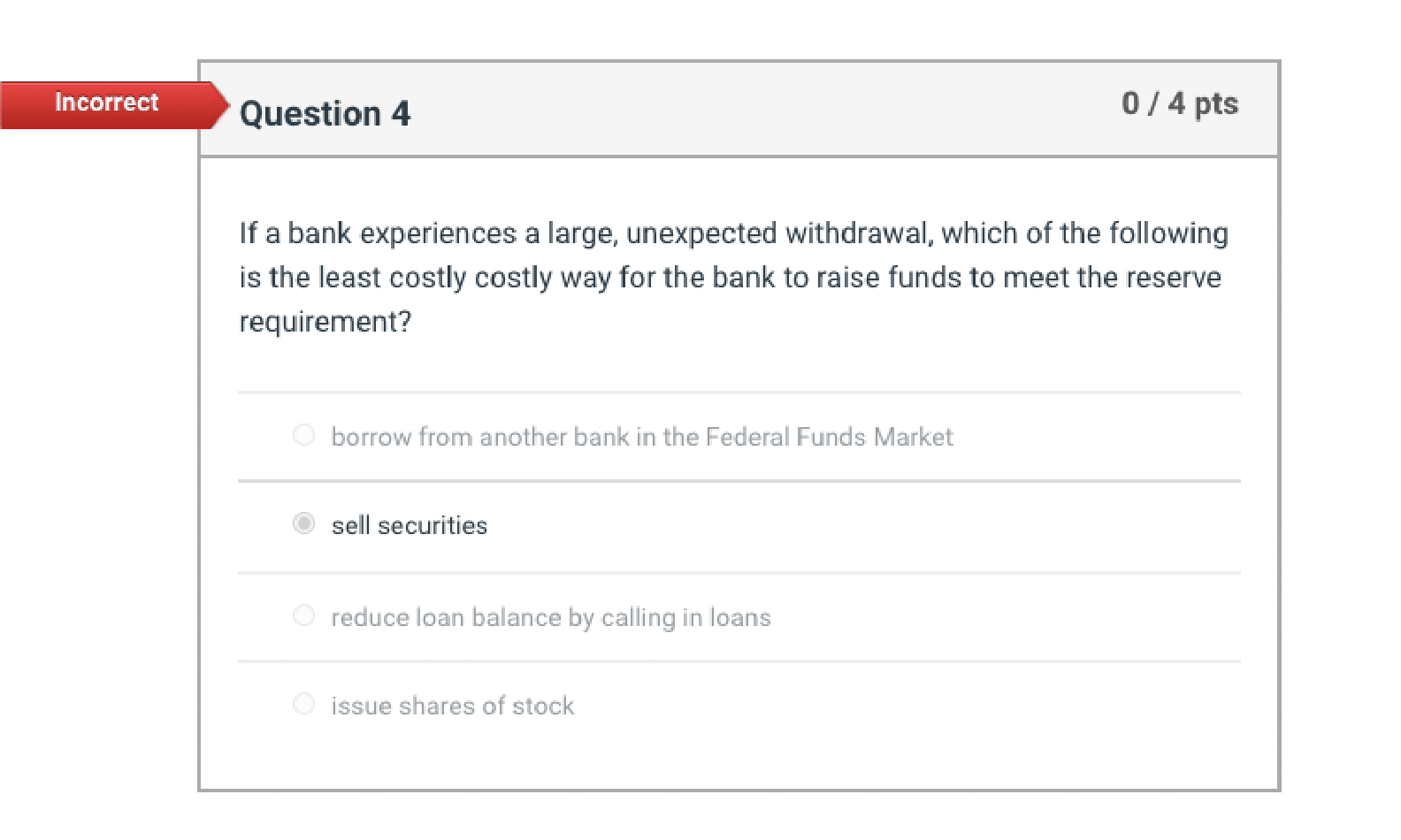

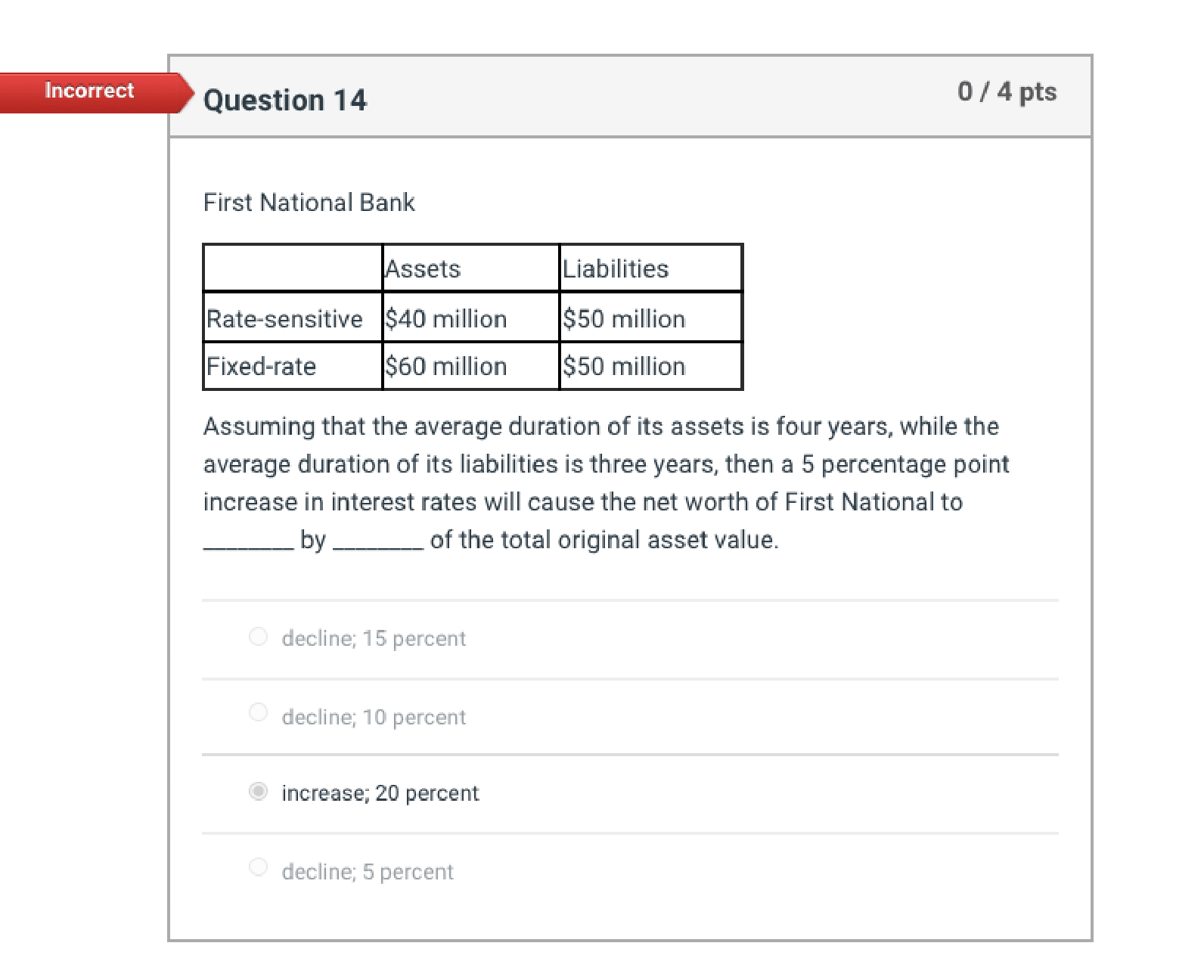

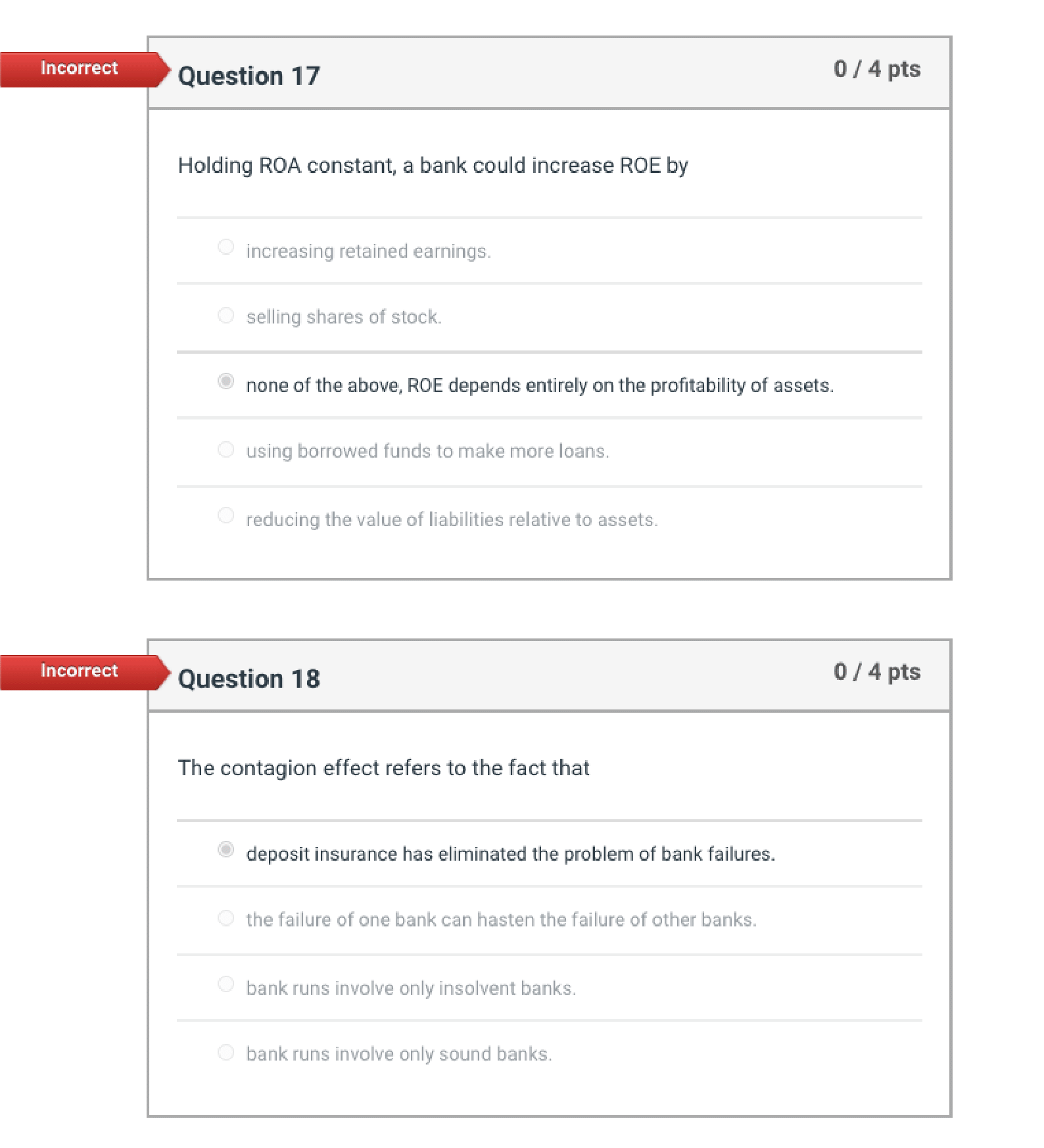

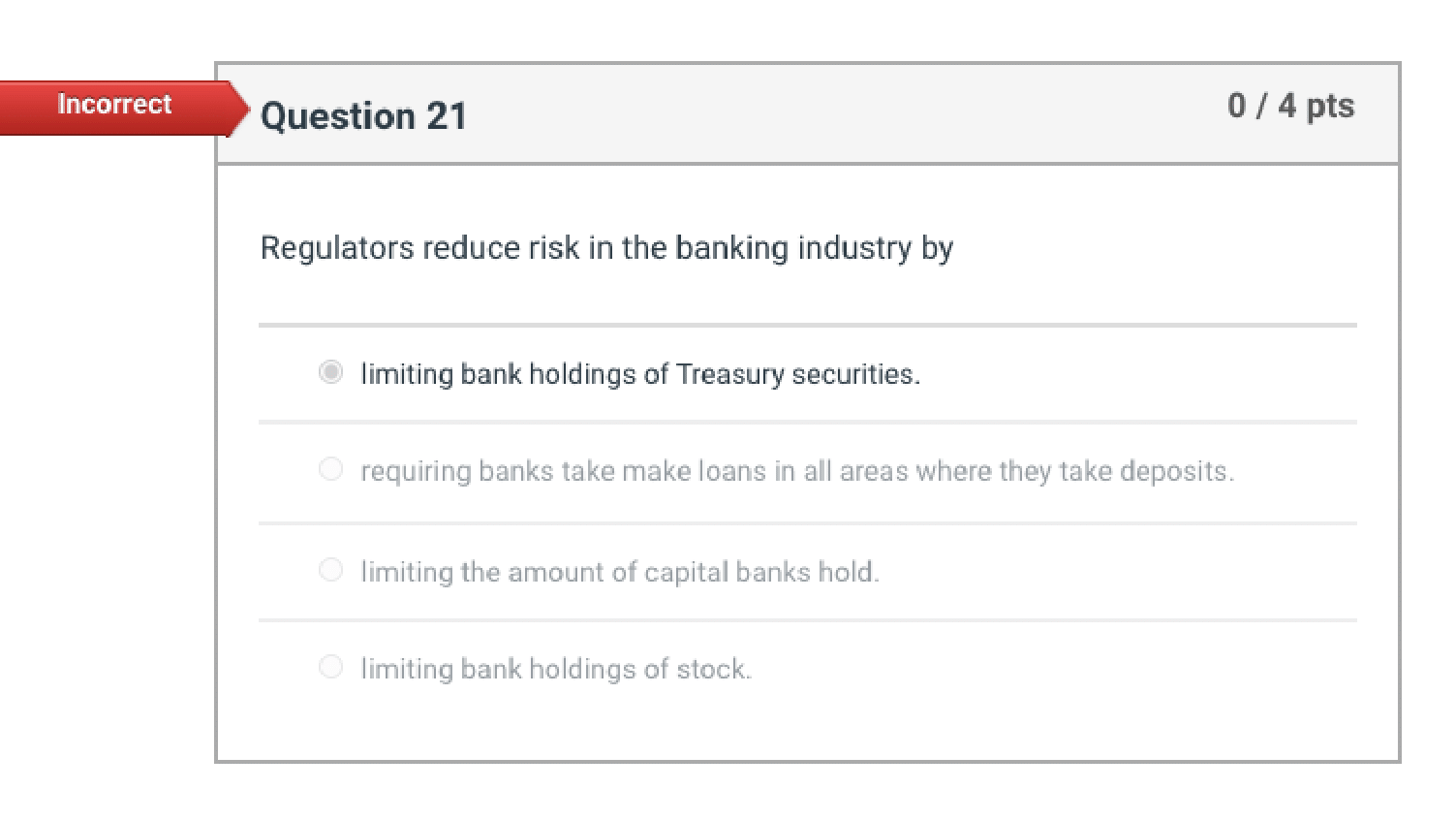

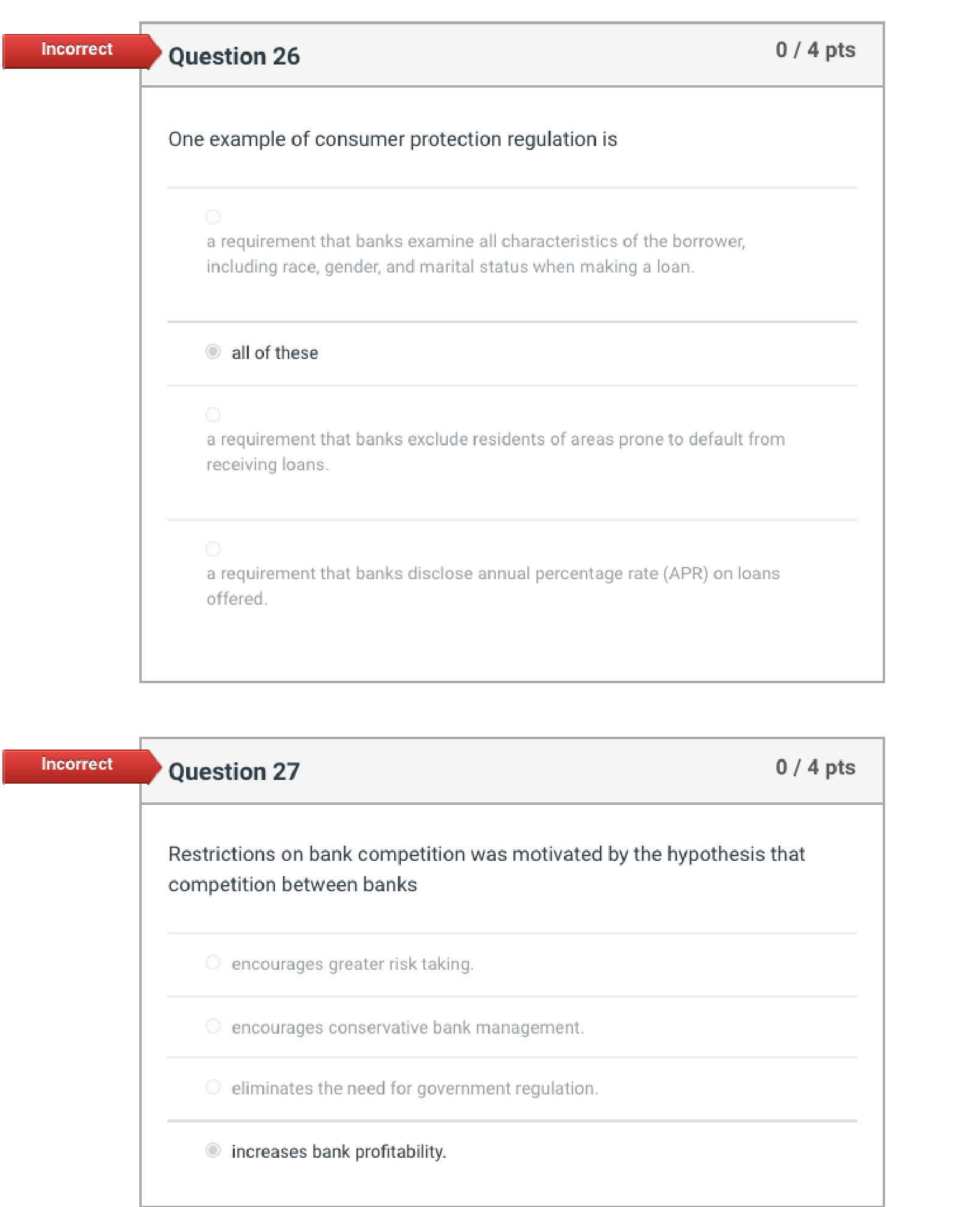

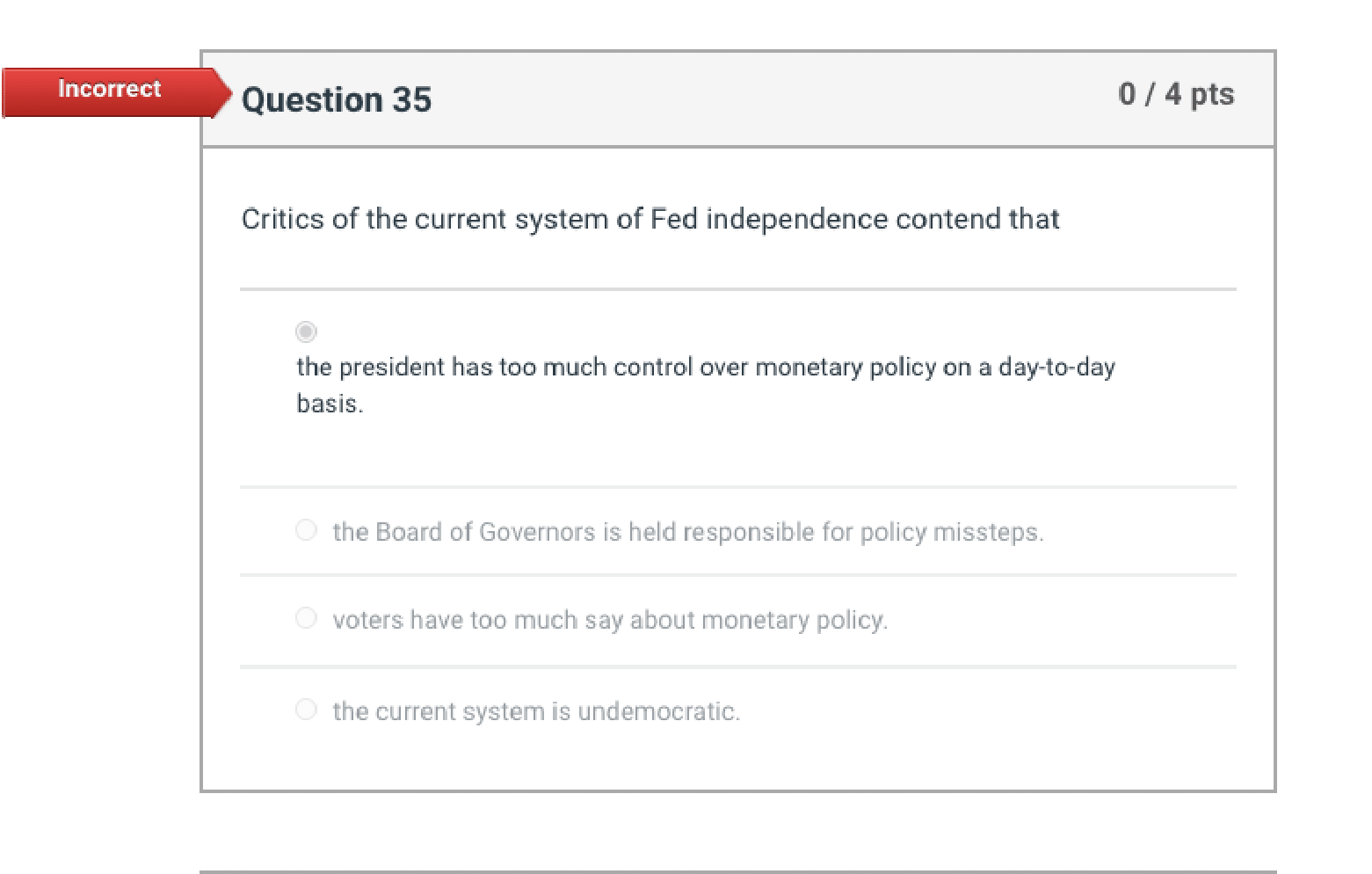

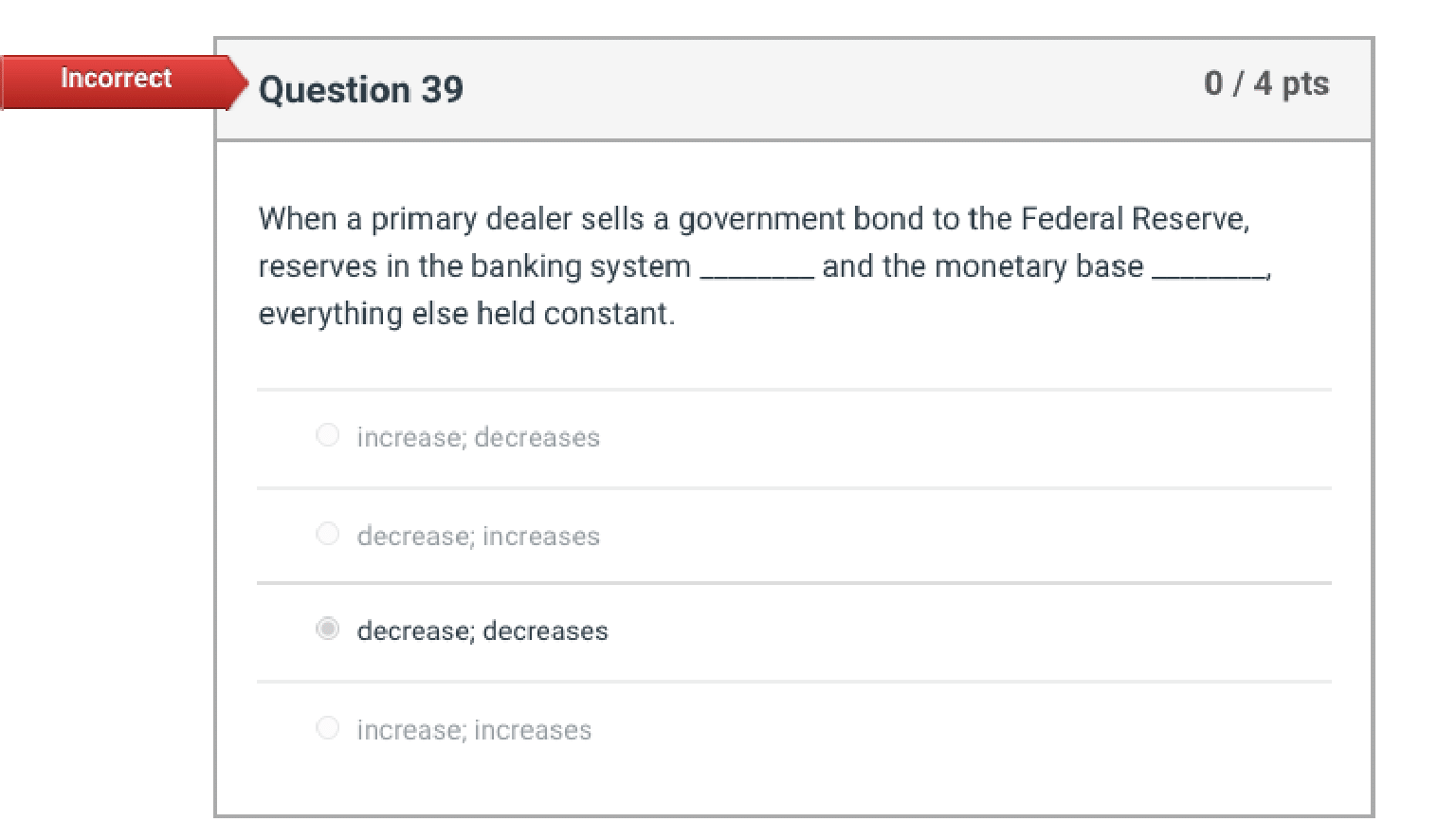

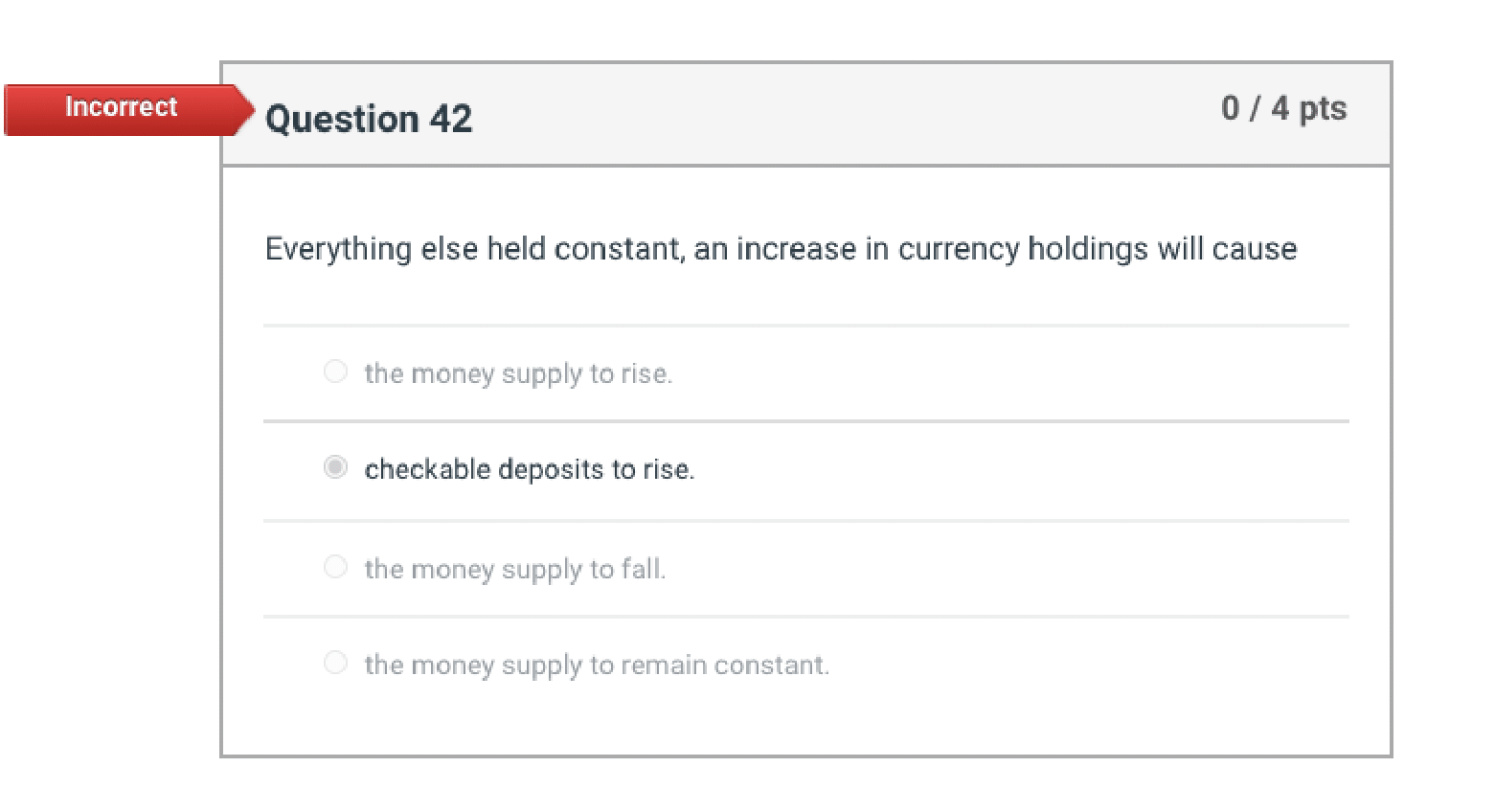

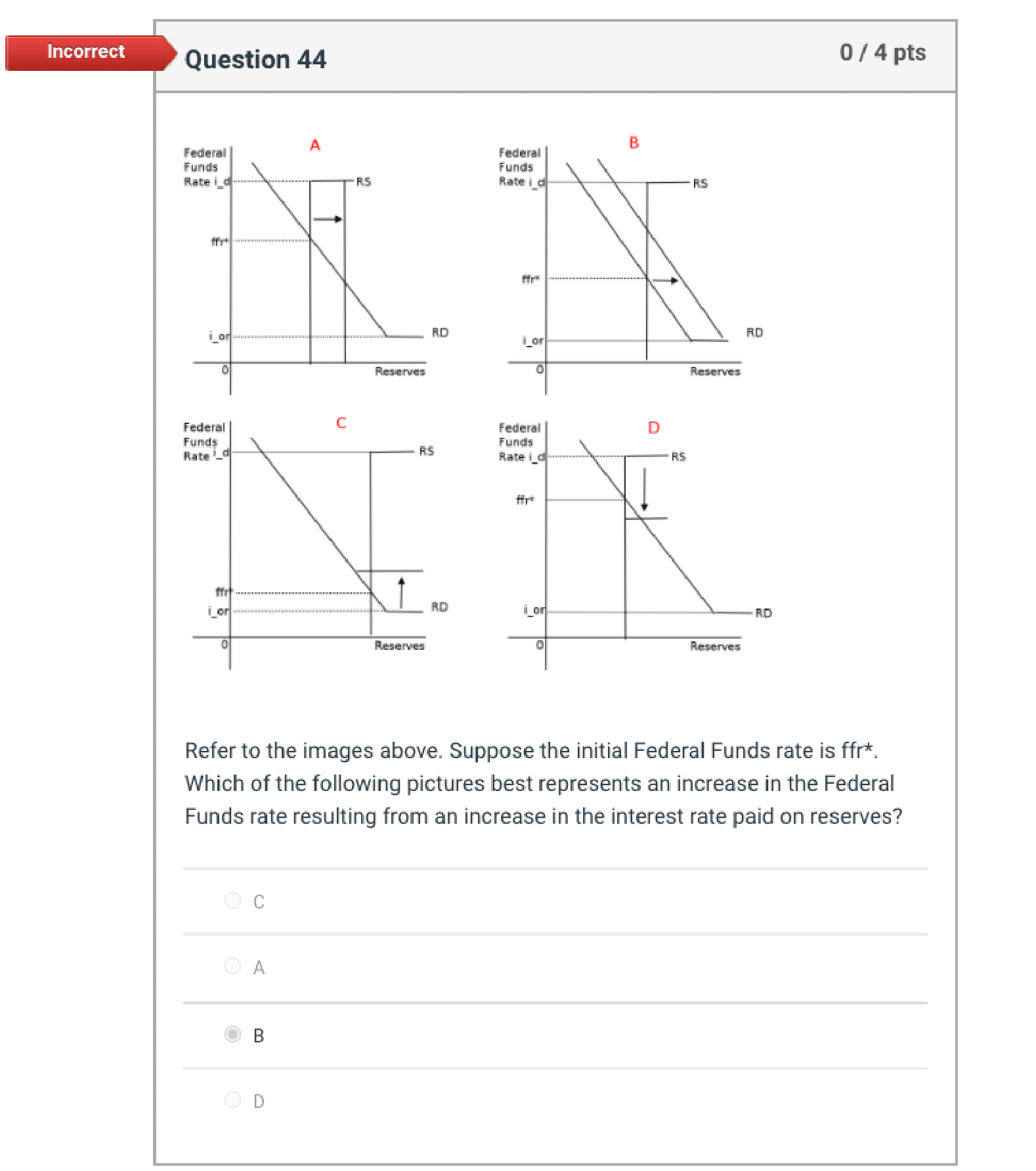

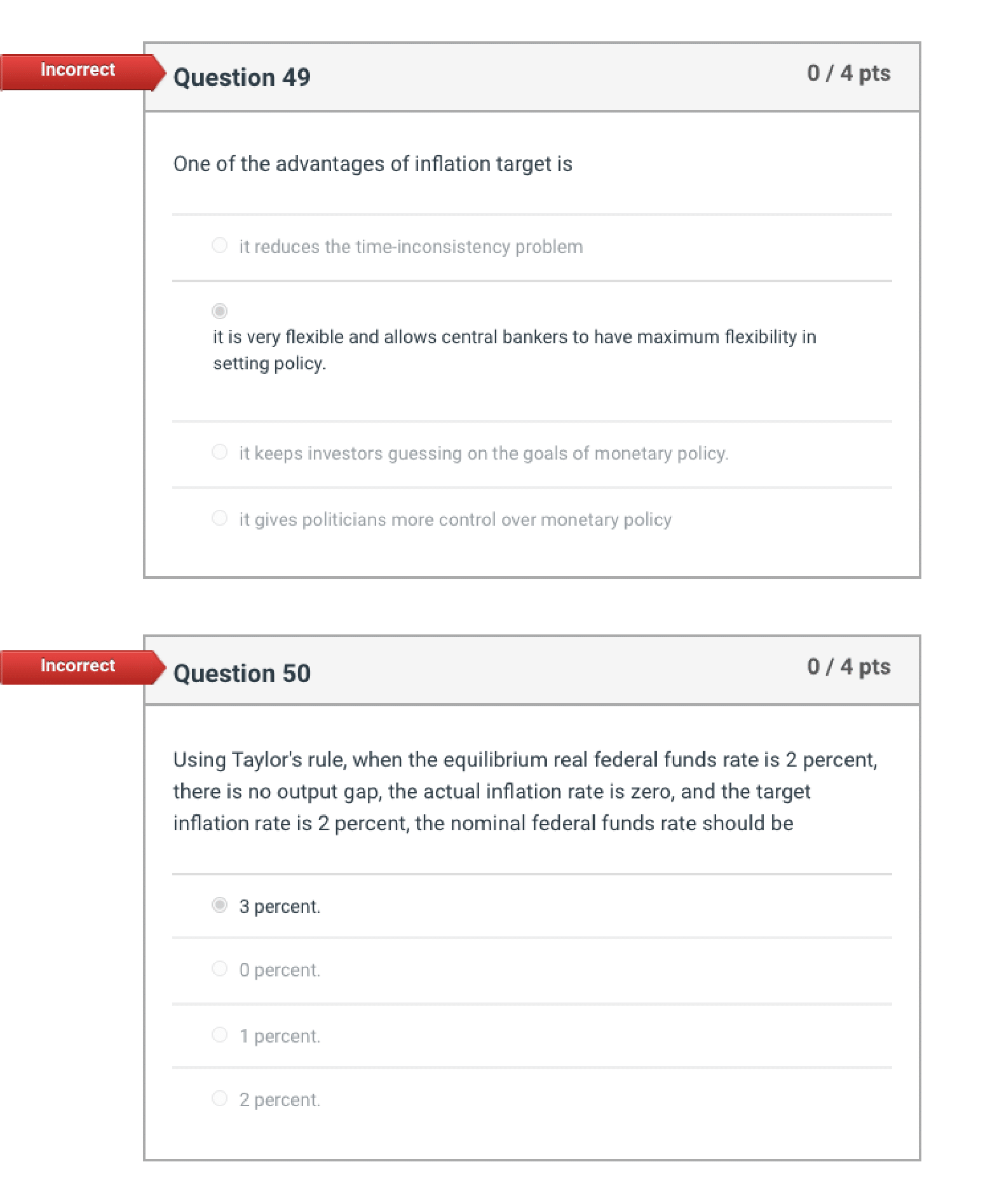

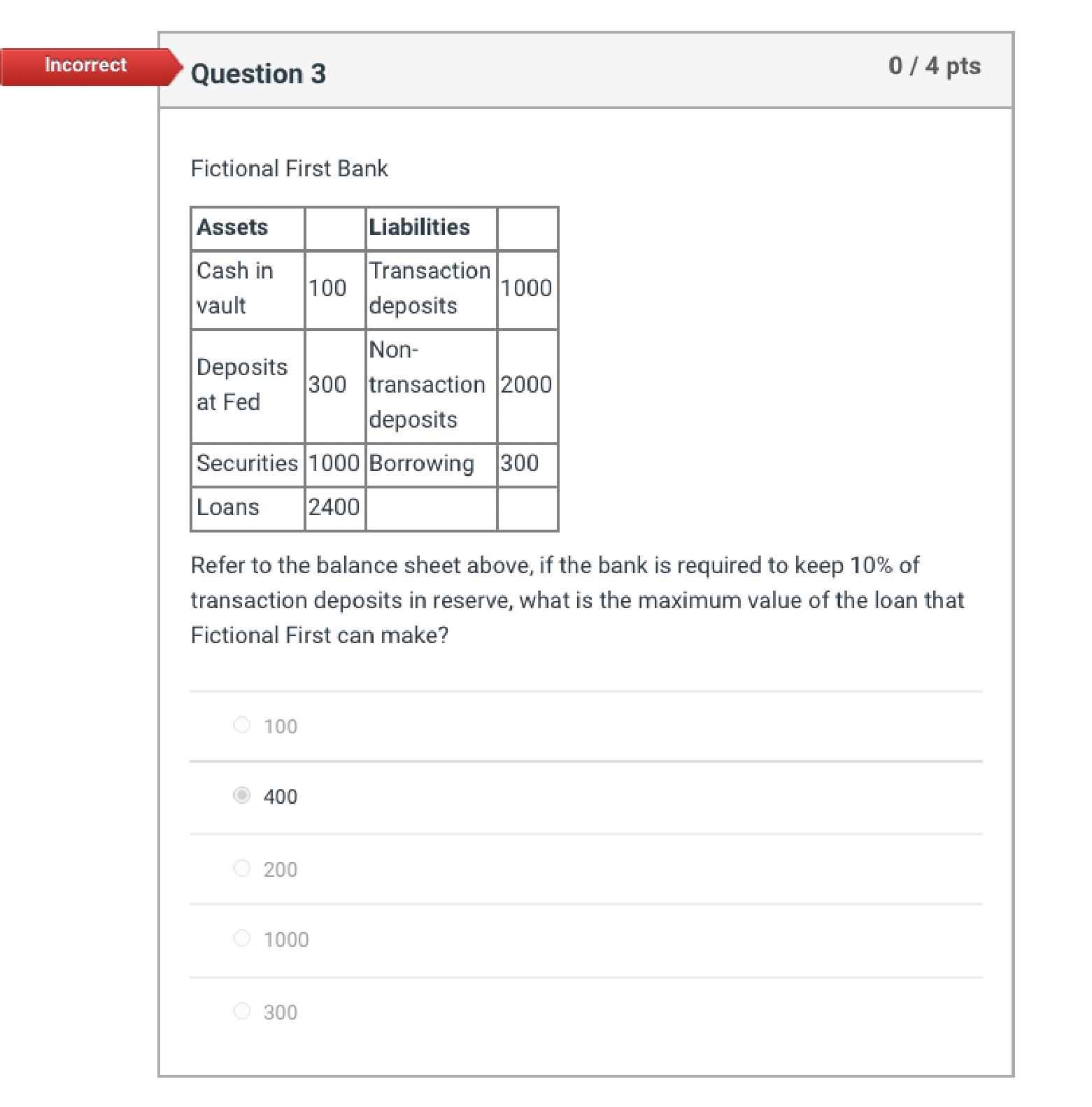

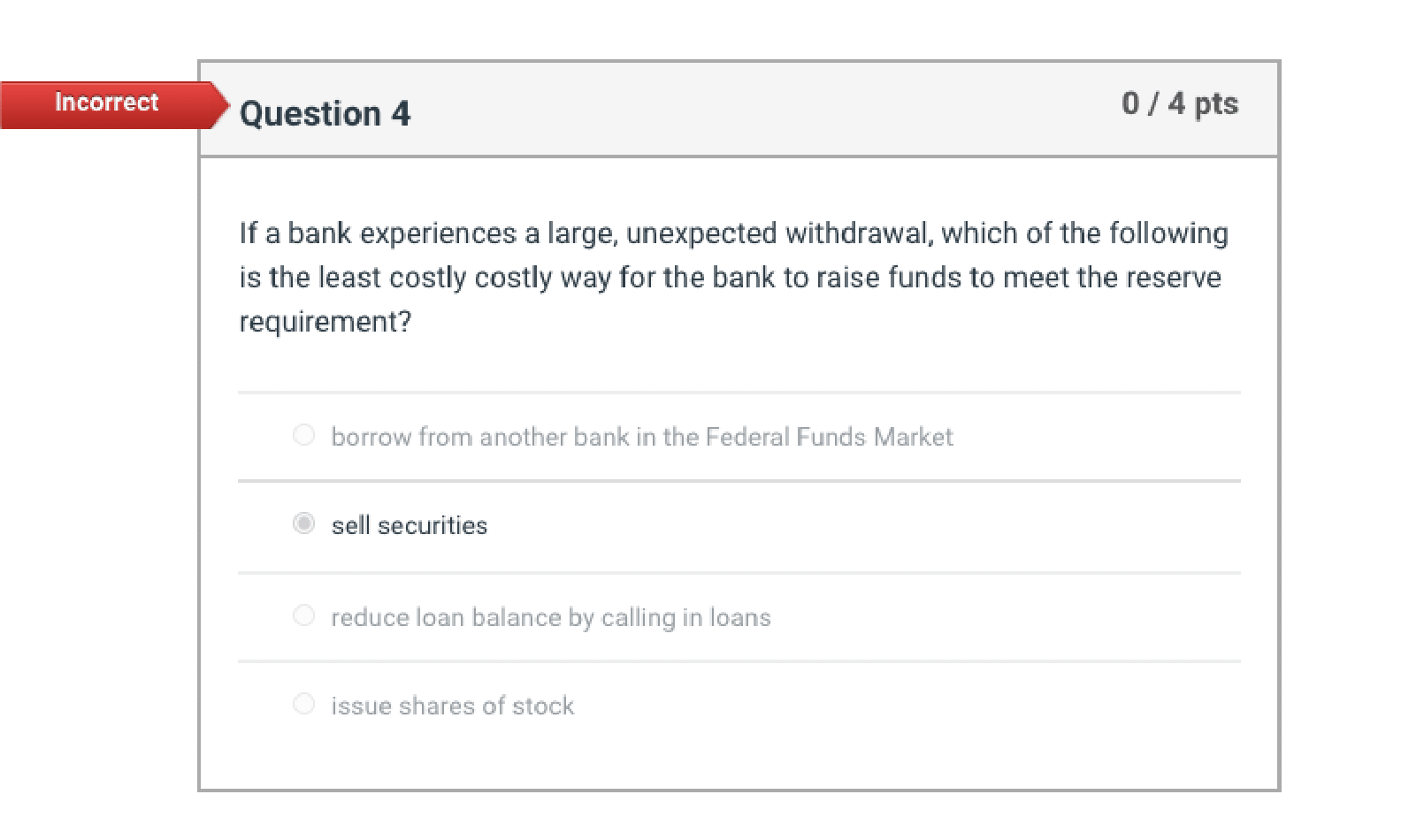

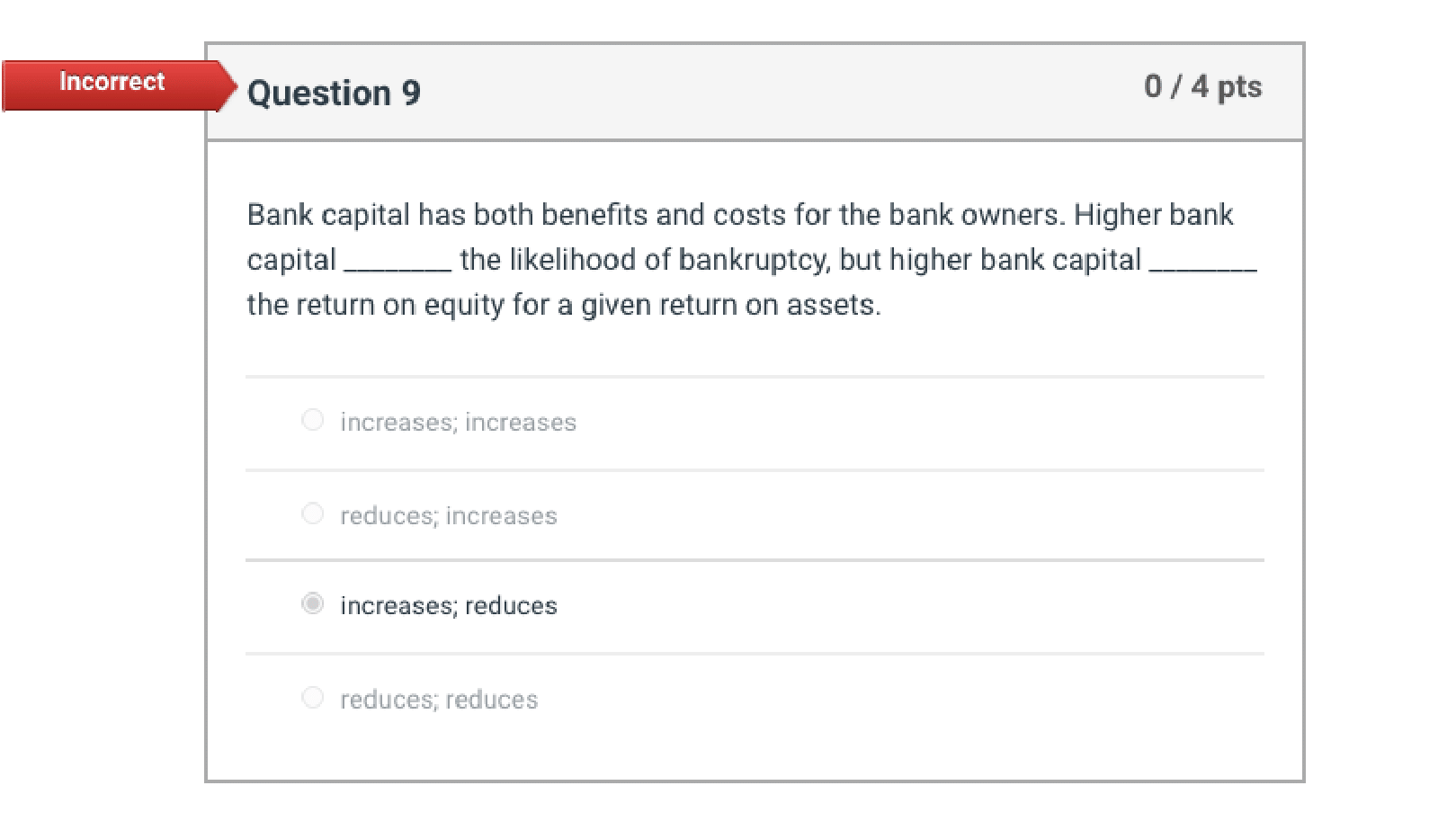

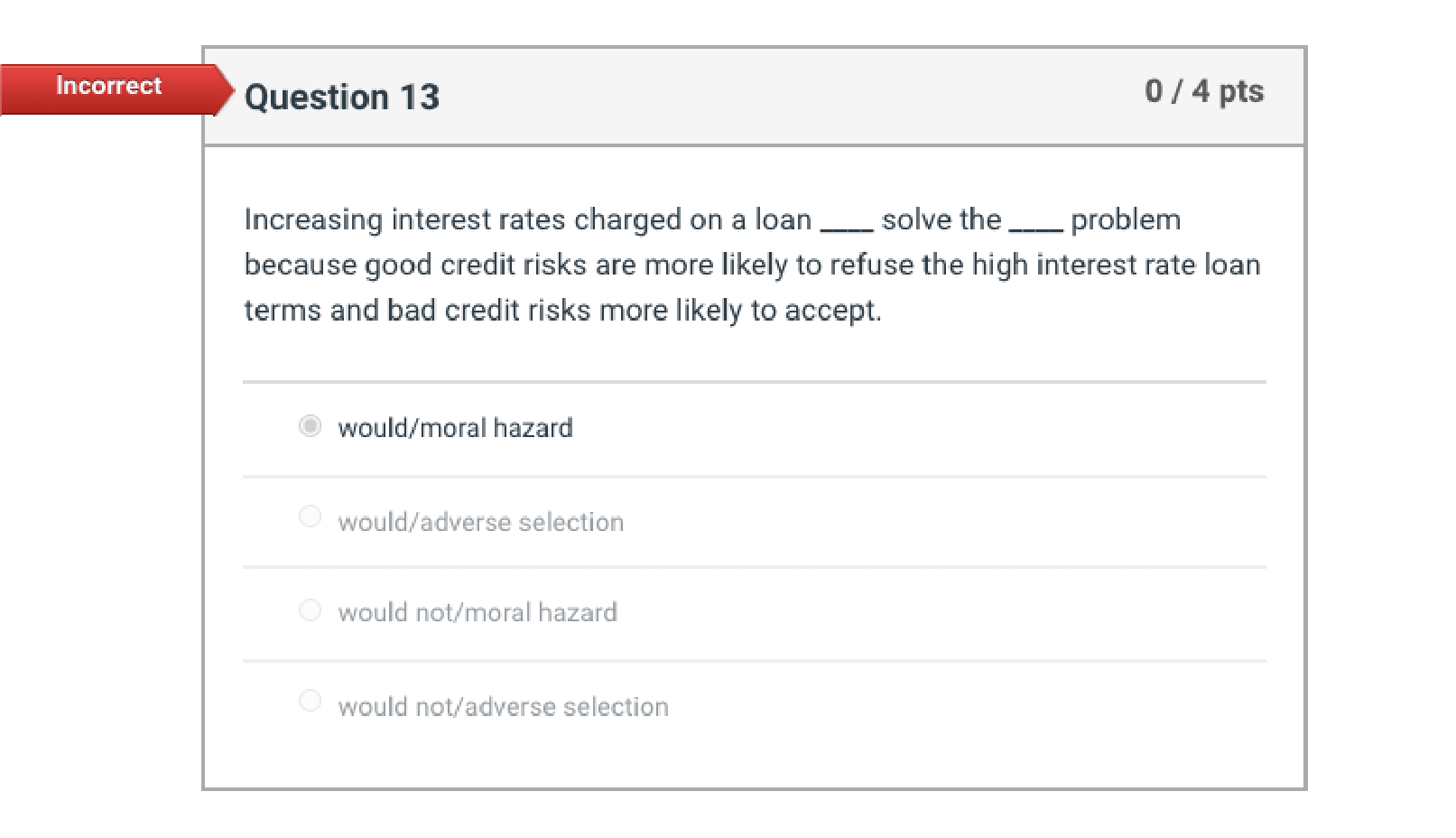

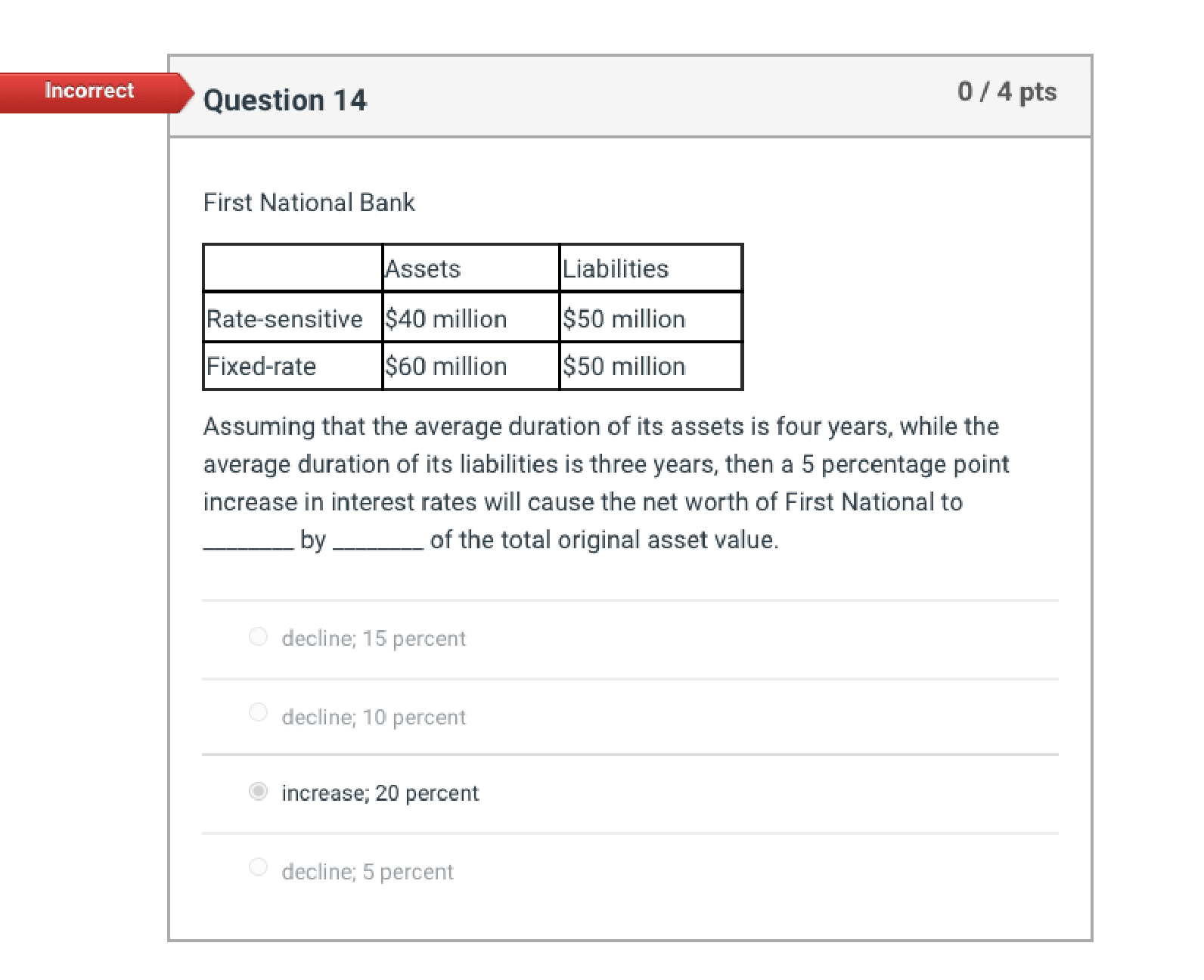

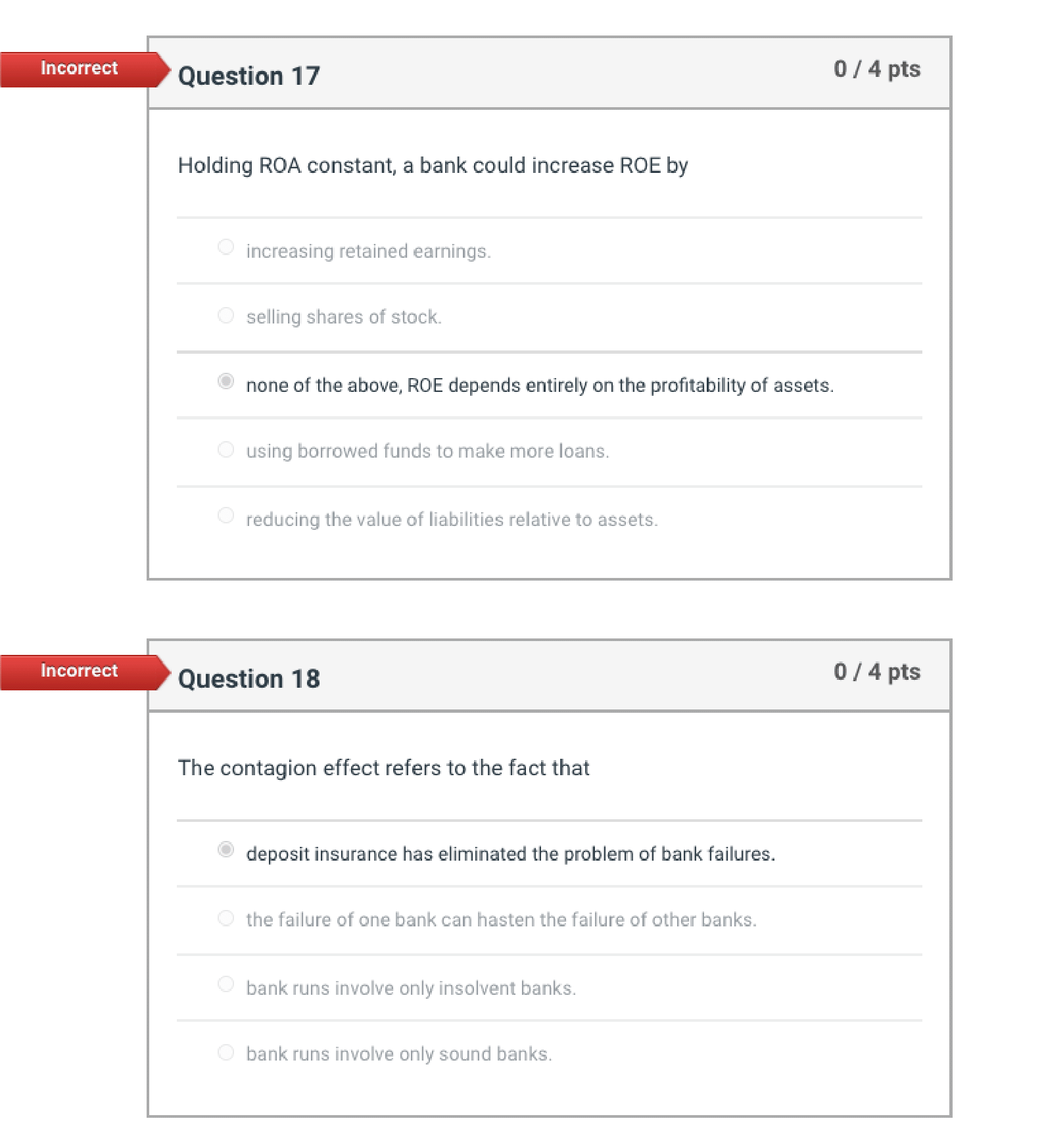

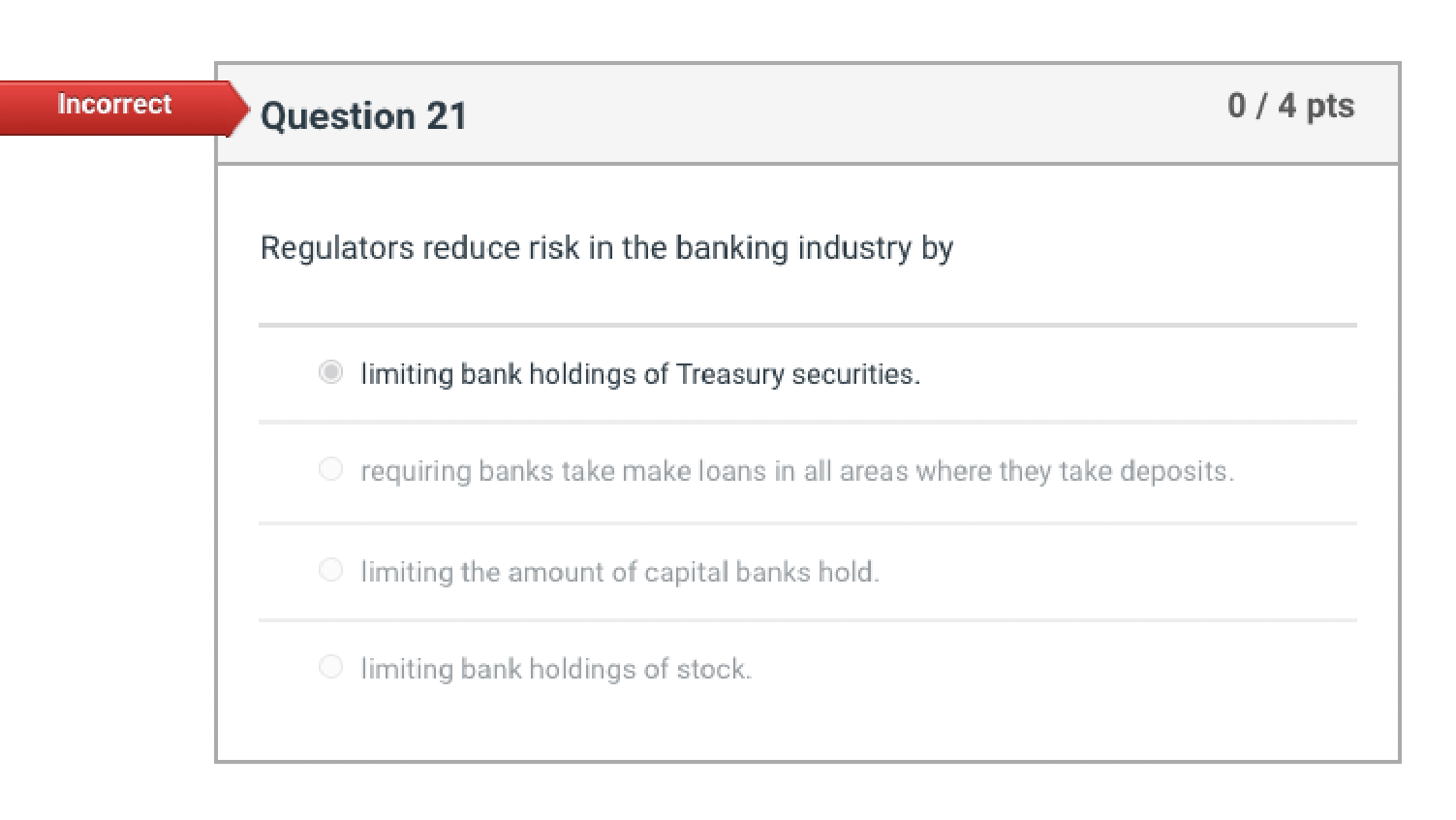

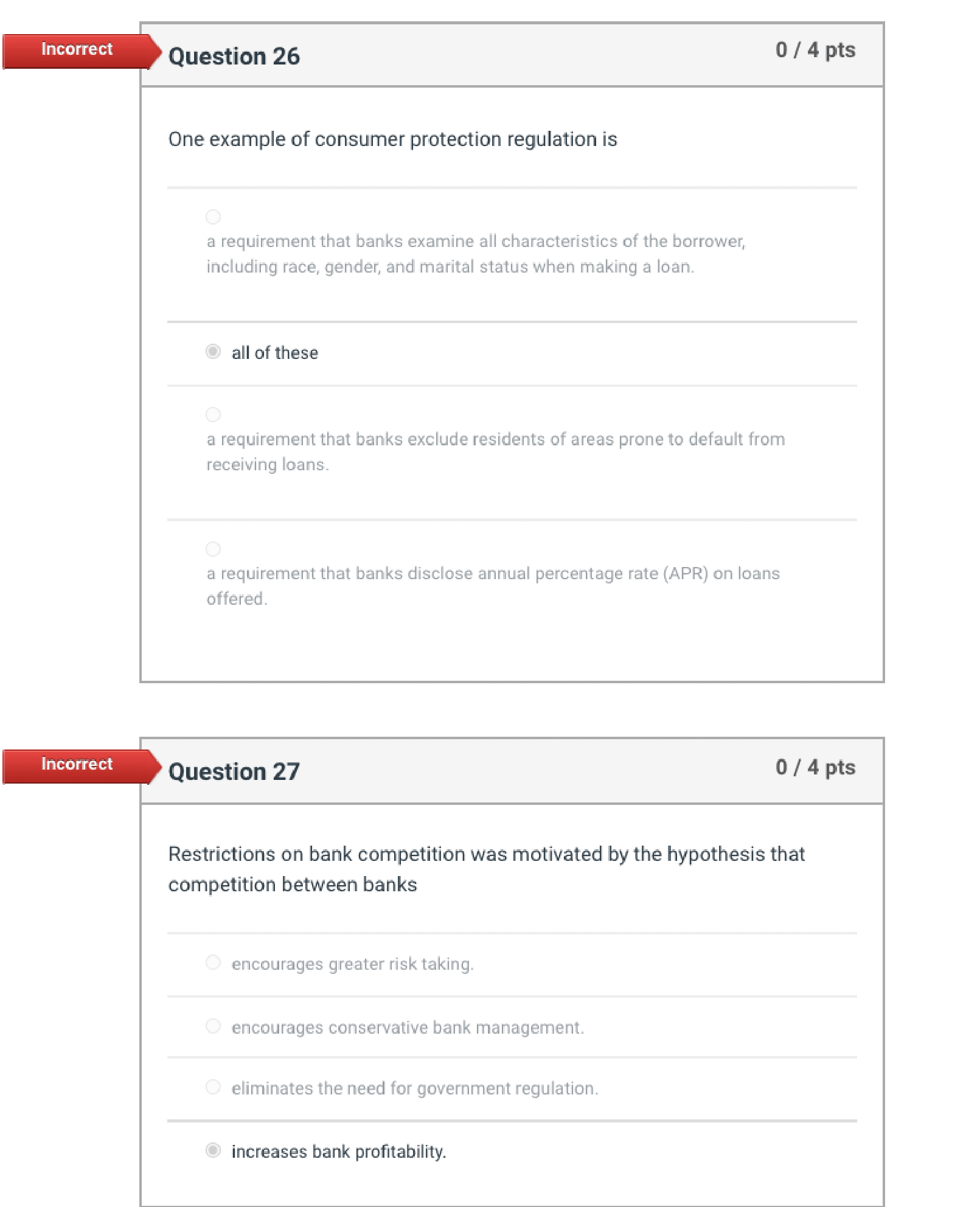

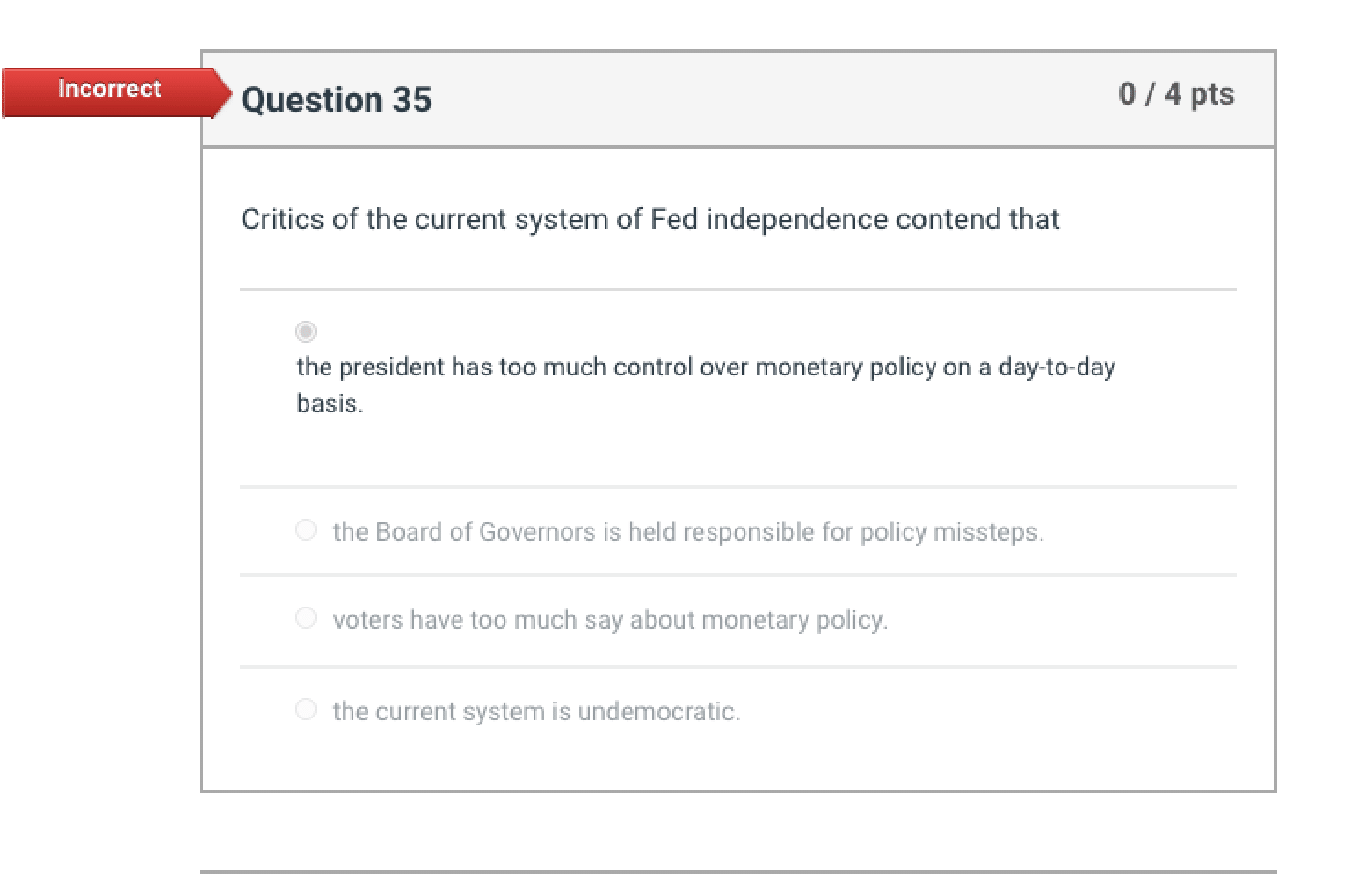

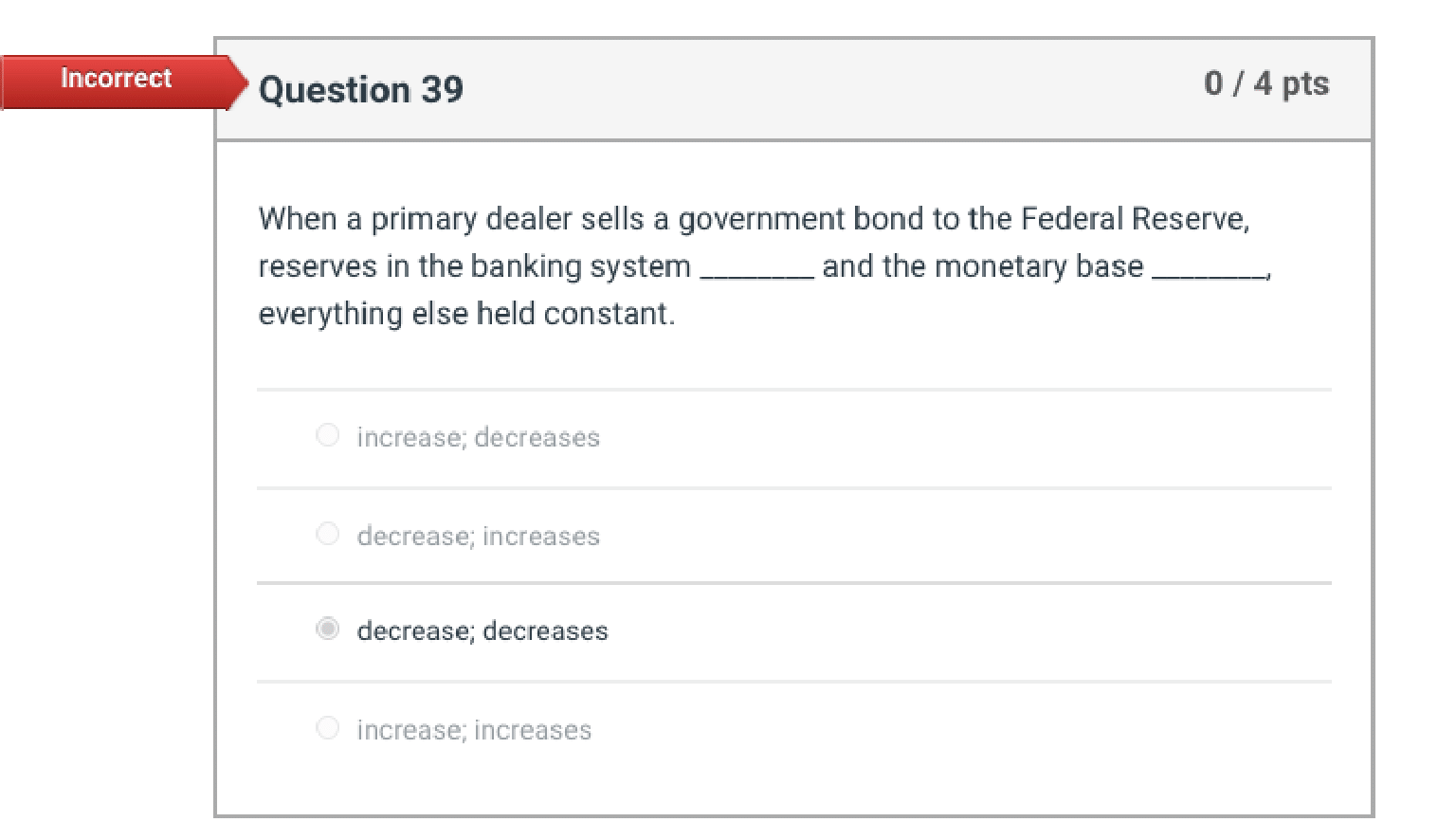

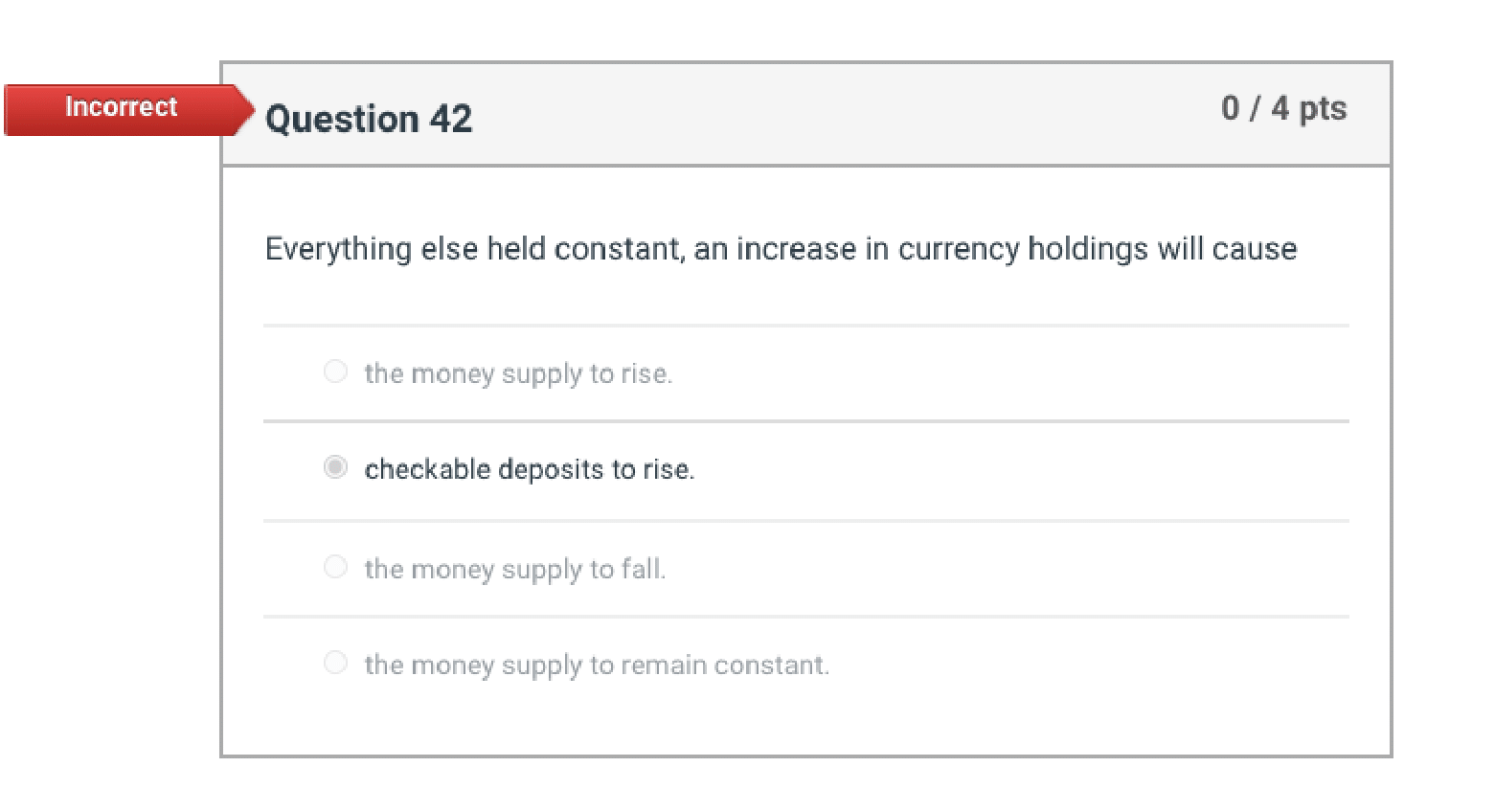

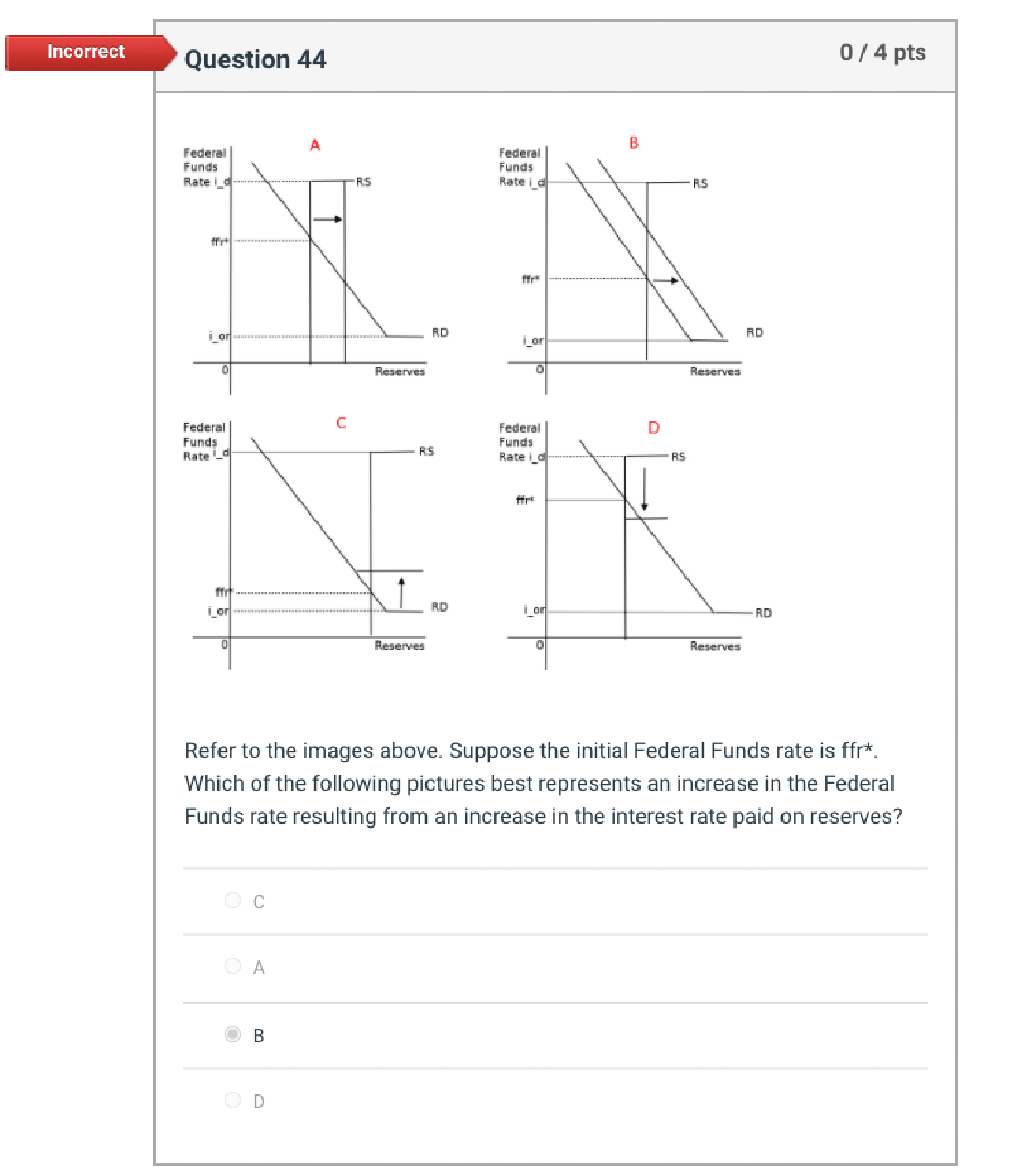

Incorrect Question 3 0 / 4 pts Fictional First Bank Assets Liabilities Cash in Transaction 100 1000 vault deposits Non- Deposits 300 transaction 2000 at Fed deposits Securities 1000 Borrowing 300 Loans 2400 Refer to the balance sheet above, if the bank is required to keep 10% of transaction deposits in reserve, what is the maximum value of the loan that Fictional First can make? O 100 O 400 O 200 O 1000 O 300Incorrect Question 4 0 / 4 pts If a bank experiences a large, unexpected withdrawal, which of the following is the least costly costly way for the bank to raise funds to meet the reserve requirement? O borrow from another bank in the Federal Funds Market O sell securities O reduce loan balance by calling in loans O issue shares of stockIncorrect Question 9 0 / 4 pts Bank capital has both benefits and costs for the bank owners. Higher bank capital the likelihood of bankruptcy, but higher bank capital the return on equity for a given return on assets. O increases; increases O reduces; increases O increases; reduces O reduces; reducesIncorrect Question 13 0 / 4 pts Increasing interest rates charged on a loan __ solve the ___problem because good credit risks are more likely to refuse the high interest rate loan terms and bad credit risks more likely to accept. would/moral hazard O would/adverse selection O would not/moral hazard O would not/adverse selectionIncorrect Question 14 D I 4 P115 First National Bank _ 4U million $50 million so million $50 million Assuming that the average duration of its assets is four years. while the average duration of its liabilities is three years, then a 5 percentage point increase in interest rates will ea use the net worth of First National to by of the total original asset value. decline; 15- percent decline; 10- percent Increase; 20 percent decline; 5 percent Incorrect QUES'IiI'I 17 U f 4 p15 Holding RDA constant. a bank could increase RUE by increasing retained earnings. selling shares of stock. 'i' none of the above, ROE depends entirely' on the protability of assets. using borrowed funds to make more leans. reducing the value of liabilities relative to assets. Incorrect Question 13 D .i' .4 P'IS The contagion effect refers to the fact that '9' deposit insurance has eliminated the problem of bank failures. the failure of one bank can hasten the failure of other banks. bank runs involve only insolvent banks. bank runs involve only sound hanks. Incorrect Question 21 0 / 4 pts Regulators reduce risk in the banking industry by O limiting bank holdings of Treasury securities. O requiring banks take make loans in all areas where they take deposits. O limiting the amount of capital banks hold. O limiting bank holdings of stock.Incorrect Question 26 0 / 4 pts One example of consumer protection regulation is O a requirement that banks examine all characteristics of the borrower, including race, gender, and marital status when making a loan. O all of these O a requirement that banks exclude residents of areas prone to default from receiving loans. O a requirement that banks disclose annual percentage rate (APR) on loans offered. Incorrect Question 27 0 / 4 pts Restrictions on bank competition was motivated by the hypothesis that competition between banks O encourages greater risk taking. O encourages conservative bank management. O eliminates the need for government regulation. O increases bank profitability.Incorrect Question 35 0 / 4 pts Critics of the current system of Fed independence contend that the president has too much control over monetary policy on a day-to-day basis. O the Board of Governors is held responsible for policy missteps. O voters have too much say about monetary policy. O the current system is undemocratic.Incorrect Question 39 0 / 4 pts When a primary dealer sells a government bond to the Federal Reserve, reserves in the banking system and the monetary base everything else held constant. O increase; decreases O decrease; increases O decrease; decreases O increase; increasesIncorrect QuEStiOI'I 42 U I 4 pts Everything else held constant. an increase in currency holdings will cause the money supply to rise. I checkahle deposits to rise. the money supply to Fall. the money supply to remain constant. Incorrect QUESIi 44 01' 4 [115 Refer to the images shave. Suppese the initial Federal Funds rate is r*. Which of the following pint ures best represents an increase in the Federal Funds rate resulting tram an increase in the interest rate paid an reserves\"? Incorrect Question 49 0 / 4 pts One of the advantages of inflation target is O it reduces the time-inconsistency problem O it is very flexible and allows central bankers to have maximum flexibility in setting policy. O it keeps investors guessing on the goals of monetary policy. O it gives politicians more control over monetary policy Incorrect Question 50 0 / 4 pts Using Taylor's rule, when the equilibrium real federal funds rate is 2 percent, there is no output gap, the actual inflation rate is zero, and the target inflation rate is 2 percent, the nominal federal funds rate should be 3 percent. O 0 percent. O 1 percent. 2 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts