Question: Correct answer is at the bottom, the x is associated with the blank answer. Your firm will be selling 64,800 barrels of oil in January.

Correct answer is at the bottom, the x is associated with the blank answer.

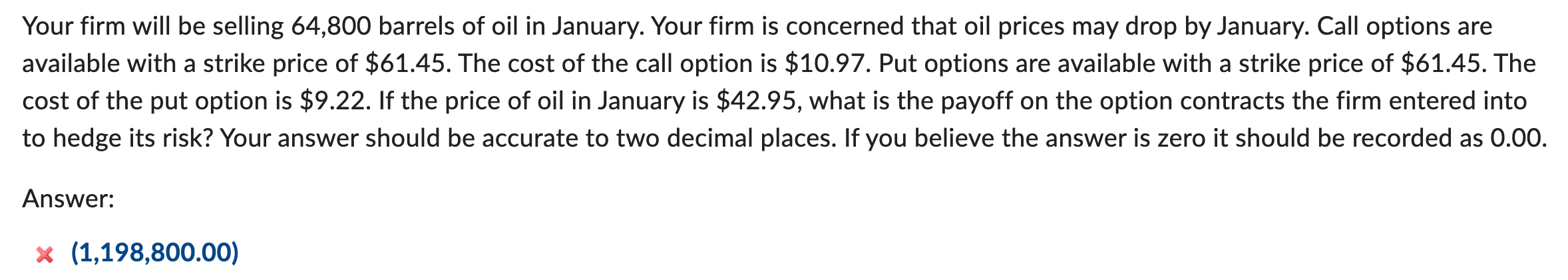

Your firm will be selling 64,800 barrels of oil in January. Your firm is concerned that oil prices may drop by January. Call options are available with a strike price of $61.45. The cost of the call option is $10.97. Put options are available with a strike price of $61.45. The cost of the put option is $9.22. If the price of oil in January is $42.95, what is the payoff on the option contracts the firm entered into to hedge its risk? Your answer should be accurate to two decimal places. If you believe the answer is zero it should be recorded as 0.00. Answer: (1,198,800.00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts