Question: CORRECT ANSWER IS THERE. JUST NEED HELP ON HOW TO GET THE ANSWER. THANK YOU 9. A 3-year dual currency AA rated bond (Euro-USD) pays

CORRECT ANSWER IS THERE. JUST NEED HELP ON HOW TO GET THE ANSWER.

THANK YOU

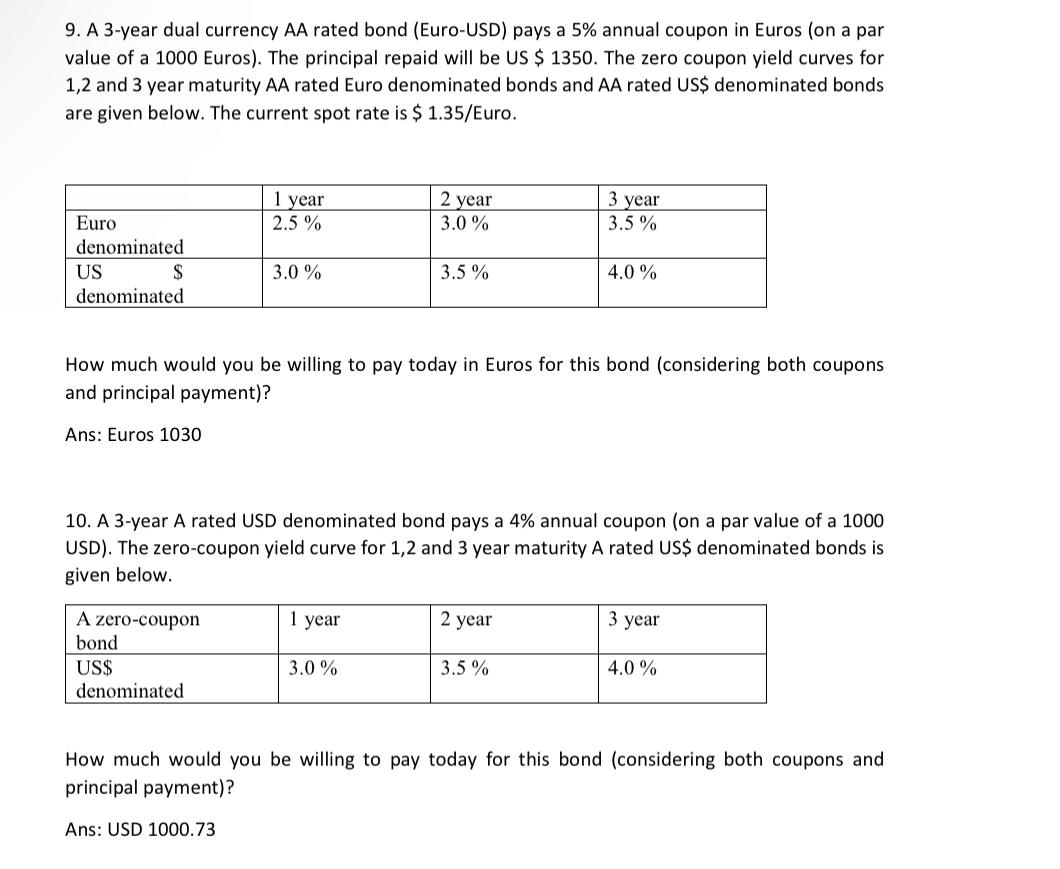

9. A 3-year dual currency AA rated bond (Euro-USD) pays a 5% annual coupon in Euros (on a par value of a 1000 Euros). The principal repaid will be US $1350. The zero coupon yield curves for 1,2 and 3 year maturity AA rated Euro denominated bonds and AA rated US\$ denominated bonds are given below. The current spot rate is $1.35/ Euro. How much would you be willing to pay today in Euros for this bond (considering both coupons and principal payment)? Ans: Euros 1030 10. A 3-year A rated USD denominated bond pays a 4\% annual coupon (on a par value of a 1000 USD). The zero-coupon yield curve for 1,2 and 3 year maturity A rated US\$ denominated bonds is given below. How much would you be willing to pay today for this bond (considering both coupons and principal payment)? Ans: USD 1000.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts