Question: CORRECT ANSWER IS THERE. JUST NEED HELP ON HOW TO GET THE ANSWER. THANK YOU 11) The 1-year risk-free interest rate in the U.S is

CORRECT ANSWER IS THERE. JUST NEED HELP ON HOW TO GET THE ANSWER.

THANK YOU

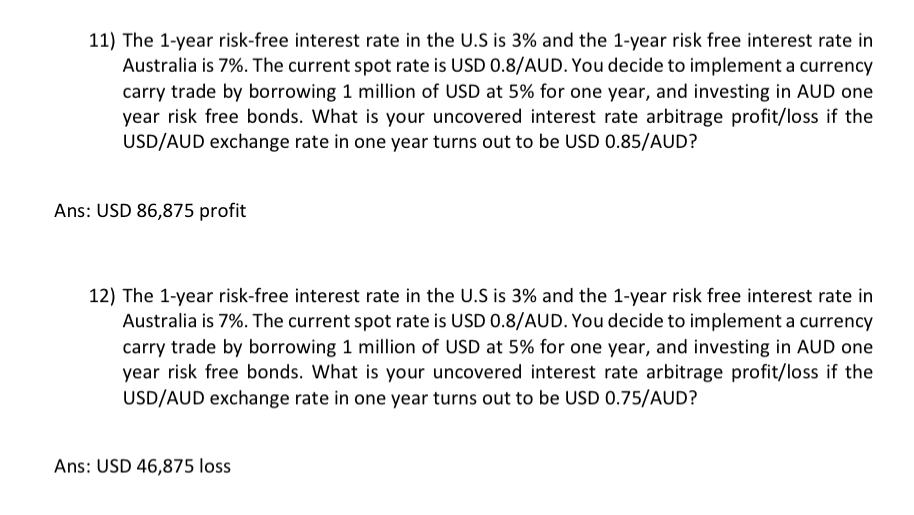

11) The 1-year risk-free interest rate in the U.S is 3% and the 1-year risk free interest rate in Australia is 7%. The current spot rate is USD 0.8/AUD. You decide to implement a currency carry trade by borrowing 1 million of USD at 5% for one year, and investing in AUD one year risk free bonds. What is your uncovered interest rate arbitrage profit/loss if the USD/AUD exchange rate in one year turns out to be USD 0.85/AUD? Ans: USD 86,875 profit 12) The 1-year risk-free interest rate in the U.S is 3% and the 1-year risk free interest rate in Australia is 7\%. The current spot rate is USD 0.8/AUD. You decide to implement a currency carry trade by borrowing 1 million of USD at 5% for one year, and investing in AUD one year risk free bonds. What is your uncovered interest rate arbitrage profit/loss if the USD/AUD exchange rate in one year turns out to be USD 0.75/AUD? Ans: USD 46,875 loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts