Question: CORRECT ANSWER IS THERE. JUST NEED HELP ON HOW TO GET THE ANSWER. THANK YOU 7) Assume that the 1-year interest rate in UK is

CORRECT ANSWER IS THERE. JUST NEED HELP ON HOW TO GET THE ANSWER.

THANK YOU

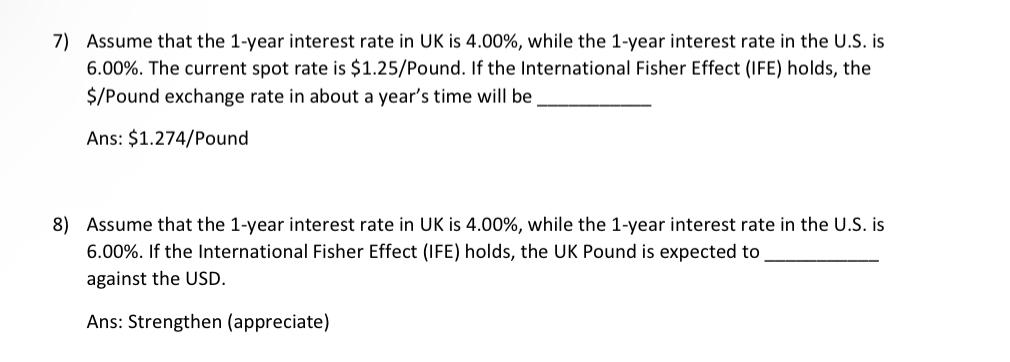

7) Assume that the 1-year interest rate in UK is 4.00%, while the 1-year interest rate in the U.S. is 6.00%. The current spot rate is $1.25/ Pound. If the International Fisher Effect (IFE) holds, the $/ Pound exchange rate in about a year's time will be Ans: $1.274/ Pound 8) Assume that the 1-year interest rate in UK is 4.00%, while the 1-year interest rate in the U.S. is 6.00%. If the International Fisher Effect (IFE) holds, the UK Pound is expected to against the USD. Ans: Strengthen (appreciate)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts