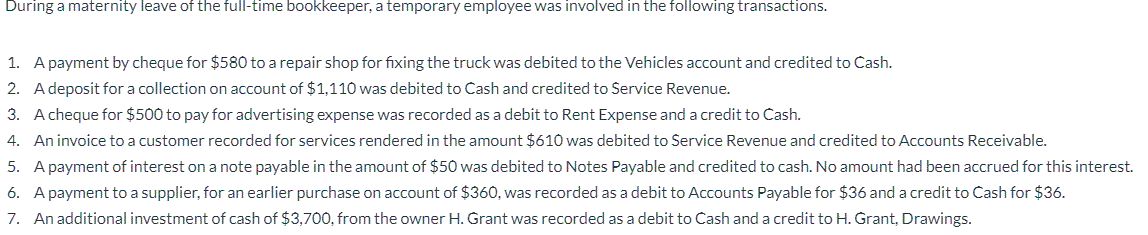

Question: correct errors without reversing the incorrect entry. :) During a maternity leave of the full-time bookkeeper, a temporary employee was involved in the following transactions.

correct errors without reversing the incorrect entry. :)

correct errors without reversing the incorrect entry. :)

During a maternity leave of the full-time bookkeeper, a temporary employee was involved in the following transactions. A payment by cheque for $580 to a repair shop for fixing the truck was debited to the Vehicles account and credited to Cash A deposit for a collection on account of $1,110 was debited to Cash and credited to Service Revenue A cheque for $500 to pay for advertising expense was recorded as a debit to Rent Expense and a credit to Cash 1. 2. 3. An invoice to a customer recorded for services rendered in the amount $610 was debited to Service Revenue and credited to Accounts Receivable. 4. A payment of interest on a note payable in the amount of $50 was debited to Notes Payable and credited to cash. No amount had been accrued for this interest. 5. A payment to a supplier, for an earlier purchase on account of $360, was recorded as a debit to Accounts Payable for $36 and a credit to Cash for $36 6. An additional investment of cash of $3,700, from the owner H. Grant was recorded as a debit to Cash and a credit to H. Grant, Drawings. 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts