Question: Correct feedback for correct answer thanks QUESTION 4 Tom and Marj received taxable pension income of $20,000 total in 2021. They also received social security

Correct feedback for correct answer thanks

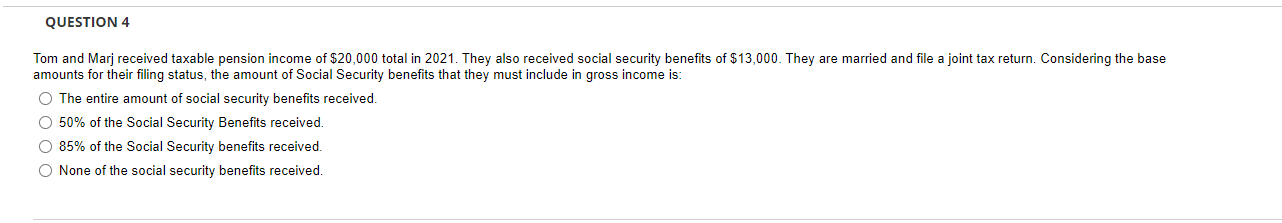

QUESTION 4 Tom and Marj received taxable pension income of $20,000 total in 2021. They also received social security benefits of $13,000. They are married and file a joint tax return. Considering the base amounts for their filing status, the amount of Social Security benefits that they must include in gross income is: The entire amount of social security benefits received. 50% of the Social Security Benefits received. O 85% of the Social Security benefits received. None of the social security benefits received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts