Question: Correct Quantitative Problem: Potter Industries has a bond issue outstanding with an annual coupon of 6% and a 10-year maturity. The par value of the

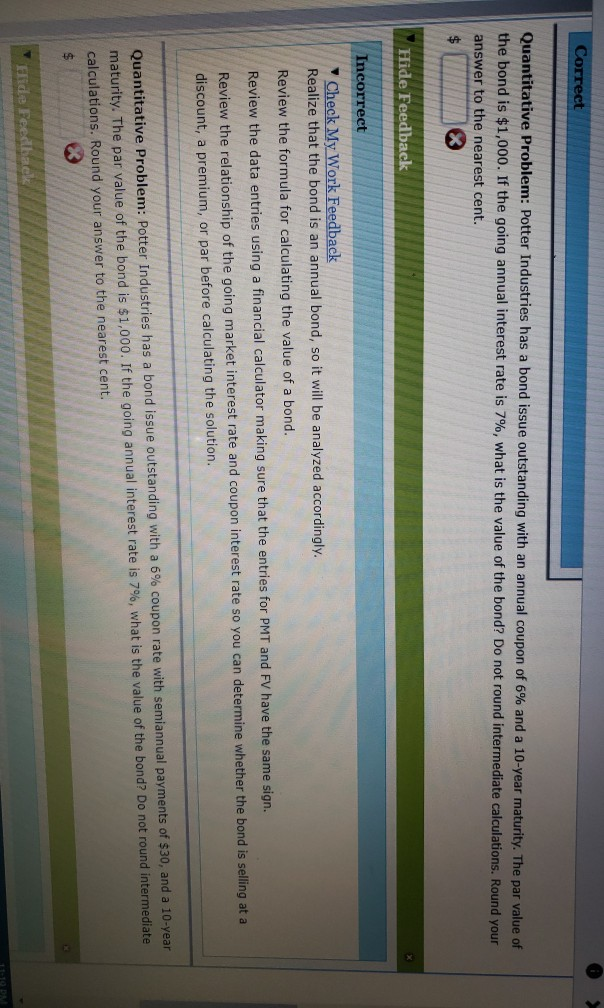

Correct Quantitative Problem: Potter Industries has a bond issue outstanding with an annual coupon of 6% and a 10-year maturity. The par value of the bond is $1,000. If the going annual interest rate is 7%, what is the value of the bond? Do not round intermediate calculations. Round your answer to the nearest cent. Hide Feedback Incorrect Check My Work Feedback Realize that the bond is an annual bond, so it will be analyzed accordingly. Review the formula for calculating the value of a bond. Review the data entries using a financial calculator making sure that the entries for PMT and FV have the same sign. Review the relationship of the going market interest rate and coupon interest rate so you can determine whether the bond is selling at a discount, a premium, or par before calculating the solution. Quantitative Problem: Potter Industries has a bond issue outstanding with a 6% coupon rate with semiannual payments of $30, and a 10-year maturity. The par value of the bond is $1,000. If the going annual interest rate is 7%, what is the value of the bond? Do not round intermediate calculations. Round your answer to the nearest cent. Fide Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts