Question: Correctly use the Edit menu in your browser to copy the 1000 numbers obtained in the coin tossing experiments. (d) Go back to LinuStats and

Correctly use the Edit menu in your browser to copy the 1000 numbers obtained

in the coin tossing experiments.

(d) Go back to LinuStats and choose the descriptive statistics page.

(e) Use the Edit menu in your browser to paste the 1000 numbers into the

data window.

(f) Choose a minimum value of 0, maximum value of 1, and window of

0.1

(g) Analyze the data by clicking the appropriate button.

(h) Copy the resulting relative frequency table and transform it into a cumulative distribution function

(i) Copy the Mean and SD (Standard Deviation) of the 1000 numbers.

Explain what this standard deviation means. I'll call these numbers

X and ?X

(j) Compare the obtained cumulative distribution function with that predicted by a Gaussian distribution with mean X and standard deviation

?X

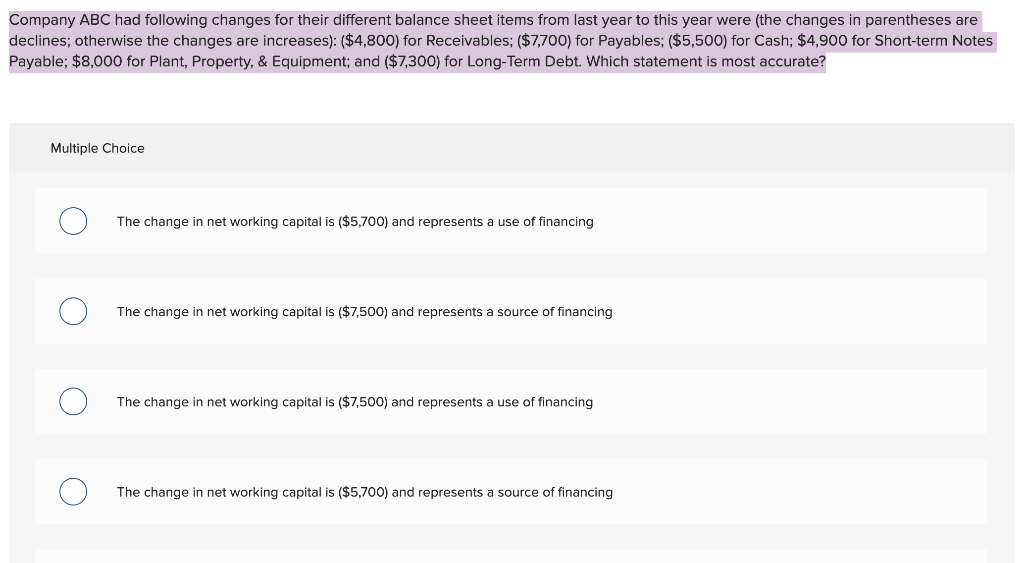

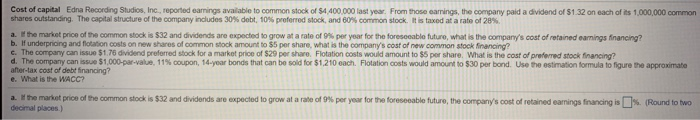

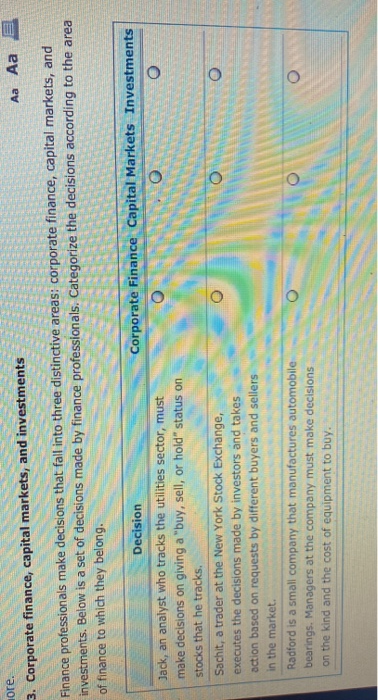

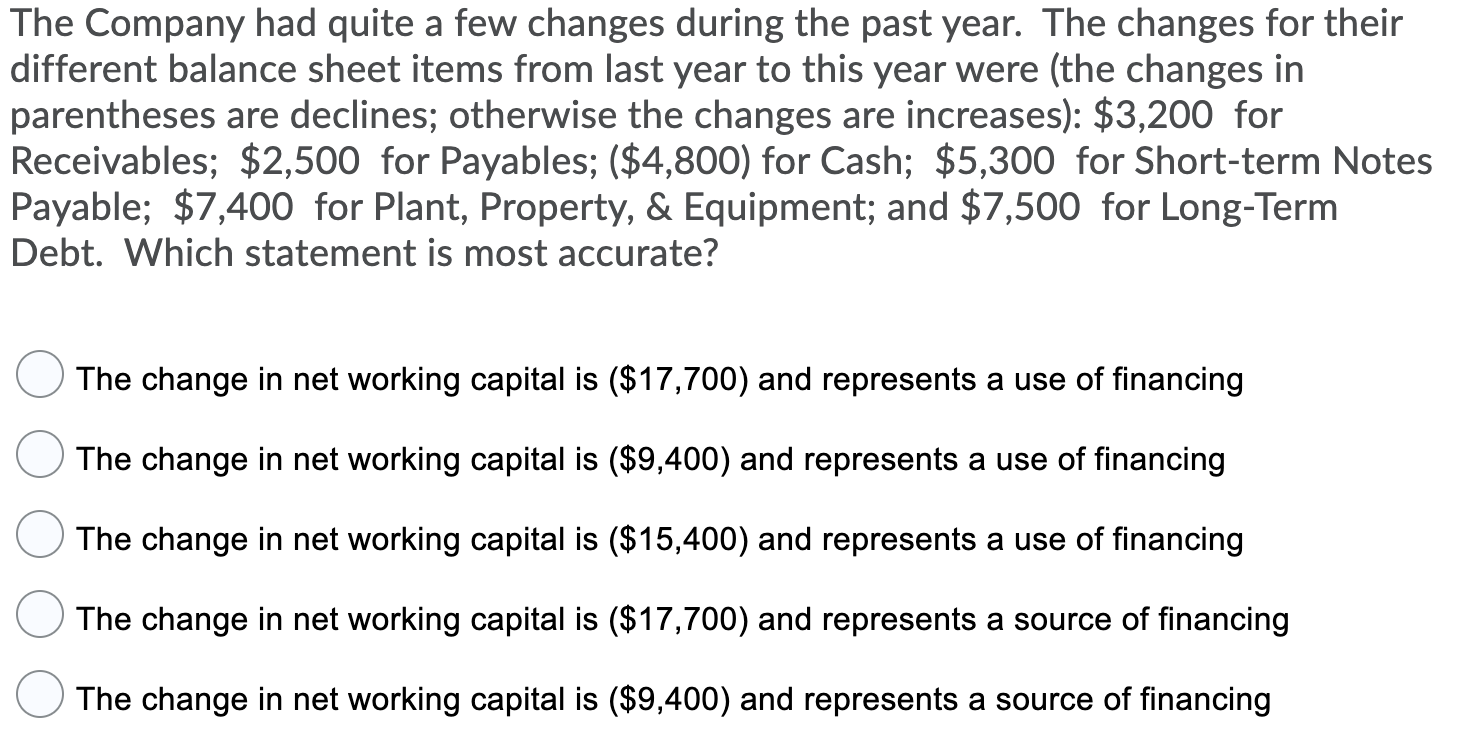

Company ABC had following changes for their different balance sheet items from last year to this year were (the changes in parentheses are declines; otherwise the changes are increases): ($4,800) for Receivables; ($7,700) for Payables; ($5,500) for Cash; $4,900 for Short-term Notes Payable; $8,000 for Plant, Property, & Equipment; and ($7,300) for Long-Term Debt. Which statement is most accurate? Multiple Choice O The change in net working capital is ($5,700) and represents a use of financing O The change in net working capital is ($7,500) and represents a source of financing O The change in net working capital is ($7,500) and represents a use of financing O The change in net working capital is ($5,700) and represents a source of financingCost of capital Edna Recording Studios, Inc., reported earnings available to common stock of $4,400 000 last year. From those earnings, the company paid a dividend of $1 32 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 30%% debt, 10%% proforred stock, and 60%% common stock. It is taxed at a rate of 285. a. If the market price of the common stock is $32 and dividends are expected to grow at a rate of 9%% per year for the foresocable future, what is the company's cost of retained earnings financing? b. If underpricing and flotation coals on new shares of common stock amount to $5 por share, what is the company's cost of new common stock financing? C. The company can issun $1.76 dividend preferred stock for a market price of $29 per share. Flotation costs would amount to $5 por share. What is the cost of preferred stock financing? d. The company can issue $1,000-par-value, 11%% coupon, 14-year bonds that can be sold for $1,210 each. Flotation costs would amount to $30 par bond. Use the estimation formula to figure the approximate after-lax cool of debt financing? . What is the WACC? a. the market price of the common stock is $32 and dividends are expected to grow at a rate of 9% per your for the foreseeable future, the company's cost of retained earnings financing is $. (Round to two decimal places.}ore. 3. Corporate finance, capital markets, and investments Aa Aa Finance professionals make decisions that fall into three distinctive areas: corporate finance, capital markets, and investments. Below is a set of decisions made by finance professionals. Categorize the decisions according to the area of finance to which they belong. Decision Corporate Finance Capital Markets Investments Jack, an analyst who tracks the utilities sector, must O make decisions on giving a "buy, sell, or hold" status on stocks that he tracks. Sachit, a trader at the New York Stock Exchange, O O O executes the decisions made by investors and takes action based on requests by different buyers and sellers in the market. Radford is a small company that manufactures automobile O O O bearings. Managers at the company must make decisions on the kind and the cost of equipment to buy.The Company had quite a few changes during the past year. The changes for their different balance sheet items from last year to this year were (the changes in parentheses are declines; otherwise the changes are increases): $3,200 for Receivables; $2,500 for Payables; ($4,800) for Cash; $5,300 for Short-term Notes Payable; $7,400 for Plant, Property, & Equipment; and $7,500 for Long-Term Debt. Which statement is most accurate? 0 The change in net working capital is ($17,700) and represents a use of financing 0 The change in net working capital is ($9,400) and represents a use of financing 0 The change in net working capital is ($15,400) and represents a use of financing 0 The change in net working capital is ($17,700) and represents a source of nancing 0 The change in net working capital is ($9,400) and represents a source of nancing