Question: Correlation is an important concept in portfolio optimisation. Portfolios with combinations of assets with low or negative correlation tend to display lower volatility than

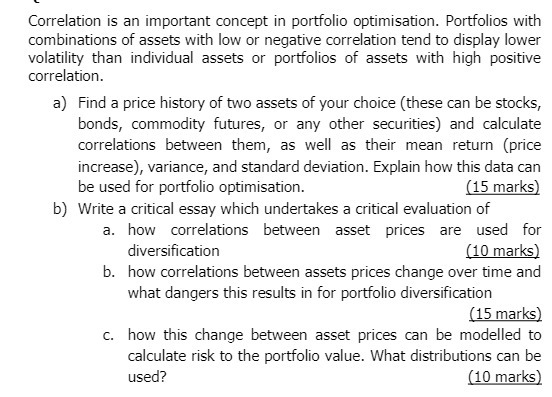

Correlation is an important concept in portfolio optimisation. Portfolios with combinations of assets with low or negative correlation tend to display lower volatility than individual assets or portfolios of assets with high positive correlation. a) Find a price history of two assets of your choice (these can be stocks, bonds, commodity futures, or any other securities) and calculate correlations between them, as well as their mean return (price increase), variance, and standard deviation. Explain how this data can be used for portfolio optimisation. diversification (15 marks) b) Write a critical essay which undertakes a critical evaluation of a. how correlations between asset prices are used for (10 marks) b. how correlations between assets prices change over time and what dangers this results in for portfolio diversification (15 marks) c. how this change between asset prices can be modelled to calculate risk to the portfolio value. What distributions can be used? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

a Finding and Analyzing Asset Price Data for Portfolio Optimization For this analysis I will choose Apple Inc AAPL and Microsoft Corporation MSFT as the two assets I have obtained the daily closing pr... View full answer

Get step-by-step solutions from verified subject matter experts