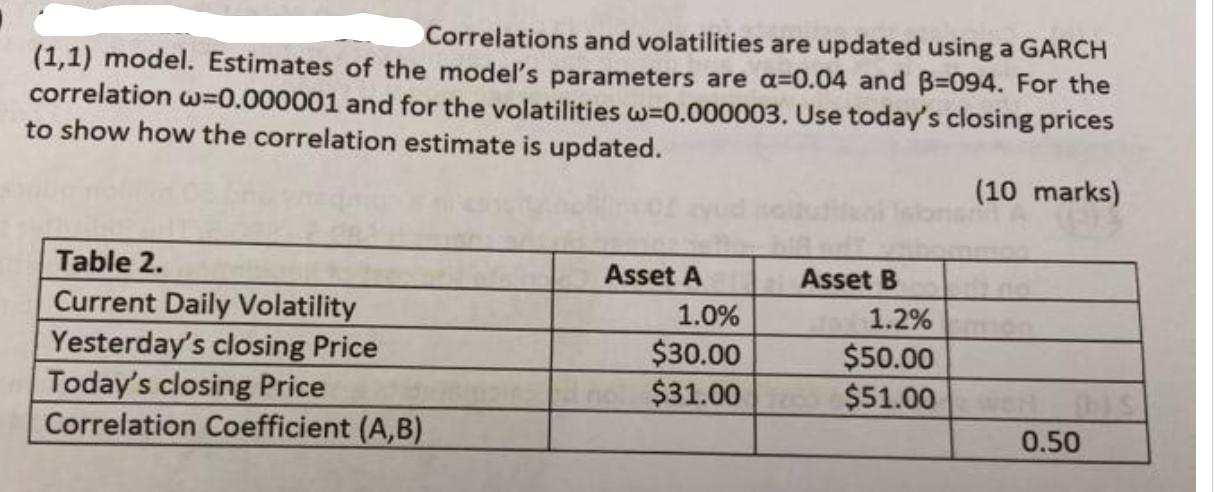

Question: Correlations and volatilities are updated using a GARCH (1,1) model. Estimates of the model's parameters are a=0.04 and B=094. For the correlation w=0.000001 and

Correlations and volatilities are updated using a GARCH (1,1) model. Estimates of the model's parameters are a=0.04 and B=094. For the correlation w=0.000001 and for the volatilities w=0.000003. Use today's closing prices to show how the correlation estimate is updated. Table 2. Current Daily Volatility Yesterday's closing Price Today's closing Price Correlation Coefficient (A,B) Asset A 1.0% $30.00 $31.00 Asset B 1.2% $50.00 $51.00 (10 marks) TA (2) wer this 0.50

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

To update the correlation estimate using the GARCH 11 model we can use the follow... View full answer

Get step-by-step solutions from verified subject matter experts