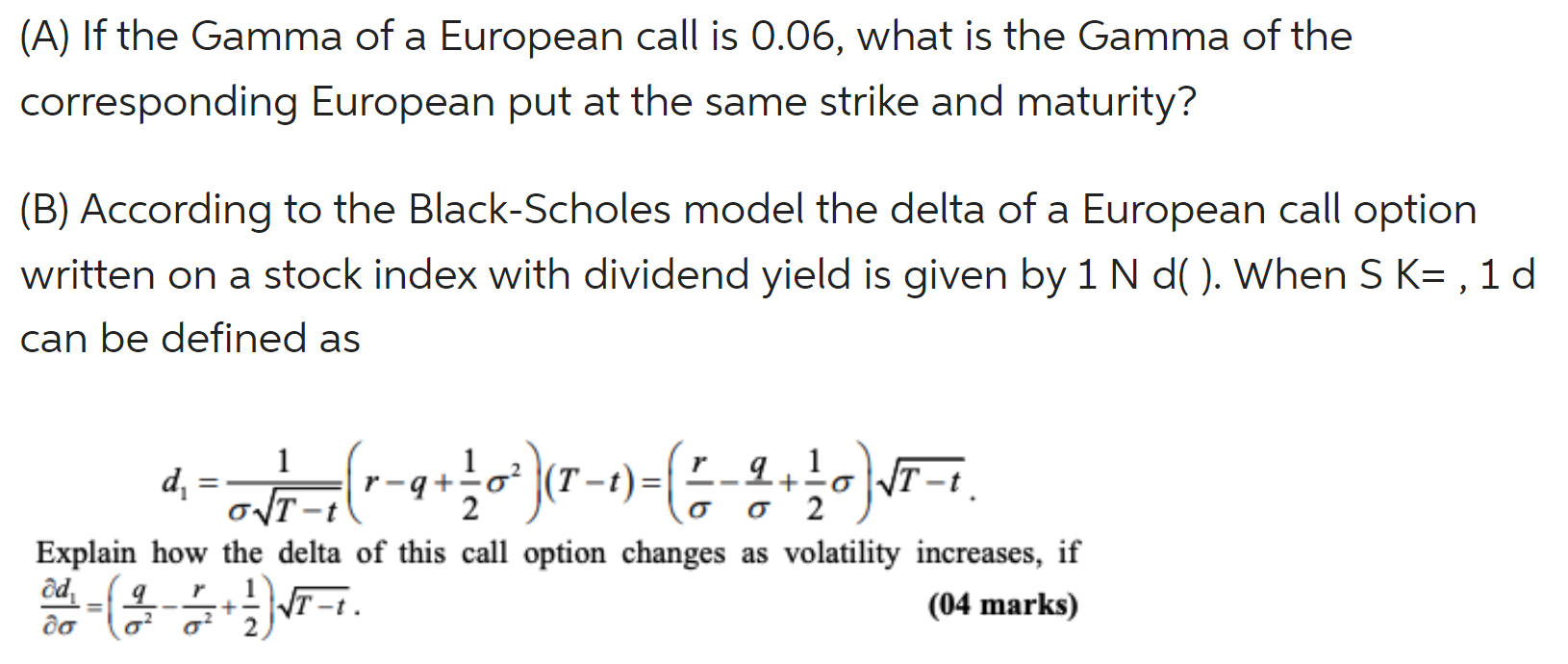

Question: corresponding European put at the same strike and maturity? (B) According to the Black-Scholes model the delta of a European call option written on a

corresponding European put at the same strike and maturity? (B) According to the Black-Scholes model the delta of a European call option written on a stock index with dividend yield is given by 1Nd(). When SK=,1d can be defined as d1=Tt1(rq+212)(Tt)=(rq+21)Tt. Explain how the delta of this call option changes as volatility increases, if d1=(2q2r+21)Tt. (04 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock