Question: Cost Accounting Help Thank you Question 8 (25 marks) Construct Ltd operates within the construction industry. The head office is based in Greater London, but

Cost Accounting Help Thank you

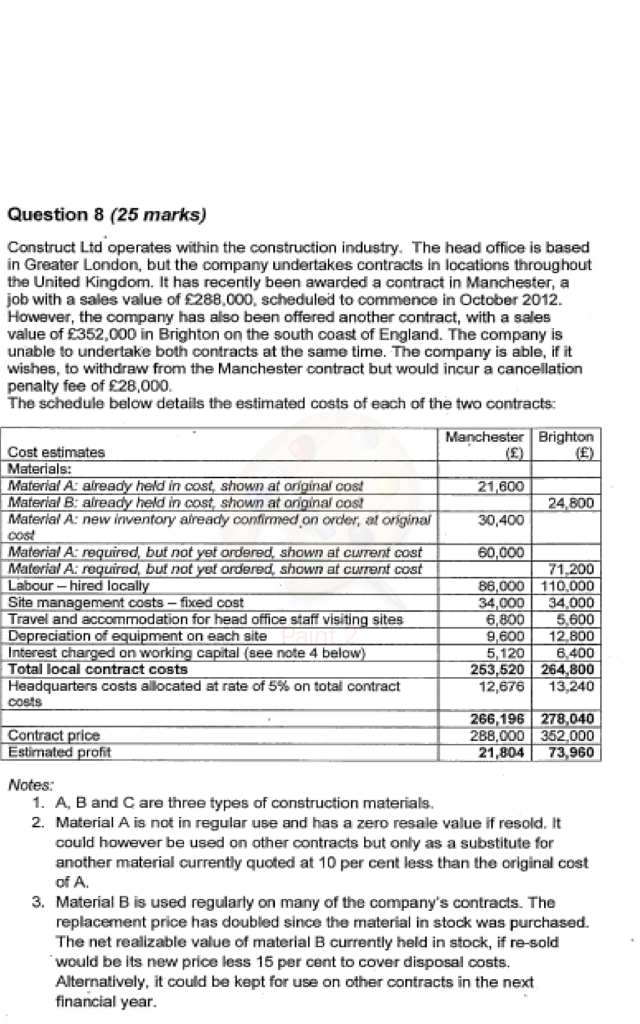

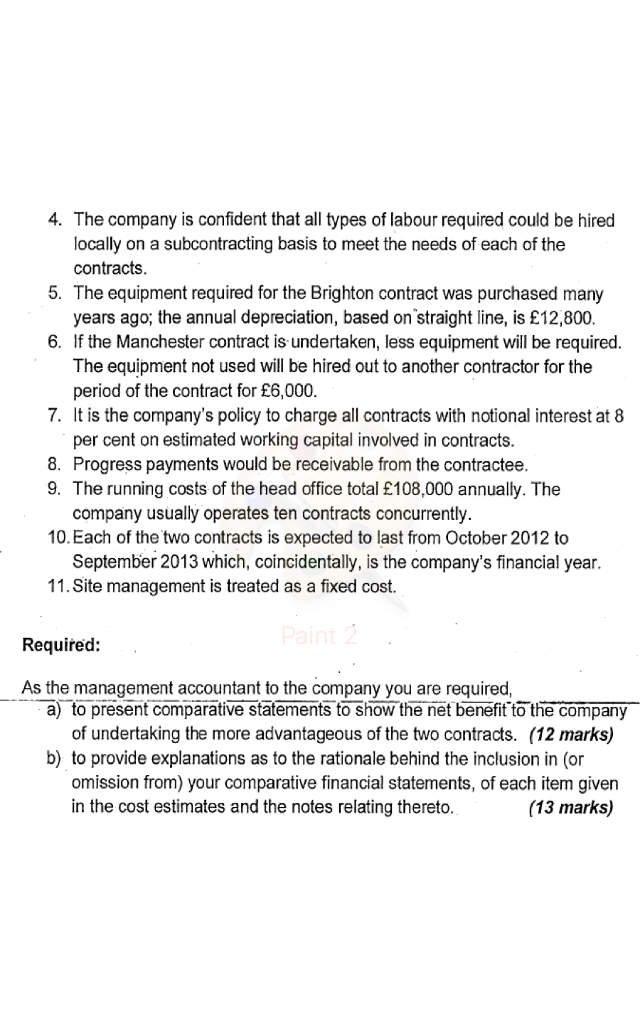

Question 8 (25 marks) Construct Ltd operates within the construction industry. The head office is based in Greater London, but the company undertakes contracts in locations throughout the United Kingdom. It has recently been awarded a contract in Manchester, a job with a sales value of 288.000, scheduled to commence in October 2012 However, the company has also been offered another contract, with a sales value of E352,000 in Brighton on the south coast of England. The company is unable to undertake both contracts at the same time. The company is able, if it wishes, to withdraw from the Manchester contract but would incur a cancellation penalty fee of 28,000. The schedule below details the estimated costs of each of the two contracts: Manchester Brighton Cost estimates Materials MateralAalready held in cost shown at onginal Cost 21600 MaterialBalready heldin cost shown at angina cos 24 B00 Material A new inventory already confinmed on order, at original 30,400 Material Arequired but not yet andered shown at cument cost 600001 71.200 Material A: reguired but not vet ordered shown at current cost 66000 110000 Labour-hired locally 34 000 L34000 Site management costs fixed cost 6800 5600 Travel and accommodation for head office staff visiting sites Depreciation of equipment on each site 9,600 12,800 Interest charged on working capital (see note 4 below 5,120 6400 253520 264 800 Total local contract costs Headquarters costs allocated at rate of 5%on total contract 12,676 13,240 Costs 266, 196 278,040 Contract price 288.000 352.000 Estimated profit 21,804 73960 Notes A, B and C are three types of construction materials. 2. Material A is not in regular use and has a zero resale value ifresold. It could however be used on other contracts but only as a substitute for another material currently quoted at 10 per cent less than the original cost of A. 3. Material B is used regularly on many of the company's contracts. The replacement price has doubled since the material in stock was purchased. The net realizable value of material B currently held in stock, if re-sold would be its new price less 15 per cent to cover disposal costs. Alternatively, it could be kept for use on other contracts in the next financial year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts