Question: Cost Flow Assumptions Amount 1. First-in, first-out (FIFO) periodic 2. Moving average 3. Weighted average 4. Last-in, first-out (LIFO) periodic 5. First-in, first-out (FIFO) perpetual

| Cost Flow Assumptions | Amount |

| 1. First-in, first-out (FIFO) periodic | |

| 2. Moving average | |

| 3. Weighted average | |

| 4. Last-in, first-out (LIFO) periodic | |

| 5. First-in, first-out (FIFO) perpetual |

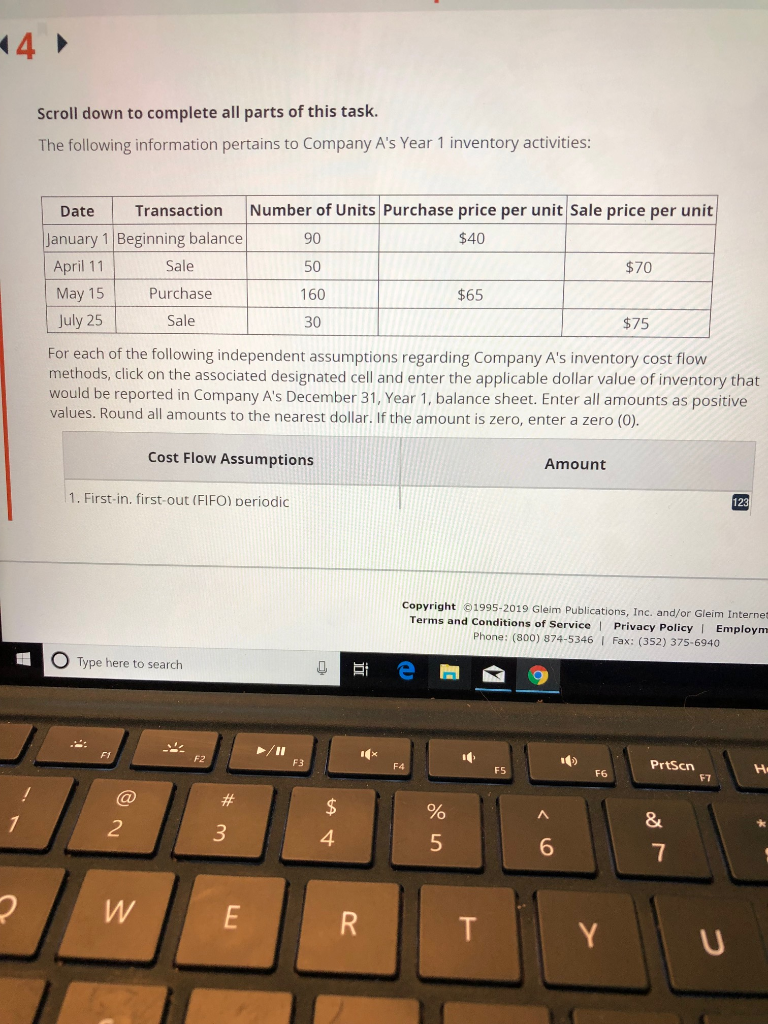

4 Scroll down to complete all parts of this task. The following information pertains to Company A's Year 1 inventory activities: Date Transaction Number of Units Purchase price per unit Sale price per unit January 1 Beginning balance 90 50 160 30 $40 April 11 May 15 Sale Purchase Sale $70 $65 July 25 $75 For each of the following independent assumptions regarding Company A's inventory cost flow methods, click on the associated designated cell and enter the applicable dollar value of inventory that would be reported in Company A's December 31, Year 1, balance sheet. Enter all amounts as positive values. Round all amounts to the nearest dollar. If the amount is zero, enter a zero (O) Cost Flow Assumptions Amount 1. First-in. first-out (FIFO) periodic Copyright 1995-2019 Gleim Publications, Inc. and/or Gleim Internet Terms and conditions of Service I Privacy Policy| Employm Phone: (800) 874-5346 Fax: (352) 375-6940 O Type here to search F2 PrtSen F6 2 3 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts