Question: costing methods You have recently been made aware that your purchasing department is spending five hours to source and purchase components for your deluxe line

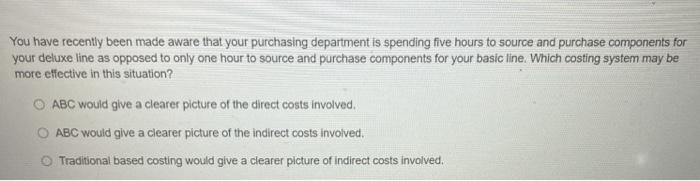

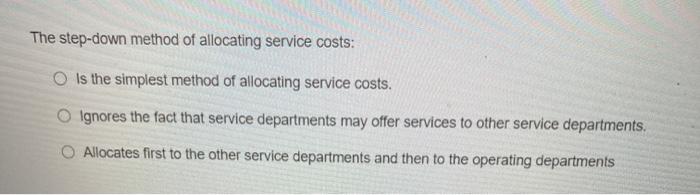

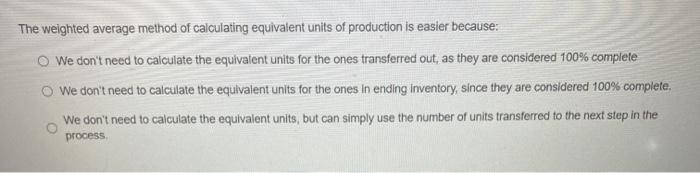

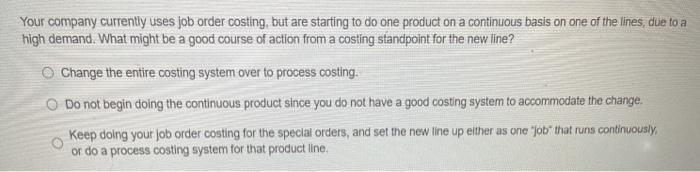

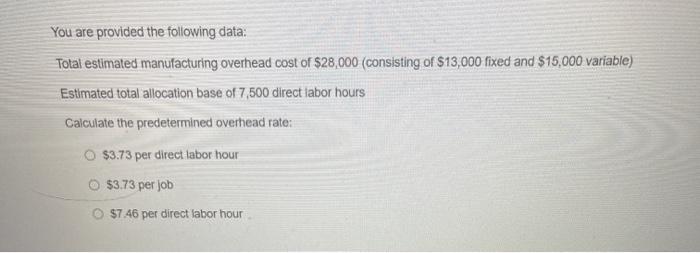

You have recently been made aware that your purchasing department is spending five hours to source and purchase components for your deluxe line as opposed to only one hour to source and purchase components for your basic line. Which costing system may be more effective in this situation? ABC would give a clearer picture of the direct costs involved. O ABC would give a clearer picture of the indirect costs involved. Traditional based costing would give a clearer picture of indirect costs involved. The step-down method of allocating service costs: O is the simplest method of allocating service costs. Ignores the fact that service departments may offer services to other service departments. Allocates first to the other service departments and then to the operating departments The welghted average method of calculating equivalent units of production is easier because: We don't need to calculate the equivalent units for the ones transferred out, as they are considered 100% complete We don't need to calculate the equivalent units for the ones in ending inventory, since they are considered 100% complete. We don't need to calculate the equivalent units, but can simply use the number of units transferred to the next step in the process Your company currently uses job order costing, but are starting to do one product on a continuous basis on one of the lines, due to a high demand. What might be a good course of action from a costing standpoint for the new line? Change the entire costing system over to process costing. Do not begin doing the continuous product since you do not have a good costing system to accommodate the change. Keep doing your job order costing for the special orders, and set the new line up either as one "job that runs continuously, or do a process costing system for that product line. You are provided the following data: Total estimated manufacturing overhead cost of $28,000 (consisting of $13,000 fixed and $15,000 variable) Estimated total allocation base of 7,500 direct labor hours Calculate the predetermined overhead rates O $3.73 per direct labor hour $3.73 per job $7 46 per direct labor hour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts