Question: Costs assigned to processing Raw materials (one unit of raw materials for each unit of product started) $142,800 Manufacturing supplies used 18,000 Direct labor costs

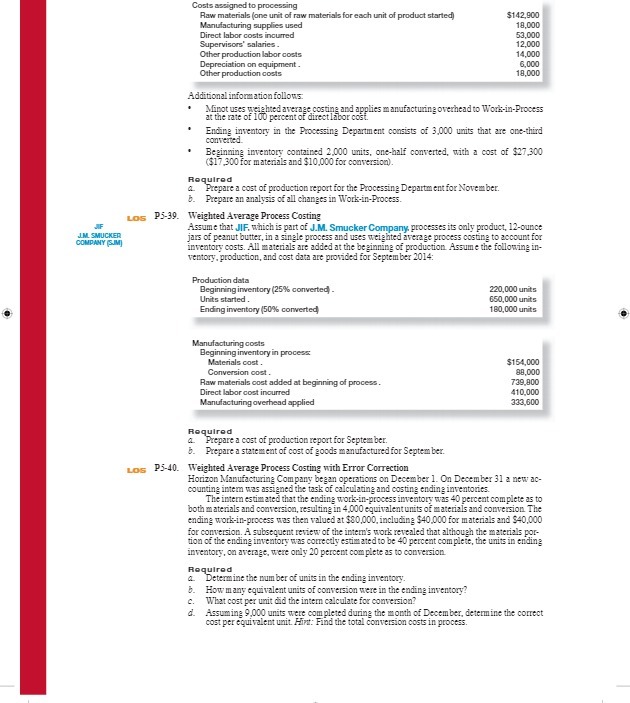

Costs assigned to processing Raw materials (one unit of raw materials for each unit of product started) $142,800 Manufacturing supplies used 18,000 Direct labor costs incurred 53,000 Supervisors' salaries. 12.000 Other production labor costs 14,000 Depreciation on equipment . 6,000 Other production costs 18,000 Additional information follows. Minot uses weighted average costing and applies manufacturing overhead to Work-in-Process at the rate of 100 percent of directlabor cost. Ending inventory in the Processing Department consists of 3,000 units that are one-third converted Beginning inventory contained 2000 units, one-half converted, with a cost of $27.300 ($17,300 for materials and $10,000 for conversion). Required a Prepare a cost of production report for the Processing Department for November. Prepare an analysis of all changes in Work-in-Process LOS P5-39. Weighted Average Process Costing JF Assume that JIF, which is part of J.M. Smucker Company, processes its only product, 12-ounce J.M. SMUCKER COMPANY (FJM] jars of peanut butter, in a single process and uses weighted average process costing to account for inventory costs. All materials are added at the beginning of production Assume the following in- ventory, production, and cost data are provided for September 2014: Production data Beginning inventory (25% converted) 220,000 units Units started . 650,000 units Ending inventory (50% converted 180,000 units Manufacturing costs Beginning inventory in process Materials cost . $154,000 Conversion cost. 98,000 Raw materials oost added at beginning of process. 739 800 Direct labor cost inourred 410,000 Manufacturing overhead applied 323.600 Required Prepare a cost of production report for Septem ber. Prepare a statement of cost of goods manufactured for Septem ber. LOS P5-40. Weighted Average Process Costing with Error Correction Horizon Manufacturing Company began operations on December 1. On December 31 a new ac- counting intern was assigned the task of calculating and costing ending inventories. The intern estimated that the ending work-in-process inventory was 40 percent complete as to both materials and conversion, resulting in 41000 equivalent units of materials and conversion The ending work-in-process was then valued at $80,000, including $40.000 for materials and $40,000 for conversion. A subsequent review of the intern's work revealed that although the materials por- tion of the ending inventory was correctly estimated to be 40 percent complete, the units in ending inventory, on average, were only 20 percent complete as to conversion. Required Determine the number of units in the ending inventory. How many equivalent units of conversion were in the ending inventory? C. What cost per unit did the intern calculate for conversion? Assuming 9.000 units were completed during the month of December, determine the correct cost per equivalent unit. Airit: Find the total conversion costs in process