Question: Cougar Communications is considering a project with an initial fixed asset cost of $400,000 which will be depreciated straight-line to a zero book value over

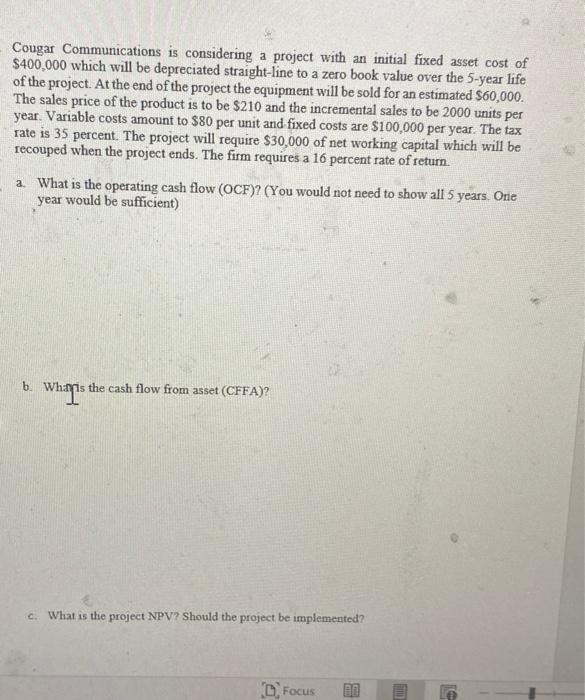

Cougar Communications is considering a project with an initial fixed asset cost of $400,000 which will be depreciated straight-line to a zero book value over the 5-year life of the project. At the end of the project the equipment will be sold for an estimated $60,000. The sales price of the product is to be $210 and the incremental sales to be 2000 units per year. Variable costs amount to $80 per unit and fixed costs are $100,000 per year. The tax rate is 35 percent. The project will require $30,000 of net working capital which will be recouped when the project ends. The firm requires a 16 percent rate of return a. What is the operating cash flow (OCF)2 (You would not need to show all 5 years. One year would be sufficient) b. Whions is the cash flow from asset (CFFA)? c. What is the project NPV? Should the project be implemented? Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts