Question: could anyone help in solving this Short Question 5: Swaps (15 marks) The table shows the information in March. Maturi June S ntember December Treasury

could anyone help in solving this

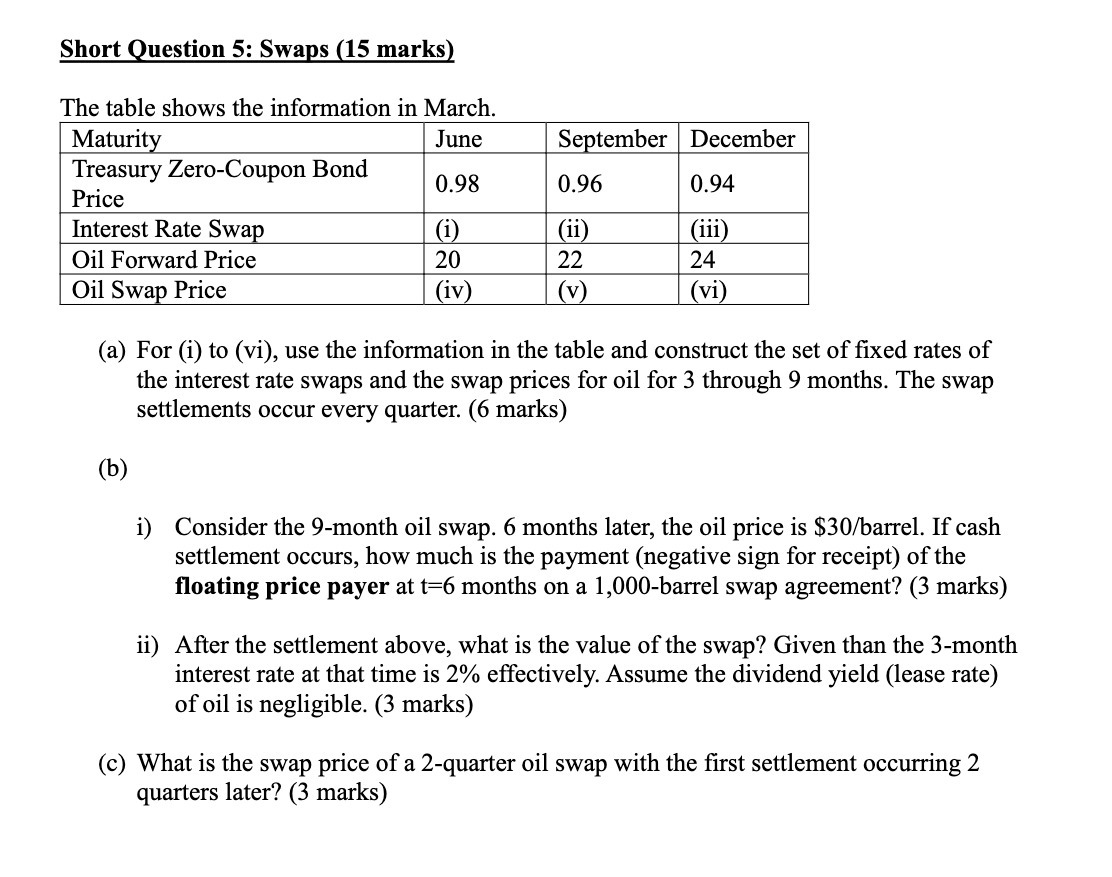

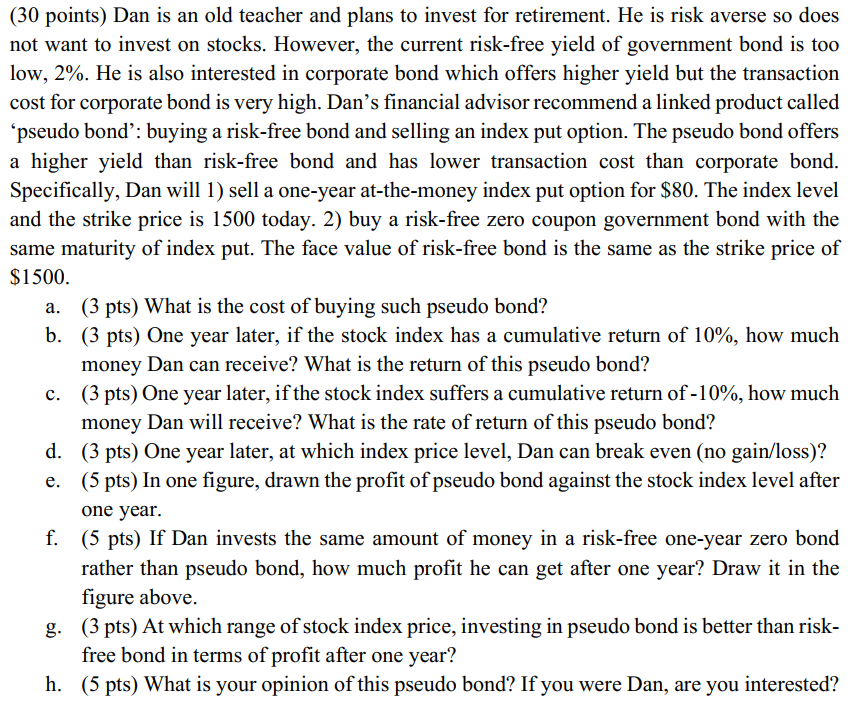

Short Question 5: Swaps (15 marks) The table shows the information in March. Maturi June S ntember December Treasury Zero-Coupon Bond -M 0.94 Price Interest Rate Swap (i) (iii) Oil Forward Price 2 22 24 Oil Swap Price (iv) (v) (vi) (a) For (i) to (vi), use the information in the table and construct the set of xed rates of the interest rate swaps and the swap prices for oil for 3 through 9 months. The swap settlements occur every quarter. (6 marks) (b) i) Consider the 9-month oil swap. 6 months later, the oil price is $30/barrel. If cash settlement occurs, how much is the payment (negative Sign for receipt) of the oating price payer at t=6 months on a LOGObarrel swap agreement? (3 marks) ii) After the settlement above, what is the value of the swap? Given than the 3-month interest rate at that time is 2% effectively. Assume the dividend yield (lease rate) of oil is negligible. (3 marks) (0) What is the swap price of a 2-quarter oil swap with the rst settlement occurring 2 quarters later? (3 marks) (30 points) Dan is an old teacher and plans to invest for retirement. He is risk averse so does not want to invest on stocks. However, the current risk-free yield of government bond is too low, 2%. He is also interested in corporate bond which offers higher yield but the transaction cost for corporate bond is very high. Dan's nancial advisor recommend a linked product called 'pseudo bond': buying a risk-free bond and selling an index put option. The pseudo bond offers a higher yield than risk-'ee bond and has lower transaction cost than corporate bond. Specically, Dan will 1) sell a one-year at-the-money index put option for $80. The index level and the strike price is 1500 today. 2) buy a risk-free zero coupon government bond with the same maturity of index put. The face value of risk-free bond is the same as the strike price of $1 500. a. (3 pts) What is the cost of buying such pseudo bond? b. (3 pts) One year later, if the stock index has a cumulative return of 10%, how much money Dan can receive? What is the return of this pseudo bond? c. (3 pts) One year later, if the stock index suffers a cumulative return of -10%, how much money Dan will receive? What is the rate of return of this pseudo bond? (3 pts) One year later, at which index price level, Dan can break even (no gainfloss)? e. (5 pts) In one gure, drawn the prot of pseudo bond against the stock index level after one year. f. (5 pts) If Dan invests the same amount of money in a risk-free one-year zero bond rather than pseudo bond, how much prot he can get after one year? Draw it in the gure above. g. (3 pts) At which range of stock index price, investing in pseudo bond is better than risk- free bond in terms of prot after one year? h. (5 pts) What is your opinion of this pseudo bond? If you were Dan, are you interested