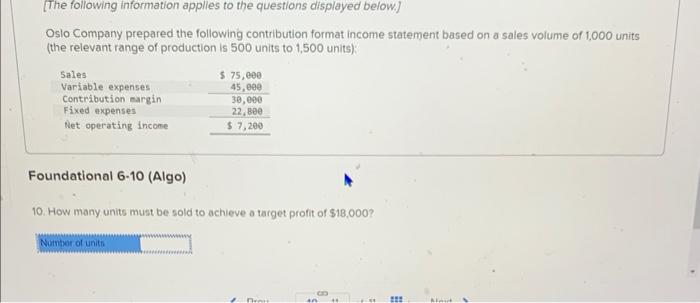

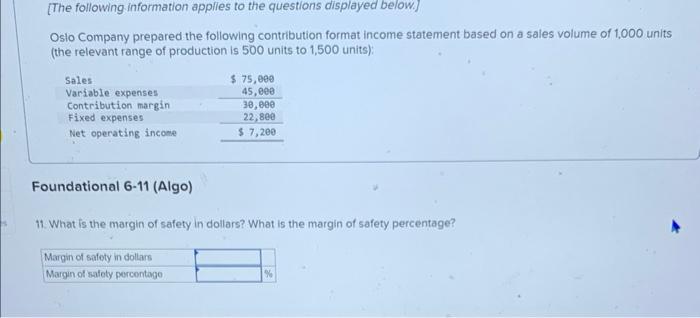

Question: Could i get some help please! I'll make sure to like/thumbs up the answer ! [The following information applies to the questions displayed below.] Oslo

![the answer ! [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671893705d322_8556718936fc8e21.jpg)

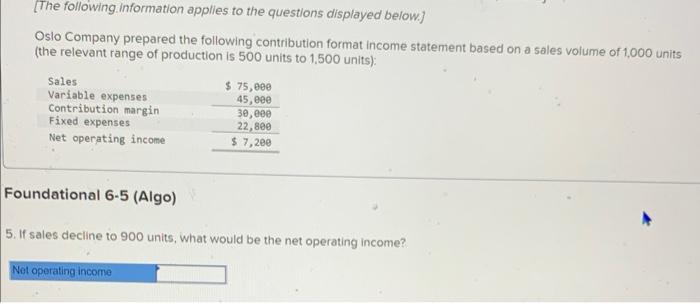

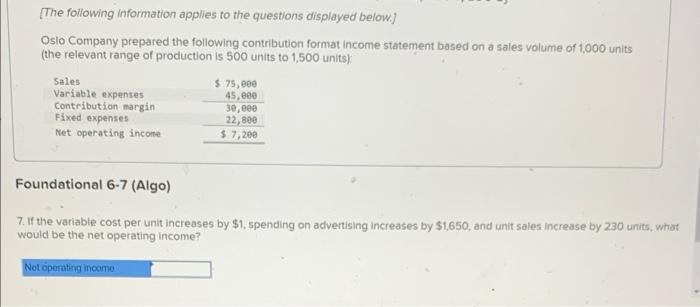

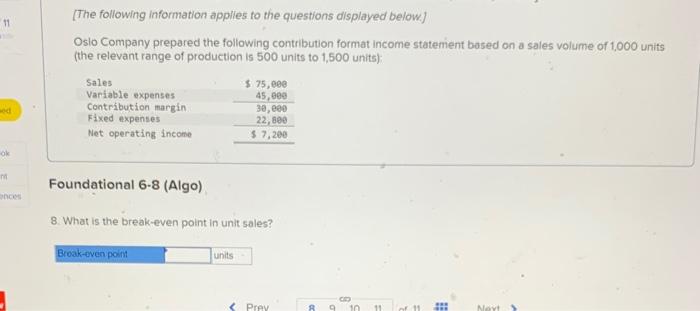

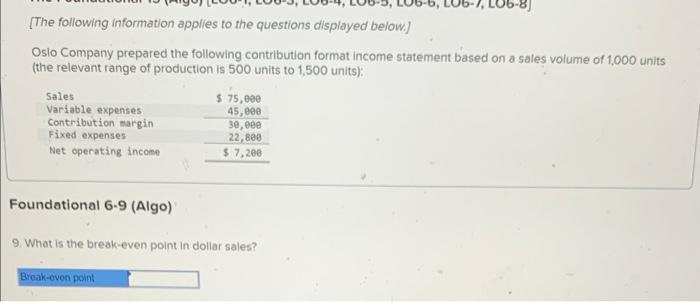

[The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income Foundational 6-5 (Algo) $ 75,000 45,000 Net operating income 30,000 22,800 $ 7,200 5. If sales decline to 900 units, what would be the net operating income? [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 75,000 45,000 LO6-6, LO6-7, LO6-8] 30,000 22,800 $ 7,200 Foundational 6-6 (Algo) 6. If the selling price increases by $2 per unit and the sales volume decreases by 100 units, what would be the net operating income? Not operating income [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units); Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 75,000 45,000 30,000 22,800 $ 7,200 Foundational 6-7 (Algo) 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,650, and unit sales increase by 230 units, what would be the net operating income? Not operating income. 11 ed ok m ances [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 75,000 45,000 30,000 22,800 $ 7,200 Foundational 6-8 (Algo) 8. What is the break-even point in unit sales? Break-even point units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts