Question: Could I please get some help on these two! I'll make sure to like/thumbs up the amswer! 14 00:29:46 A manufacturing company that produces a

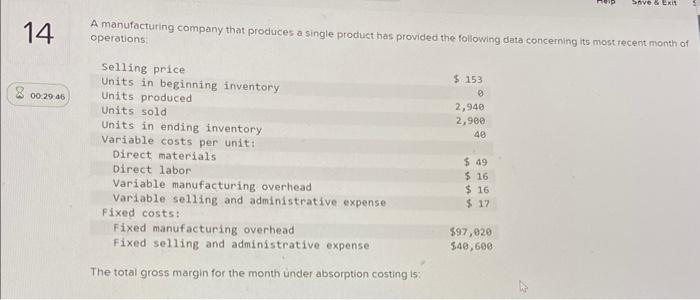

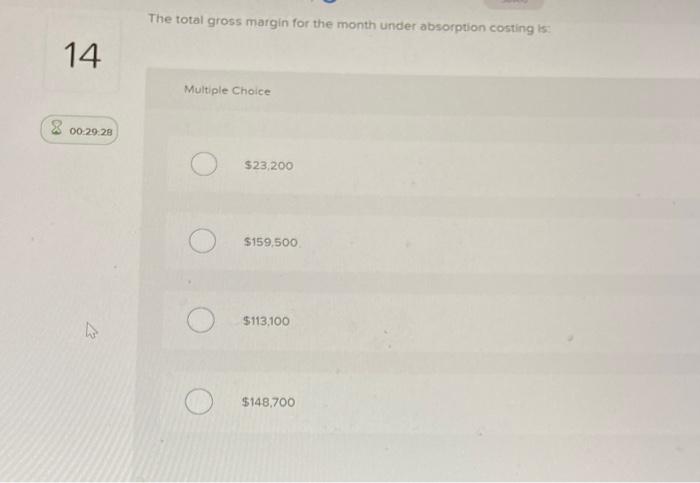

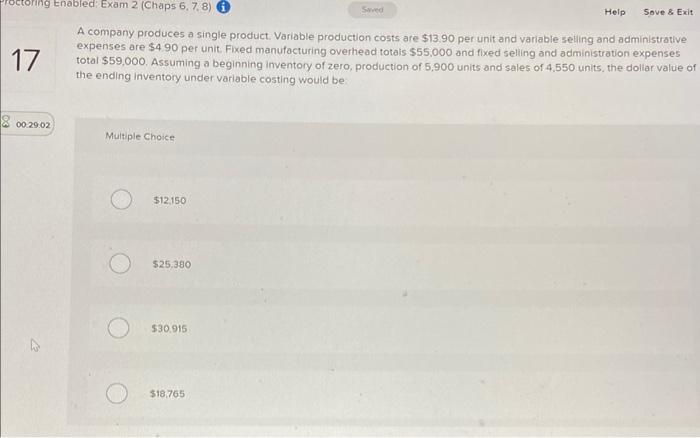

14 00:29:46 A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations Selling price Units in beginning inventory Units produced Units sold. Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense The total gross margin for the month under absorption costing is: $ 153 0 2,940 2,900 40 $ 49 $ 16 $ 16 $ 17 Save & Exi $97,020 $40,600 14 00:29:28 A The total gross margin for the month under absorption costing is: Multiple Choice $23,200 $159,500 $113,100 $148,700 toring Enabled: Exam 2 (Chaps 6, 7, 8) A company produces a single product Variable production costs are $13.90 per unit and variable selling and administrative expenses are $4.90 per unit. Fixed manufacturing overhead totals $55,000 and fixed selling and administration expenses total $59,000. Assuming a beginning inventory of zero, production of 5,900 units and sales of 4,550 units, the dollar value of the ending inventory under variable costing would be: 17 00.29.02 Multiple Choice $12,150 $25,380 $30.915 $18,765 Saved Help Sove & Exit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts