Question: Could more than one correct answer 2. Suppose that you find the market price of the call option is lower than the market price of

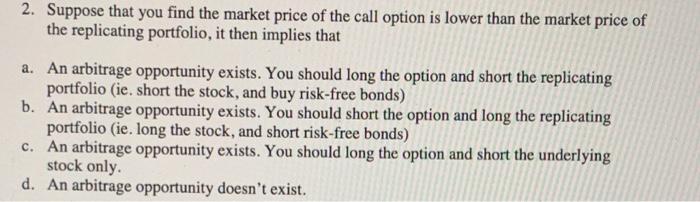

2. Suppose that you find the market price of the call option is lower than the market price of the replicating portfolio, it then implies that a. An arbitrage opportunity exists. You should long the option and short the replicating portfolio (ie, short the stock, and buy risk-free bonds) b. An arbitrage opportunity exists. You should short the option and long the replicating portfolio (ie. long the stock, and short risk-free bonds) c. An arbitrage opportunity exists. You should long the option and short the underlying stock only. d. An arbitrage opportunity doesn't exist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts