Question: Could really use some quick help on this. Thank you SO much in advance! Problem 11-22 (LO 11-9) Mikkeli OY acquired a brand name with

Could really use some quick help on this. Thank you SO much in advance!

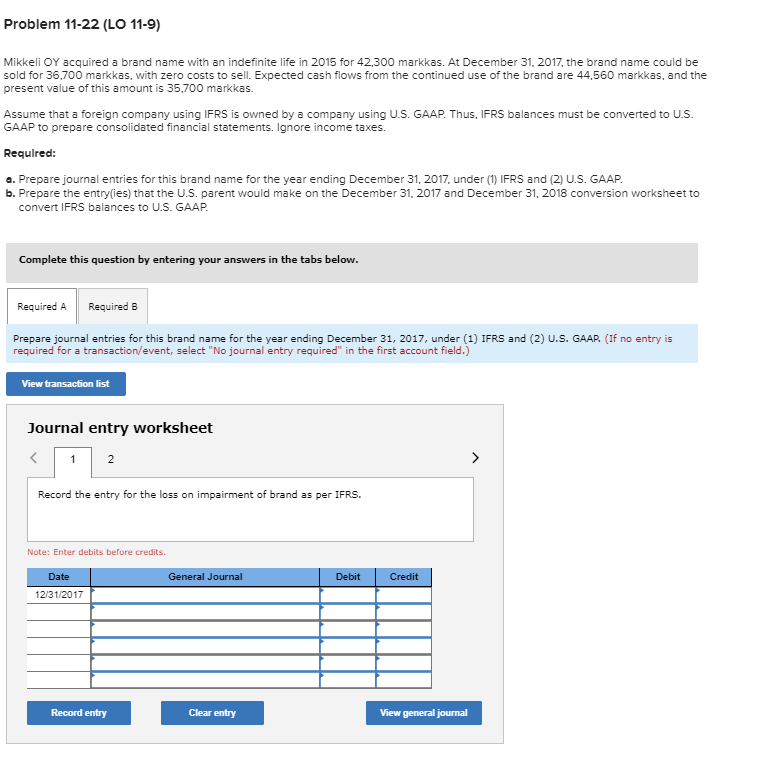

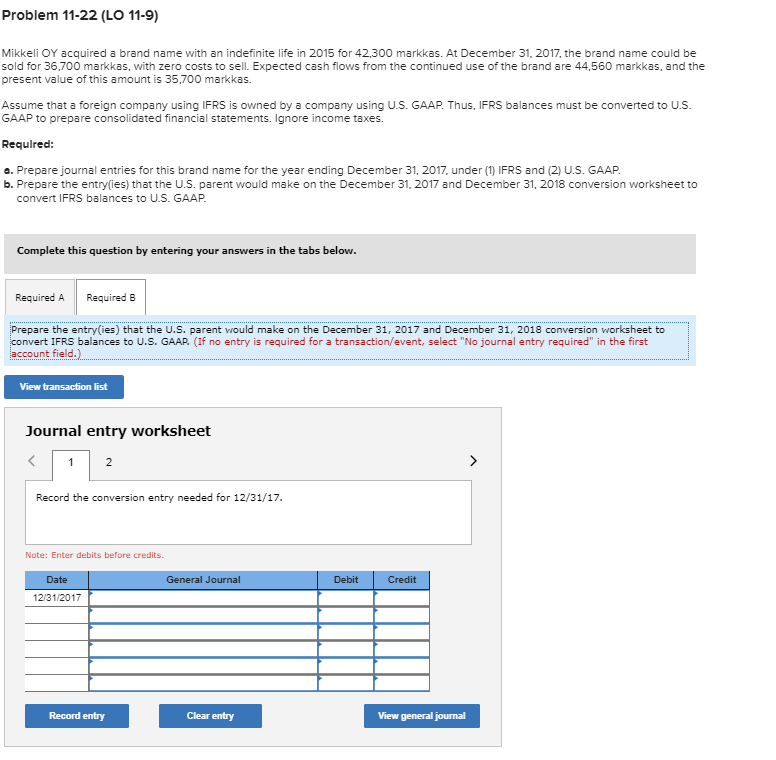

Problem 11-22 (LO 11-9) Mikkeli OY acquired a brand name with an indefinite life in 2015 for 42,300 markkas. At December 31, 2017, the brand name could be sold for 36,700 markkas, with zero costs to sell. Expected cash flows from the continued use of the brand are 44,560 markkas, and the present value of this amount is 35,700 markkas. Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for this brand name for the year ending December 31, 2017, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S.parent would make on the December 31, 2017 and December 31, 2018 conversion worksheet to convert IFRS balances to U.S. GAAP. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for this brand name for the year ending December 31, 2017, under (1) IFRS and (2) U.S. GAAP. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for the loss on impairment of brand as per IFRS. Note: Enter debits before credits. Date General Journal Debit Credit 12/31/2017 Record entry Clear entry View general journal Problem 11-22 (LO 11-9) Mikkeli OY acquired a brand name with an indefinite life in 2015 for 42,300 markkas. At December 31, 2017, the brand name could be sold for 36,700 markkas, with zero costs to sell. Expected cash flows from the continued use of the brand are 44,560 markkas, and the present value of this amount is 35,700 markkas. Assume that a foreign company using IFRS is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for this brand name for the year ending December 31, 2017. under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017 and December 31, 2018 conversion worksheet to convert IFRS balances to U.S. GAAP. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the entry(ies) that the U.S. parent would make on the December 31, 2017 and December 31, 2018 conversion worksheet to convert IFRS balances to U.S. GAAR. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the conversion entry needed for 12/31/17. Note: Enter debits before credits. General Journal Debit Credit Date 12/31/2017 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts