Question: could someone answer these two questions please. The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $36. The unit cost

could someone answer these two questions please.

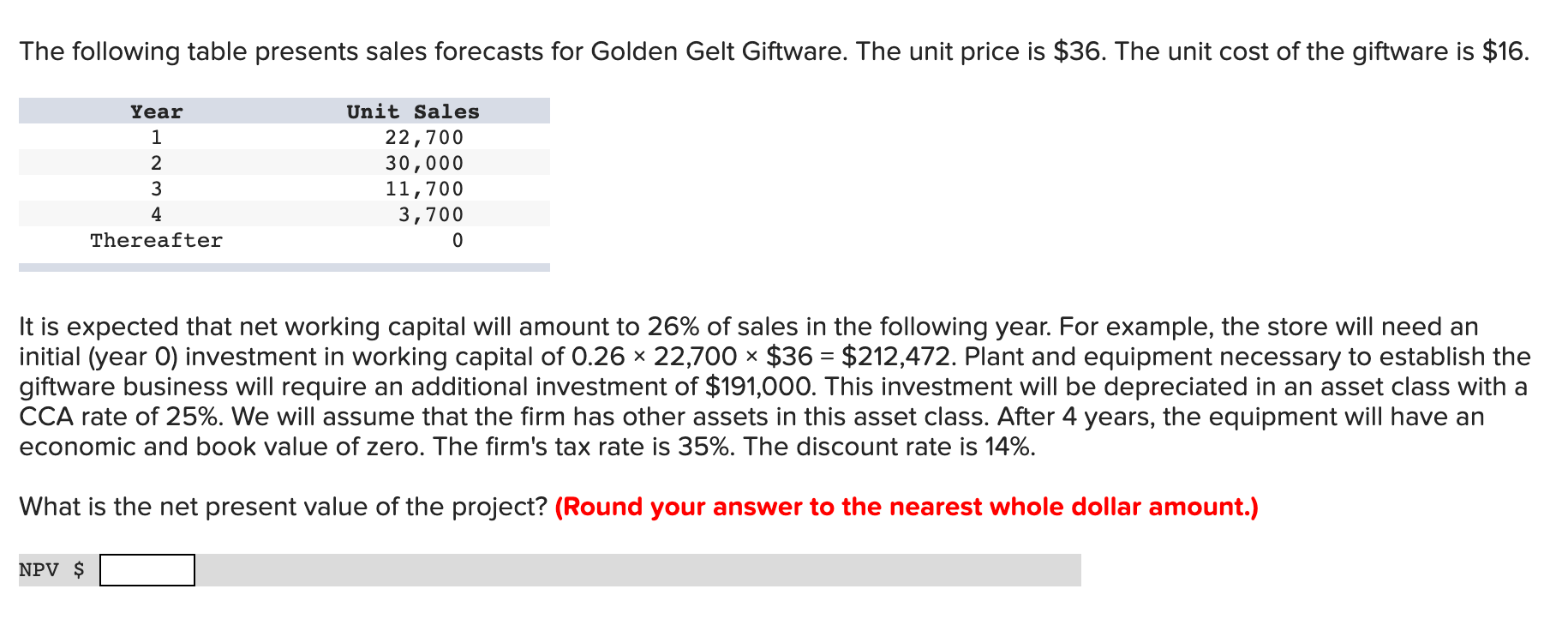

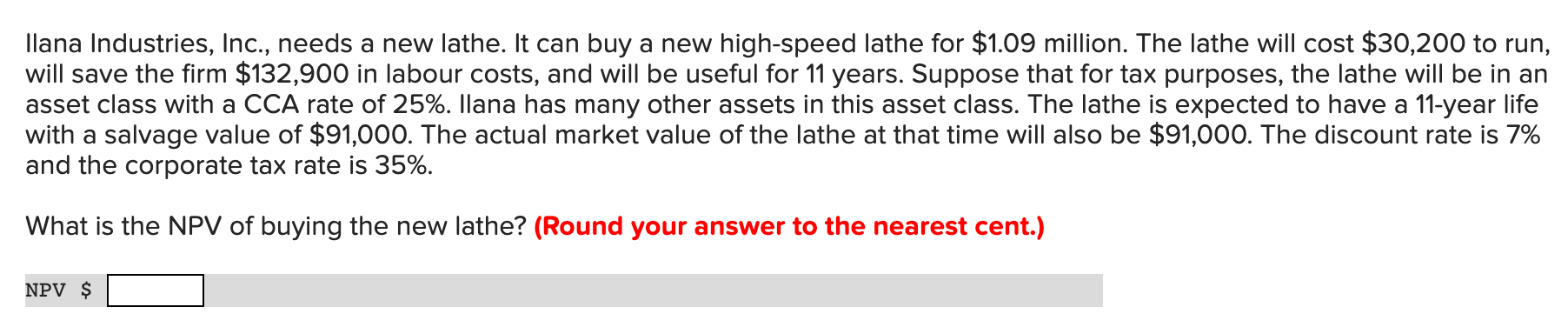

The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $36. The unit cost of the giftware is $16. It is expected that net working capital will amount to 26% of sales in the following year. For example, the store will need an initial (year 0) investment in working capital of 0.2622,700$36=$212,472. Plant and equipment necessary to establish the giftware business will require an additional investment of $191,000. This investment will be depreciated in an asset class with a CCA rate of 25%. We will assume that the firm has other assets in this asset class. After 4 years, the equipment will have an economic and book value of zero. The firm's tax rate is 35%. The discount rate is 14%. What is the net present value of the project? (Round your answer to the nearest whole dollar amount.) Ilana Industries, Inc., needs a new lathe. It can buy a new high-speed lathe for $1.09 million. The lathe will cost $30,200 to run, will save the firm $132,900 in labour costs, and will be useful for 11 years. Suppose that for tax purposes, the lathe will be in an asset class with a CCA rate of 25%. llana has many other assets in this asset class. The lathe is expected to have a 11 -year life with a salvage value of $91,000. The actual market value of the lathe at that time will also be $91,000. The discount rate is 7% and the corporate tax rate is 35%. What is the NPV of buying the new lathe? (Round your answer to the nearest cent.) The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $36. The unit cost of the giftware is $16. It is expected that net working capital will amount to 26% of sales in the following year. For example, the store will need an initial (year 0) investment in working capital of 0.2622,700$36=$212,472. Plant and equipment necessary to establish the giftware business will require an additional investment of $191,000. This investment will be depreciated in an asset class with a CCA rate of 25%. We will assume that the firm has other assets in this asset class. After 4 years, the equipment will have an economic and book value of zero. The firm's tax rate is 35%. The discount rate is 14%. What is the net present value of the project? (Round your answer to the nearest whole dollar amount.) Ilana Industries, Inc., needs a new lathe. It can buy a new high-speed lathe for $1.09 million. The lathe will cost $30,200 to run, will save the firm $132,900 in labour costs, and will be useful for 11 years. Suppose that for tax purposes, the lathe will be in an asset class with a CCA rate of 25%. llana has many other assets in this asset class. The lathe is expected to have a 11 -year life with a salvage value of $91,000. The actual market value of the lathe at that time will also be $91,000. The discount rate is 7% and the corporate tax rate is 35%. What is the NPV of buying the new lathe? (Round your answer to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts