Question: Could someone correct the mistakes in red for this problem? My apologies, I accidently included the wrong question. This is the correct question, parts a

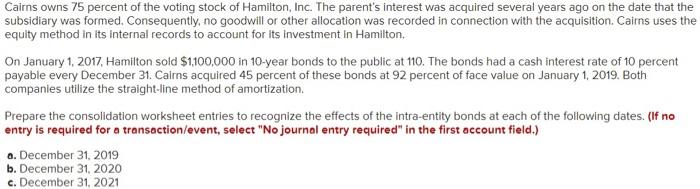

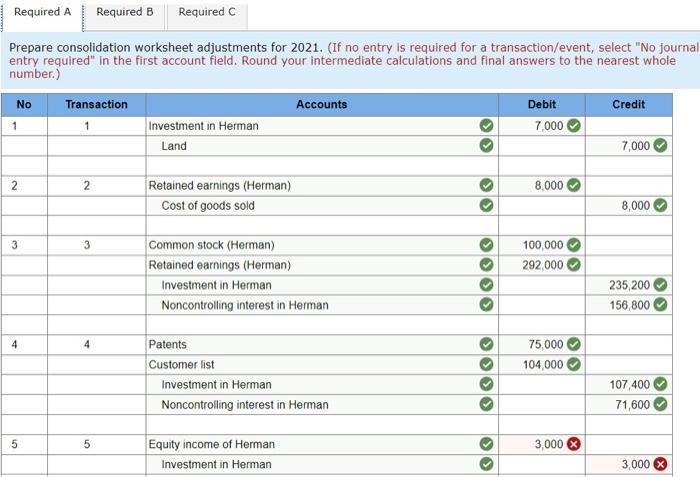

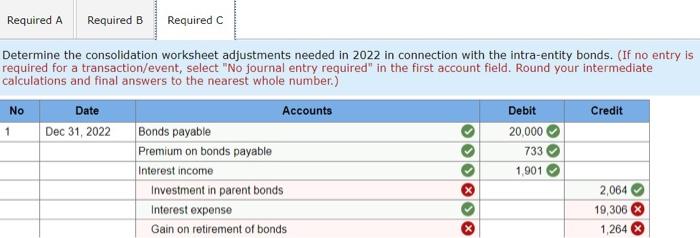

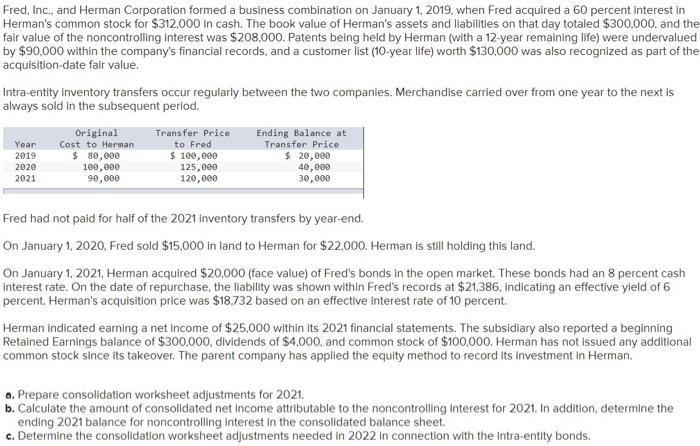

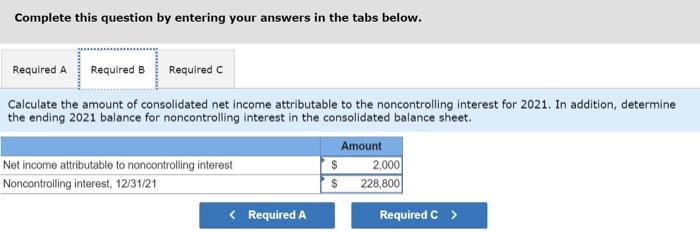

Cairns owns 75 percent of the voting stock of Hamilton, Inc. The parent's interest was acquired several years ago on the date that the subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition. Cairns uses the equity method in its internal records to account for its investment in Hamilton. On January 1, 2017. Hamilton sold $1,100,000 in 10-year bonds to the public at 110 . The bonds had a cash interest rate of 10 percent payable every December 31. Calrns acquired 45 percent of these bonds at 92 percent of face value on January 1,2019 . Both companies utilize the straight-line method of amortization. Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) o. December 31,2019 b. December 31,2020 c. December 31, 2021 Prepare consolidation worksheet adjustments for 2021. (If no entry is required for a transaction/event, select "No journa entry required" in the first account field. Round your intermediate calculations and final answers to the nearest whole number.) Determine the consolidation worksheet adjustments needed in 2022 in connection with the intra-entity bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate calculations and final answers to the nearest whole number.) Fred, Inc., and Herman Corporation formed a business combination on January 1, 2019, when Fred acquired a 60 percent interest in Herman's common stock for $312,000 in cash. The book value of Herman's assets and liabilities on that day totaled $300,000, and the fair value of the noncontrolling interest was $208,000. Patents being held by Herman (with a 12-year remaining life) were undervalued by $90,000 within the company's financial records, and a customer list (10-year life) worth $130,000 was also recognized as part of the acquisition-date fair value. Intra-entity Inventory transfers occur regularly between the two companies. Merchandise carried over from one year to the next is always sold in the subsequent period. Fred had not paid for half of the 2021 inventory transfers by year-end. On January 1, 2020. Fred sold $15,000 in land to Herman for $22,000. Herman is still holding this land. On January 1. 2021, Herman acquired $20.000 (face value) of Fred's bonds in the open market. These bonds had an 8 percent cash interest rate. On the date of repurchase, the liability was shown within Fred's records at $21,386, indicating an effective yleld of 6 percent. Herman's acquisition price was $18,732 based on an effective interest rate of 10 percent. Herman indicated earning a net income of $25,000 within its 2021 financial statements. The subsidiary also reported a beginning Retained Earnings balance of $300,000, dividends of $4,000, and common stock of $100,000. Herman has not issued any additional common stock since its takeover. The parent company has applied the equity method to record its investment in Herman. a. Prepare consolidation worksheet adjustments for 2021. b. Calculate the amount of consolidated net income attributable to the noncontrolling interest for 2021 . In addition, determine the ending 2021 balance for noncontrolling interest in the consolidated balance sheet. c. Determine the consolidation worksheet adjustments needed in 2022 in connection with the intra-entity bonds. Complete this question by entering your answers in the tabs below. Calculate the amount of consolidated net income attributable to the noncontrolling interest for 2021 . In addition, determine the ending 2021 balance for noncontrolling interest in the consolidated balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts