Question: Could someone help? 5. A $100 par value non-callable bond has 4% semiannual coupons and is redeemable at $103 after 20 years. The bond is

Could someone help?

Could someone help?

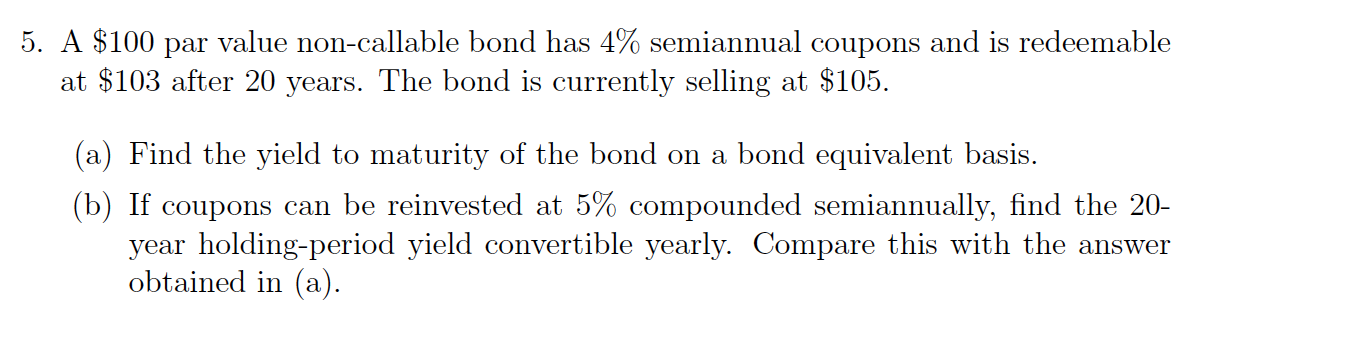

5. A $100 par value non-callable bond has 4% semiannual coupons and is redeemable at $103 after 20 years. The bond is currently selling at $105. (a) Find the yield to maturity of the bond on a bond equivalent basis. (b) If coupons can be reinvested at 5% compounded semiannually, find the 20- year holding-period yield convertible yearly. Compare this with the answer obtained in (a). 5. A $100 par value non-callable bond has 4% semiannual coupons and is redeemable at $103 after 20 years. The bond is currently selling at $105. (a) Find the yield to maturity of the bond on a bond equivalent basis. (b) If coupons can be reinvested at 5% compounded semiannually, find the 20- year holding-period yield convertible yearly. Compare this with the answer obtained in (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts