Question: Could someone please answer this? Q6) Bruin, Inc., has identified the following two mutually exclusive projects: Year 0 1 | 2 3 Cash Flow (A)

Could someone please answer this?

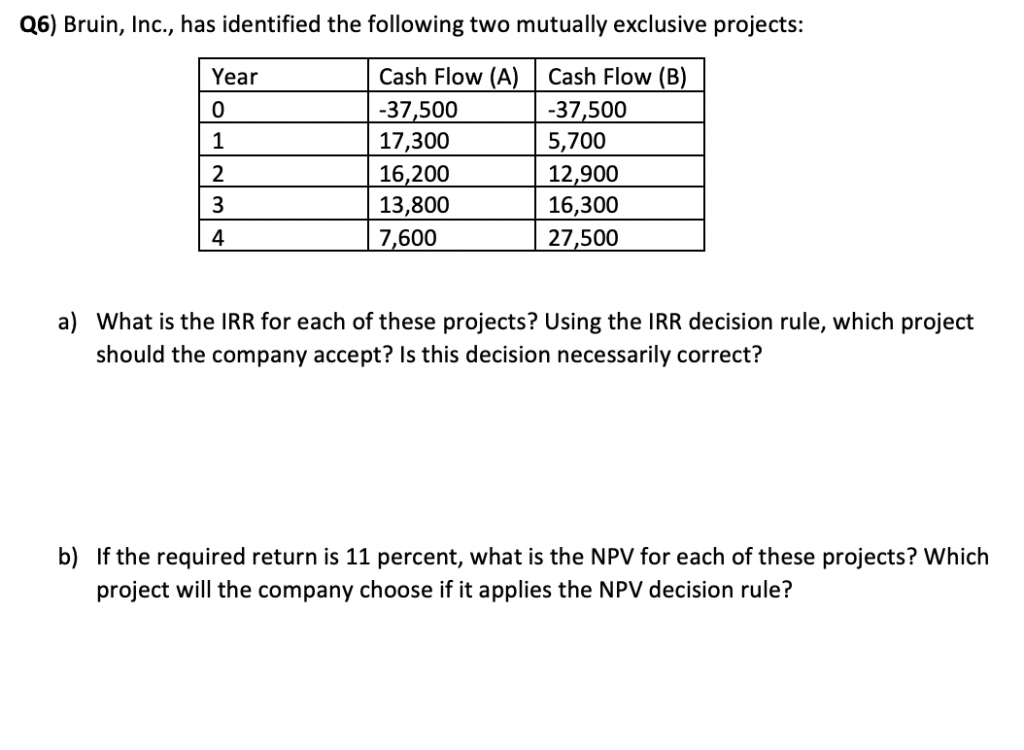

Q6) Bruin, Inc., has identified the following two mutually exclusive projects: Year 0 1 | 2 3 Cash Flow (A) -37,500 17,300 | 16,200 13,800 7,600 Cash Flow (B) -37,500 5,700 12,900 16,300 27,500 a) What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? b) If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock