Question: could someone please explain the steps to get the final answer for ordinary & annuity due? dont need all, just one as an example. thank

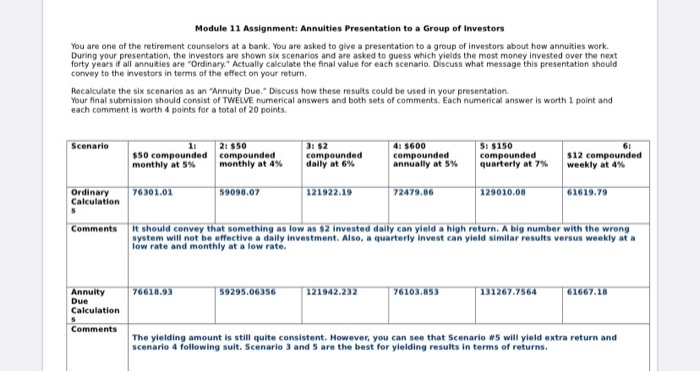

Module 11 Assignments Annuities Presentation to a Group of Investors You are one of the retirement counselors at a bank. You are asked to give a presentation to a group of investors about how annuities work. During your presentation, the investors are shown six scenarios and are asked to guess which yields the most money invested over the next forty years if all annuities are "Ordinary. Actually calculate the final value for each scenario. Discuss what message this presentation should convey to the investors in terms of the effect on your return. Recalculate the six scenarios as an "Annuity Due." Discuss how these results could be used in your presentation Your final submission should consist of TWELVE numerical answers and both sets of comments. Each numerical answer is worth 1 point and each comment is worth 4 points for a total of 20 points Scenario $50 compounded monthly at 5% 2: $50 compounded monthly at 4% 3: $2 compounded daily at 6% 41 600 compounded annually at 5% 51 $150 compounded quarterly at 7% $12 compounded weekly at 4% 76301.01 59098.07 121922.19 172479.86 Ordinary Calculation 129010.08 51619.79 Comments it should convey that something as low as $2 invested daily can yield a high return. A big number with the wrong system will not be effective a daily investment. Also, a quarterly invest can yield similar results versus weekly at a low rate and monthly at a low rate. 76618.93 59295.06356 1 21942.232 76103.853 131267.7564 6 1667.18 Annuity Due Calculation Comments The yielding amount is still quite consistent. However, you can see that scenario #5 will yield extra return and scenario 4 following suit. Scenario 3 and 5 are the best for yielding results in terms of returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts