Question: please explain step by step on obtaining the answer commercial (business customers. For example, a omer will sell stock and request that cash funds be

please explain step by step on obtaining the answer

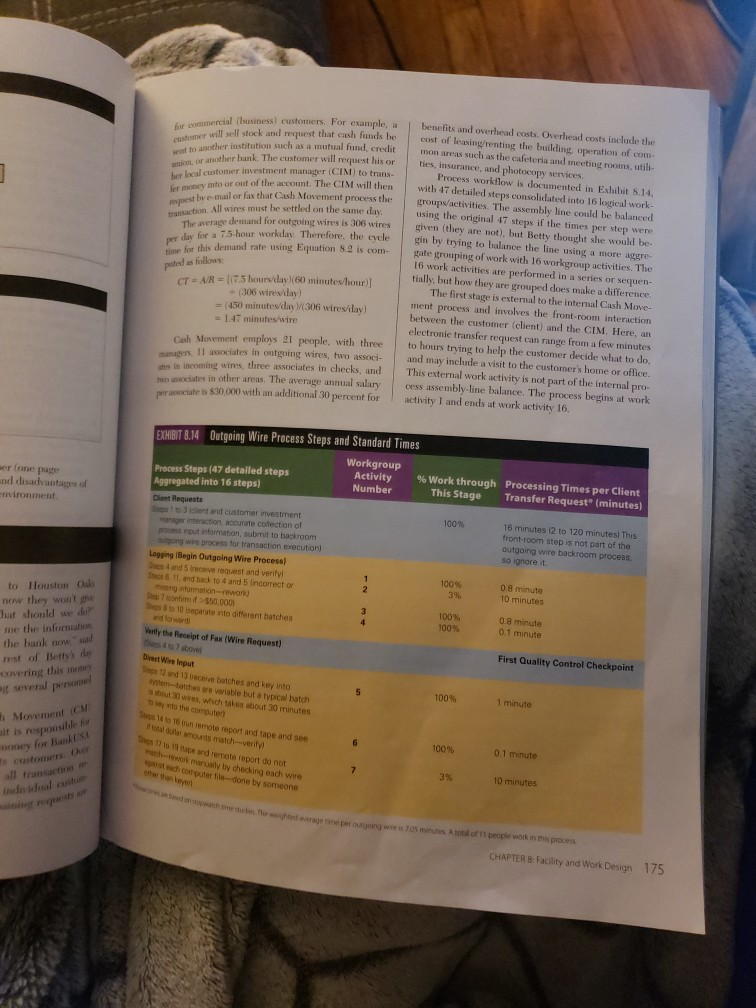

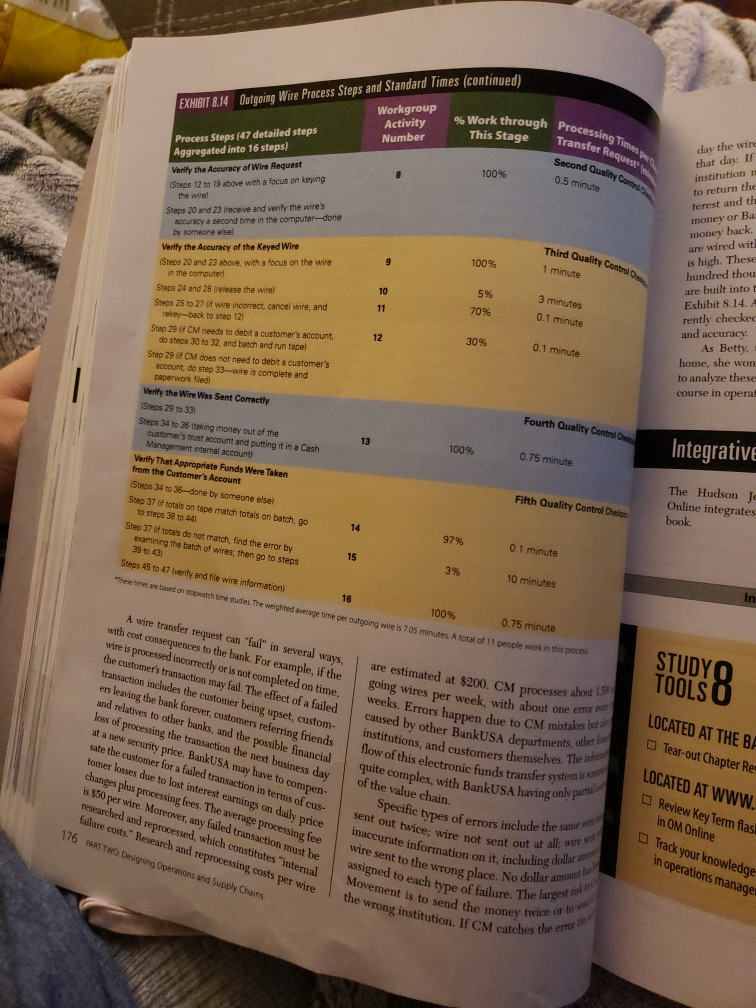

commercial (business customers. For example, a omer will sell stock and request that cash funds be to another institution such as a mutual fund, credit or another bank. The customer will request his or customer investment manager (CIM) to tmns ey into or out of the account. The CIM will by e-mail or fax that Cash Movement process the action. All wires must be settled on the same day The ge demand for outgoing wires is 306 wires day for a 7.5 hour workday. Therefore, the evile Se for this demand rate using Equation 8.2 is com- benefits and overhead costs. Overhead costs include the cost of leasing/renting the building, operation of com- mon areas such as the cafeteria and meeting rooms, utili ties, insurance, and photocopy services Process workflow is documented in Exhibit 6.14, with 47 detailed steps consolidated into 16 logical work- groups/activities. The assembly line could be balanced using the original 47 steps if the times per step were given they are not), but Betty thought she would be gin by trying to balance the line using a more aggre- gate grouping of work with 16 workgroup activities. The 16 work activities are performed in a series or sequen- tially, but how they are grouped does make a difference. The first stage is external to the internal Cash Move- ment process and involves the front-room interaction between the customer (client) and the CIM, Here, an electronic transfer request can range from a few minutes to hours trying to help the customer decide what to do. and may include a visit to the customer's home or office. This external work activity is not part of the internal pro- cess assembly-line balance. The process begins at work activity I and ends at work activity 16. CT = A/R = .5 hours/day)(60 minutes bour (306 wires/day) = (450 minutes day 306 wiresday = 1.47 minutes wire Cish Movement employs 21 people, with three grs. Il sociates in outgoing wires, two associ- shes in incoming wires three associates in checks, and sociates in other areas. The average annual salary asciate is $30,000 with an additional 30 percent for EXHIBIT 8.14 Outgoing Wire Process Steps and Standard Times and disadvantages of environment Workgroup Activity Number % Work through Processing Times per Client This Stage Transfer Request (minutes) 100% Process Steps (47 detailed steps Aggregated into 16 steps) Client Requests to cent and customer investment er action accurate collection of yout information, submit to backroom on we process for transaction becution Legging Begin Outgoing Wire Process) Dhind 5 treceverest and verify Shell and back to 4 and 5 incorrector mong information - reworks no confirm 550.000 to remento different batches 16 minutes 12 to 120 minutes. This front-room step is not part of the outgoing wire backroom process 50 ignore it 100% 3% 0.8 minute 10 minutes 100% 100% to Houston Oils now they won't be that should we do? me the information the bank now.ad rest of Betty's de covering this mon e several pro Vanly the Receipt of Fax (Wire Request) 0.8 minute 0.1 minute First Quality Control Checkpoint 100% 1 minute Direct Wire Input and 13 recente batches and key into m atches are variable but a typical batch 3 wires, which takes about 30 minutes by the computer es 10 to 16 remote report and tape and see Fa m ounts match-verify Des Toupe and remote iwport do not twork marowly by checking each we each computer tiledone by someone Movement CM it is responsible for honey for Banks 100% 0 1 minute all transact 3% 10 minutes CHAPTER 8: Facility and Work Design 175 9 Work through Processi This Stage sing Times mes (continued EXHIBIT 8.14 Outgoing Wire Process Steps and Standard Workgroup Activity Process Steps (47 detailed steps Number Aggregated into 16 steps) Verify the Accuracy of Wire Request Steps 12 to 19 above with a focus on keying 100% the wire Steps 20 and 23 receive and verify the wire's accuracy a second time in the computer-done by someone else Transfer Request Second Quality Conte 0.5 minute day the wire that day. If institution to return the terest and the money or Ba money back are wired with is high. These 100% Third Quality Control 1 minute 5% 70% 3 minutes 0.1 minute Verify the Accuracy of the Keyed Wire (Steps 20 and 23 above, with a focus on the wire in the computer Steps 24 and 28 release the wire Steps 25 to 27 of wire incorrect, cancel wire, and reker-back to step 12) Step 29 FCM needs to debit a customer's account do steps 30 to 32 and batch and run tapel Step 29 CM does not need to debit a customer's account do step 33-wire is complete and paperwork filed Verity the Wire Was Sent Correctly Steps 29 to 331 30% hundred thou are built into t Exhibit 8.14. A rently checked and accuracy. As Betty, home, she won to analyze these course in operat 0.1 minute Fourth Quality Control de tina cast 13 100% Integrative 0.75 minute Steps 34 to 36 taking money out of the customer's trust account and putting it in a Cash Management internal account Verity That Appropriate Funds Were Taken Fifth Quality Control Check from the Customer's Account Steps 34 to 36-done by someone elsel Step 37 of totals on tape match totais on batch, go 0.1 minute to steps 38 to 441 Step 37 it totals do not match, find the error by examining the batch of wires, then go to steps 3% 10 minutes 39 to 43) Steps 45 to 47 Iverity and file wire information 100% These time 0.75 minute baved on the studies. The weighted average time per outgoing wire is 705 minutes. A total of 11 people workin The Hudson Jo Online integrates book 97% STUDY eransaction includes thon may fail. The red on time, TOOLSO A wire transfer request can "fail in several ways, with cost consequences to the bank. For example, if the wire is processed incorrectly or is not completed on time, the customer's transaction may fail. The effect of a failed transaction includes the customer being upset, custom- ers leaving the bank forever, customers referring friends and relatives to other banks, and the possible financial loss of processing the transaction the next business day at a new security price. BankUSA may have to compen- sate the customer for a failed transaction in terms of cus- tomer losses due to lost interest earnings on daily price changes plus processing fees. The average processing fee is $50 per wire. Moreover, any failed transaction must be researched and reprocessed, which constitutes internal failure costs." Research and reprocessing costs per wire are estimated at $200. CM processes about 1 going wires per week, with about one error Errors happen due to CM mistakes bet y other BankUSA departments, other loss of waves to other bank customers refere custom- sate the security price. Bantion the next bu financial Omer losses der for a failed. SA may ban themselves. The info transfer system is weeks. Errors happen due to caused by other BankUSA depart institutions, and customers themselves. flow of this electronic funds transfer sys quite complex, with BankUSA having only p of the value chain Specific types of errors in sent out twice: wire not sent out at a mhaccurate information on it including wire sent to the wrong place. No assigned to each type of failure. The Movement is to send the money LOCATED AT THE BA Tear-out Chapter Re LOCATED AT WWW. Review Key Term flasi in OM Online only partiala 176 le same inde PART TWO Designing Operations and Supply Chains out at all wires Track your knowledge in operations managed acting dollar the wrong institution. If No dollar amouth e. The largest e money twice or to If CM catches the error! of assembly-line balancing (she majored in finance), but she wondered if this method would work for services. She decided to begin her analysis by answering the fol- lowing questions. be returned Ehe receiving he customer Its in lost in- eturning the on to get the equests that money back p to several ontrol steps as shown in ats, are cur- mpleteness Case Questions for Discussion 1. What is the best way to group the work represented by the 16 workgroups for an average demand of 306 outgoing wires per day? What is your line balance if peak demand is 450 wires per day? What is assembly-line efficiency for each line-balance solution? 2. How many people are needed for the outgoing wire process using assembly-line-balancing methods versus the current staffing level of 11 full-time-equivalent employees? 3. How many staff members do you need for the outgoing wire process if you eliminate all rework? 4. What are your final recommendations? ent, drove -t the time ga college the topic velers at OM6 er of this Case Question for Discussion Design and draw the layout for your high-end jewelry store. Critique its strengths and weaknesses. (Make use of concepts in Chapters 4, 5, 7 and 8.) nal cases by visiting wonStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock