Question: could someone please help me to fill the yellow boxes. thankyou Layout References >> Office Update To keep up-to-date with security updates, fixes, and improvements,..

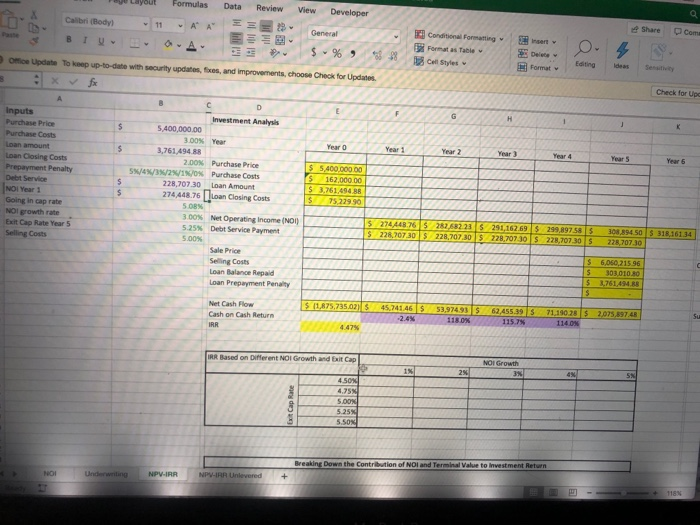

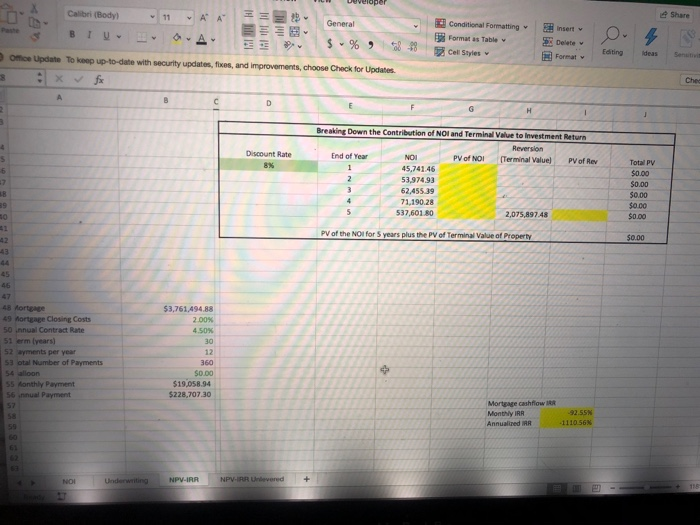

Layout References >> Office Update To keep up-to-date with security updates, fixes, and improvements,.. Share (3) Che Fill in the sheet titled "NPV-IRR". You will buy the property now (Year 0), collect NOI for 5 years Year 1-Year 5, and sell it at the end of Year 5. Your loan has a 5/4/3/2/1 prepayment penalty structure, so if you prepay in the first year, you will pay a penalty equal to 5% of the balance, in the second year you will pay a penalty equal to 4% of the balance etc. Payoff the loan balance, the prepayment penalty and any transaction costs. You forecast NOI will grow at 3% per year, compounded annually. You forecast you can sell the property at the end of year 5 at a 5.25% cap rate. Recall: Sale Price in Year 5 = Nols cap rates (3.a) How much will You sell the property for in Year 5? (3.b) What is Your IRR for this investment? (3.c) What is your "cash on cash"return for Year 1? Recall that the cash on cash return is equal to your annual Net Cash Flow divided by your total cash investment at closing. The formula cash on cash return NCH NCH For the following questions, change only the variable indicated. Keep the others as dictated above. (3.) What is your IRR IF NOI growth is 5% compounded annually all other variables held constant)? (e) What is your IRR If your exit cap rate is 4.75% (all other variables held constant) (3.1) Complete the data table using the What If Analysis in Excel in the sheette NPV IRR Unlevered AutoSaver svo - Project_2_as... - Saved to my Home Insert Draw Design Layout References >> Share Office Update To keep up-to-date with security updates, fixes, and improvements,... Che (3.c) What is your "cash on cash" return for Year 1? Recall that the cash on cash return is equal your annual Net Cash Flow divided by your total cash investment at closing. The formula = cash on cash return = NCF NCE For the following questions, change only the variable indicated. Keep the others as dictated above. (3.d) What is your IRR if NOI growth is 5% compounded annually (all other variables held constant)? (3.) What is your IRR if your exit cap rate is 4.75% (all other variables held constant)? (3.f) Complete the data table using the What-If Analysis in Excel. (4) Fill in the sheet titled "NPV-IRR Unlevered" Assume you purchase this property without any financing. (4.a) What is your unleveraged IRR (using the base case of 3% NOI growth and 5.25% Exit Cap Rate). Fill in the chart "Breaking down the contribution of NOI and Terminal Value to Investment Return. Use the numbers from the Net Cash Flow line. (4.b) Using the NCF from years 1 through 5 as presented, what would you be willing to pay if you wanted to earn a 10% IRR on this investment? Review View Formulas A A Developer Data = Calibriedy 11 Share Com General Conditional Formatting Formatas Tali E P S % 9 Editing to t ode w ord s for improvements, choose Check for Update Check for Up Inputs stment Analysis $ Year Purchase Costs Loan amount Loan Closing Costs Pret Penalty S I 400 000 DO 3.00 3,761 494 88 2.DON I NN 228.70730 274448.76 SON 3.00 525 Purchase price Purchase Costs Loan Amount Loan Closing Costs $ $ $ 5.400000.00 162.000.00 3.761.05088 75.229.90 NOI Year Going in cap rate NOI growth rate Exit Cap Rate Year 5 Seng Costs Net Operating Income (NO) Debt Service Payment 527448765224225211162.595299897585 $ 226,707305228.707.30 5 7870730 22.707.30 450 S 31.161.34 220 707.30 $ Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty 6,060,215 96 303010.80 $ 11,075,735.0 45,741.46 $ 53,974.935 Net Cash Flow Cash on Cash Return 62.455.39S 71.110.28 $ 2025.597.4 IRR Based on Different NOI Growth and BitCap 4.50% Ex Cap Rate Cat NOTeratoret NPV-IRR N eed + Calibri (Body) 11 A A Insert Conditional Formatting Format as Table = 9 3 Cell Styles Format Once Update To keep up-to-date with security updates free ements, choose Check for Updates 12 98 king Down the Contribution of NO and Terminal Value to investment Return Reversion NOI PV of NOI (Terminal Value PV of Rev 45.741.46 53,974,93 62.455 39 71,190.28 $ Total PV $0.00 $0.00 50.00 $0.00 -- $0.00 $0.00 PV of the NOI for years plus the PV of Terminal value of Property 4.50% Art Closing Costs 50 al Contract Rate 51 years 52 per year Satal Number of Payments se alloon Payment Payment $0.00 $19.58.54 $228.707.30 Morte Cashow Mont IRR Aed NPV IR NPV Uvered Layout References >> Office Update To keep up-to-date with security updates, fixes, and improvements,.. Share (3) Che Fill in the sheet titled "NPV-IRR". You will buy the property now (Year 0), collect NOI for 5 years Year 1-Year 5, and sell it at the end of Year 5. Your loan has a 5/4/3/2/1 prepayment penalty structure, so if you prepay in the first year, you will pay a penalty equal to 5% of the balance, in the second year you will pay a penalty equal to 4% of the balance etc. Payoff the loan balance, the prepayment penalty and any transaction costs. You forecast NOI will grow at 3% per year, compounded annually. You forecast you can sell the property at the end of year 5 at a 5.25% cap rate. Recall: Sale Price in Year 5 = Nols cap rates (3.a) How much will You sell the property for in Year 5? (3.b) What is Your IRR for this investment? (3.c) What is your "cash on cash"return for Year 1? Recall that the cash on cash return is equal to your annual Net Cash Flow divided by your total cash investment at closing. The formula cash on cash return NCH NCH For the following questions, change only the variable indicated. Keep the others as dictated above. (3.) What is your IRR IF NOI growth is 5% compounded annually all other variables held constant)? (e) What is your IRR If your exit cap rate is 4.75% (all other variables held constant) (3.1) Complete the data table using the What If Analysis in Excel in the sheette NPV IRR Unlevered AutoSaver svo - Project_2_as... - Saved to my Home Insert Draw Design Layout References >> Share Office Update To keep up-to-date with security updates, fixes, and improvements,... Che (3.c) What is your "cash on cash" return for Year 1? Recall that the cash on cash return is equal your annual Net Cash Flow divided by your total cash investment at closing. The formula = cash on cash return = NCF NCE For the following questions, change only the variable indicated. Keep the others as dictated above. (3.d) What is your IRR if NOI growth is 5% compounded annually (all other variables held constant)? (3.) What is your IRR if your exit cap rate is 4.75% (all other variables held constant)? (3.f) Complete the data table using the What-If Analysis in Excel. (4) Fill in the sheet titled "NPV-IRR Unlevered" Assume you purchase this property without any financing. (4.a) What is your unleveraged IRR (using the base case of 3% NOI growth and 5.25% Exit Cap Rate). Fill in the chart "Breaking down the contribution of NOI and Terminal Value to Investment Return. Use the numbers from the Net Cash Flow line. (4.b) Using the NCF from years 1 through 5 as presented, what would you be willing to pay if you wanted to earn a 10% IRR on this investment? Review View Formulas A A Developer Data = Calibriedy 11 Share Com General Conditional Formatting Formatas Tali E P S % 9 Editing to t ode w ord s for improvements, choose Check for Update Check for Up Inputs stment Analysis $ Year Purchase Costs Loan amount Loan Closing Costs Pret Penalty S I 400 000 DO 3.00 3,761 494 88 2.DON I NN 228.70730 274448.76 SON 3.00 525 Purchase price Purchase Costs Loan Amount Loan Closing Costs $ $ $ 5.400000.00 162.000.00 3.761.05088 75.229.90 NOI Year Going in cap rate NOI growth rate Exit Cap Rate Year 5 Seng Costs Net Operating Income (NO) Debt Service Payment 527448765224225211162.595299897585 $ 226,707305228.707.30 5 7870730 22.707.30 450 S 31.161.34 220 707.30 $ Sale Price Selling Costs Loan Balance Repaid Loan Prepayment Penalty 6,060,215 96 303010.80 $ 11,075,735.0 45,741.46 $ 53,974.935 Net Cash Flow Cash on Cash Return 62.455.39S 71.110.28 $ 2025.597.4 IRR Based on Different NOI Growth and BitCap 4.50% Ex Cap Rate Cat NOTeratoret NPV-IRR N eed + Calibri (Body) 11 A A Insert Conditional Formatting Format as Table = 9 3 Cell Styles Format Once Update To keep up-to-date with security updates free ements, choose Check for Updates 12 98 king Down the Contribution of NO and Terminal Value to investment Return Reversion NOI PV of NOI (Terminal Value PV of Rev 45.741.46 53,974,93 62.455 39 71,190.28 $ Total PV $0.00 $0.00 50.00 $0.00 -- $0.00 $0.00 PV of the NOI for years plus the PV of Terminal value of Property 4.50% Art Closing Costs 50 al Contract Rate 51 years 52 per year Satal Number of Payments se alloon Payment Payment $0.00 $19.58.54 $228.707.30 Morte Cashow Mont IRR Aed NPV IR NPV Uvered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts