Question: Could someone tell which is correct or incorrect for the ones thats incorrect write a brief 5-30 words on why its incorrect a Partnerships have

Could someone tell which is correct or incorrect for the ones thats incorrect write a brief 5-30 words on why its incorrect

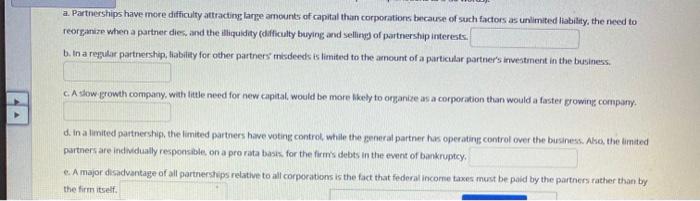

a Partnerships have more difficulty attracting large amounts of capital than corporations because of such factors as unlimited liability, the need to reorganize when a partner dies, and the liquidity (chifficulty buying and selling of partnership interests. b. In a regular partnership, Hability for other partners isdeeds is limited to the amount of a particular partner's investment in the business CA stew.growth company with little need for new capital, would be more Skely to organize as a corporation than would a faster growing company it. In almited partnershia the limited partners have votre control while the general partner has operating control over the business. Also, the limited partners are individually responsible on a pro rata basis for the firm's debts in the event of bankruptcy. e. A major disadvantage of all partnerships relative to all corporations is the fact that federal income taxes must be paid by the partners rather than by the firm itself

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts