Question: Could u please show me how it works? Two Final Examinations, 2017 FINM2401 Financial Management nformation on several possible investments as laid out in the

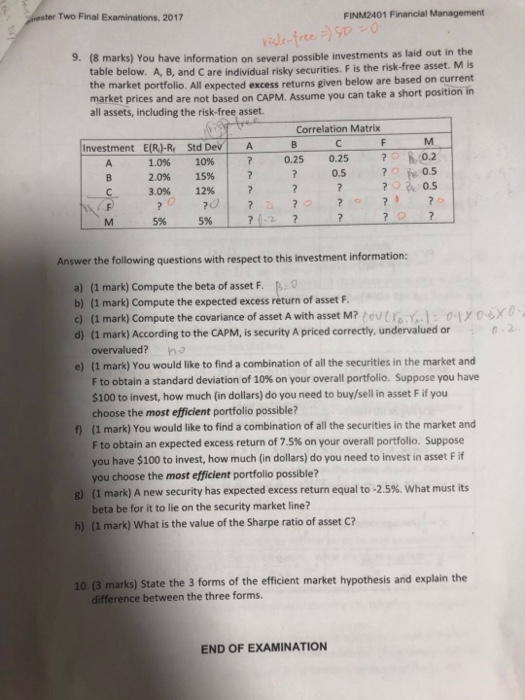

Two Final Examinations, 2017 FINM2401 Financial Management nformation on several possible investments as laid out in the A, B, and C are individual risky securities. F is the risk-free asset. M is arket portfolio. All expected excess returns given below are based on current 9. (8 marks) You have i table below. the m market prices and are not based on CAPM. Assume you can take a short position in all assets, including the risk-free asset Correlation Matrix Investment EIRJ-R Std DevA 8 1.0% 10%| ? 0.25 0.25 2.0% 15% ?oh:0.2 0.5 0.5 ? 0.5 3.0% 12% 07 5% 5% Answer the following questions with respect to this investment information a) (1 mark) Compute the beta of asset F. B: b) (1 mark) Compute the expected excess rturn of asset F c) (1 mark) Compute the covariance of asset A with asset M7/evtG.Yn]: 0-1x0yY? d) (1 mark) According to the CAPM, is security A priced correctly, undervalued or overvalued?o (1 mark) You would like to find a combination of all the securities in the market and F to obtain a standard deviation of 10% on your overall portfolio. Suppose you have $100 to invest, how much (in dollars) do you need to buy/sell in asset F if you choose the most efficient portfolio possible? (1 mark) You would like to find a combination of all the securities in the market and F to obtain an expected excess return of 7.5% on your overall portfolio. Suppose you have $100 to invest, how much (in dollars) do you need to invest in asset Fif you choose the most efficient portfolio possible? (1 mark) A new security has expected excess return equal to-2.5%, what must its beta be for it to lie on the security market line? (1 mark) what is the value of the Sharpe ratio of asset C? e) f) g) h) 10. (3 marks) State the 3 forms of the efficient market hypothesis and explain the difference between the three forms. END OF EXAMINATION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts