Question: Could use some help in preparing a pension worksheet based on the data & requirements written below (Ayayai Company) & constructed like the images provided.

Could use some help in preparing a pension worksheet based on the data & requirements written below (Ayayai Company) & constructed like the images provided. Thank you!

Ayayai Company provides the following information about its defined benefit pension plan for the year 2022.

Service cost $91,200

Contribution to the plan 104,700

Prior service cost amortization 9,800

Actual and expected return on plan assets 62,800

Benefits paid 40,500

Plan assets at January 1, 2022 632,600

Projected benefit obligation at January 1, 2022 686,700

Accumulated OCI (PSC) at January 1, 2022 152,100

Interest/discount (settlement) rate 9%

Requirements:

1) Using Excel I need help w/ a pension worksheet inserting January 1, 2022, balances, and then showing December 31, 2022.

2) Prepare the journal entry to record pension expense.

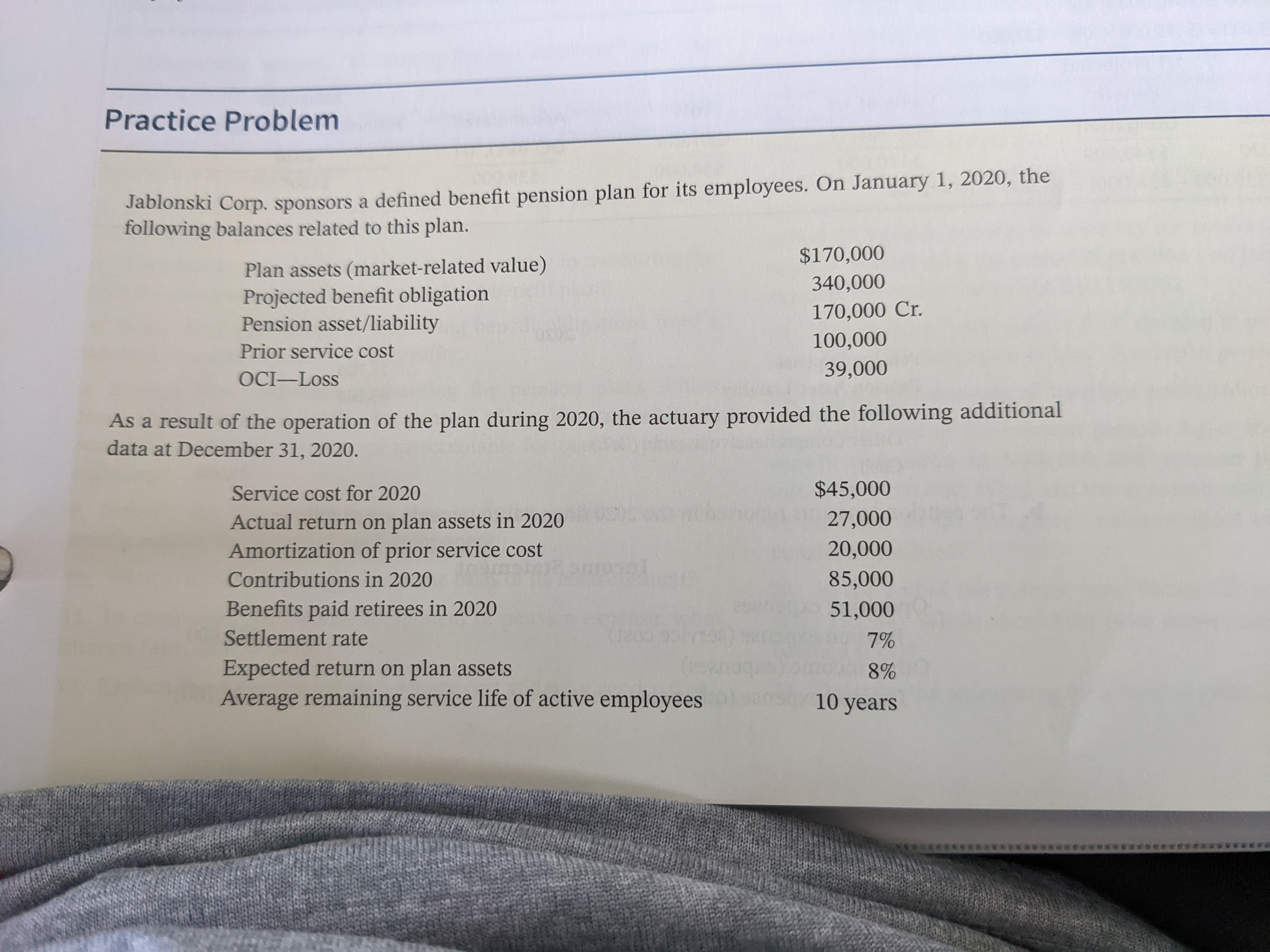

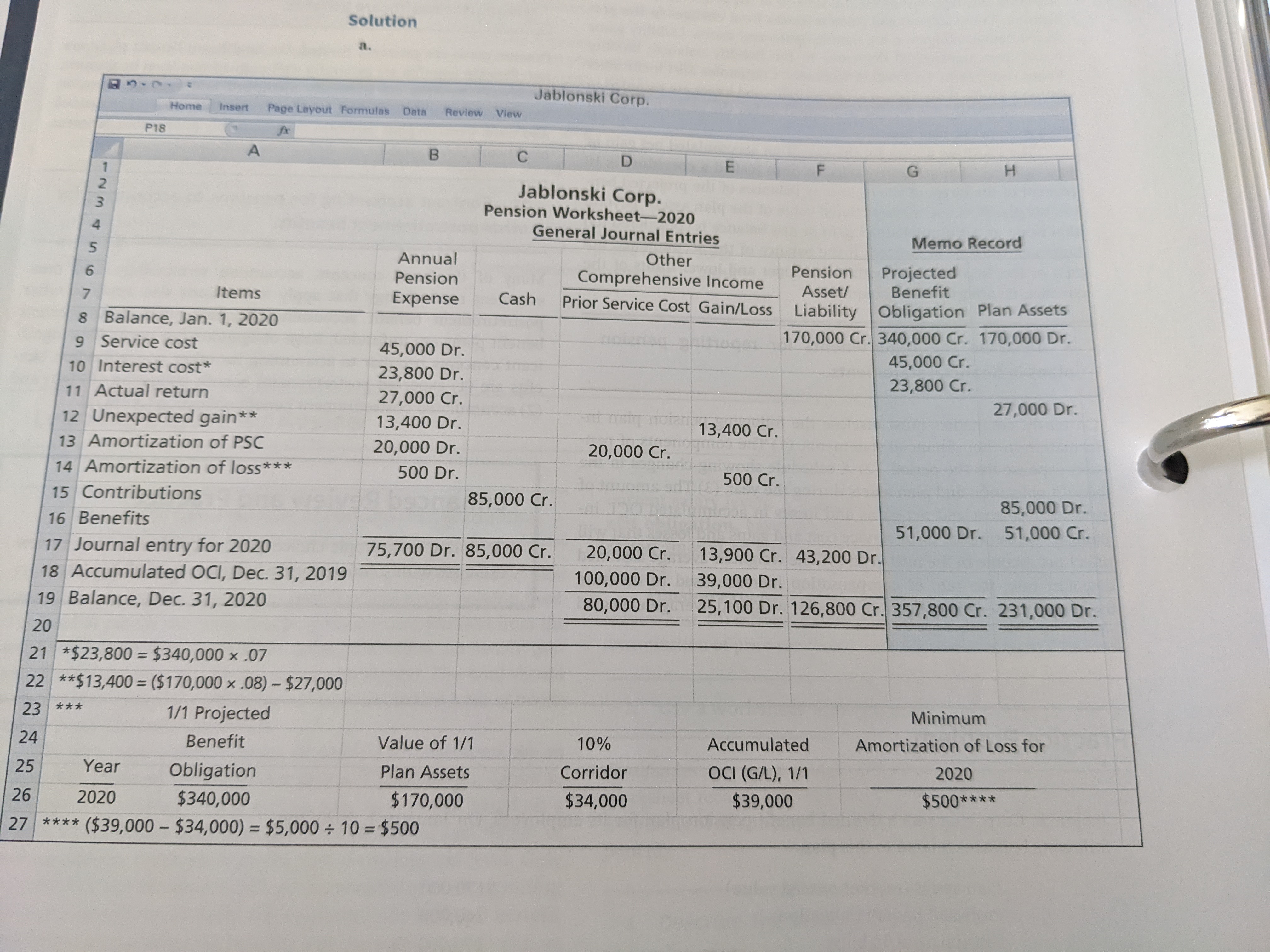

Practice Problem Jablonski Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2020, the following balances related to this plan. Plan assets (market-related value) $170,000 Projected benefit obligation 340,000 Pension asset/liability 170,000 Cr. Prior service cost 100,000 OCI-Loss 39,000 As a result of the operation of the plan during 2020, the actuary provided the following additional data at December 31, 2020. Service cost for 2020 $45,000 Actual return on plan assets in 2020 27,000 Amortization of prior service cost 20,000 Contributions in 2020 85,000 Benefits paid retirees in 2020 51,000 Settlement rate 7% Expected return on plan assets 8% Average remaining service life of active employees 10 yearsSolution Jablonski Corp. Home Insert Page Layout Formulas Data Review View P18 fix A B C D E F G H Jablonski Corp. D WN - Pension Worksheet-2020 General Journal Entries Memo Record Annual Other Pension Projected Pension Comprehensive Income Asset/ Benefit 10 00 V G UI A Items Expense Cash Prior Service Cost Gain/Loss Liability Obligation Plan Assets Balance, Jan. 1, 2020 170,000 Cr. 340,000 Cr. 170,000 Dr. Service cost 45,000 Dr. 45,000 Cr. 10 Interest cost* 23,800 Dr. 23,800 Cr. 11 Actual return 27,000 Cr. 27,000 Dr. 12 Unexpected gain** 13,400 Dr. 13,400 Cr. 13 Amortization of PSC 20,000 Dr. 20,000 Cr. 14 Amortization of loss*** 500 Dr. 500 Cr. 15 Contributions 85,000 Cr. 85,000 Dr. 16 Benefits 51,000 Dr. 51,000 Cr. 17 Journal entry for 2020 75,700 Dr. 85,000 Cr. 20,000 Cr. 13,900 Cr. 43,200 Dr. 18 Accumulated OCI, Dec. 31, 2019 100,000 Dr. 39,000 Dr. 19 Balance, Dec. 31, 2020 80,000 Dr. 25, 100 Dr. 126,800 Cr. 357,800 Cr. 231,000 Dr. 20 21 *$23,800 = $340,000 x .07 22 **$13,400 = ($170,000 x .08) - $27,000 23 * * * 1/1 Projected Minimum 24 Benefit Value of 1/1 10% Accumulated Amortization of Loss for 25 Year Obligation Plan Assets Corridor OCI (G/L), 1/1 2020 2020 $340,000 $34,000 $39,000 $500* * * * 26 $170,000 27 * * ** ($39,000 - $34,000) = $5,000 + 10 = $500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts