Question: could you also check if this is the right answer? 5. Question. A chemical company is considering investment in a project that costs Rs. 500000

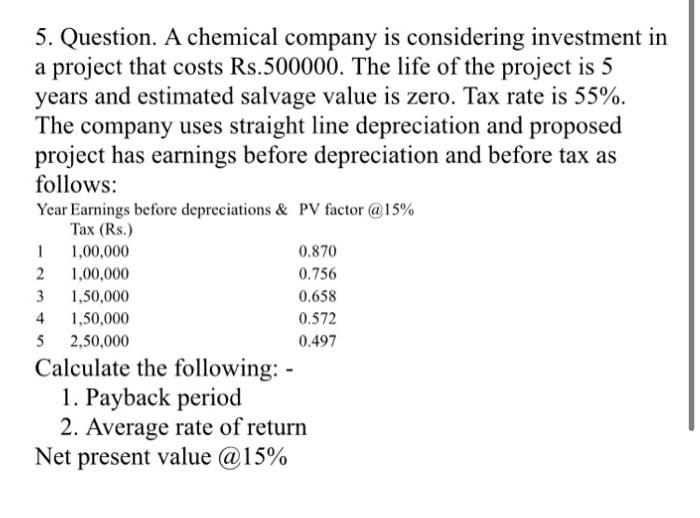

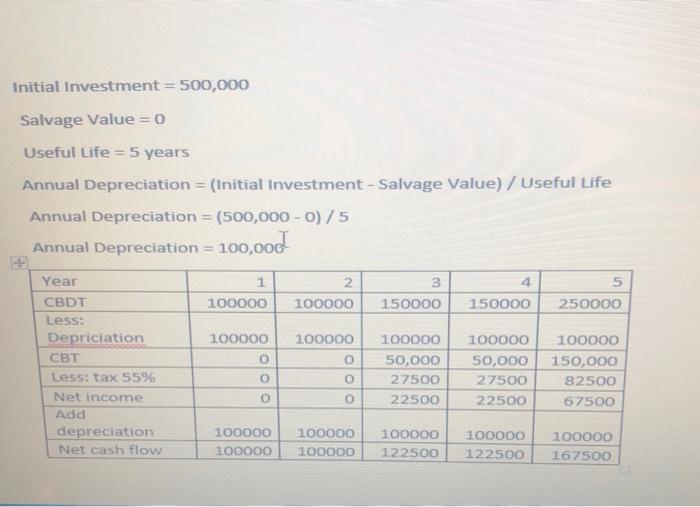

5. Question. A chemical company is considering investment in a project that costs Rs. 500000 . The life of the project is 5 years and estimated salvage value is zero. Tax rate is 55%. The company uses straight line depreciation and proposed project has earnings before depreciation and before tax as follows: Year Earnings before depreciations \& PV factor @15\% Calculate the following: - 1. Payback period 2. Average rate of return Net present value @15\% Initial Investment =500,000 Salvage Value =0 Useful Life =5 years Annual Depreciation = (Initial Investment - Salvage Value)/Useful Life Annual Depreciation =(500,0000)/5 Annual Depreciation =100,00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts