Question: Could you also show how you got to the answer please? I am stuck on this one. Thank you! Problem 8-32 (LO. 2) Juan acquires

Could you also show how you got to the answer please? I am stuck on this one. Thank you!

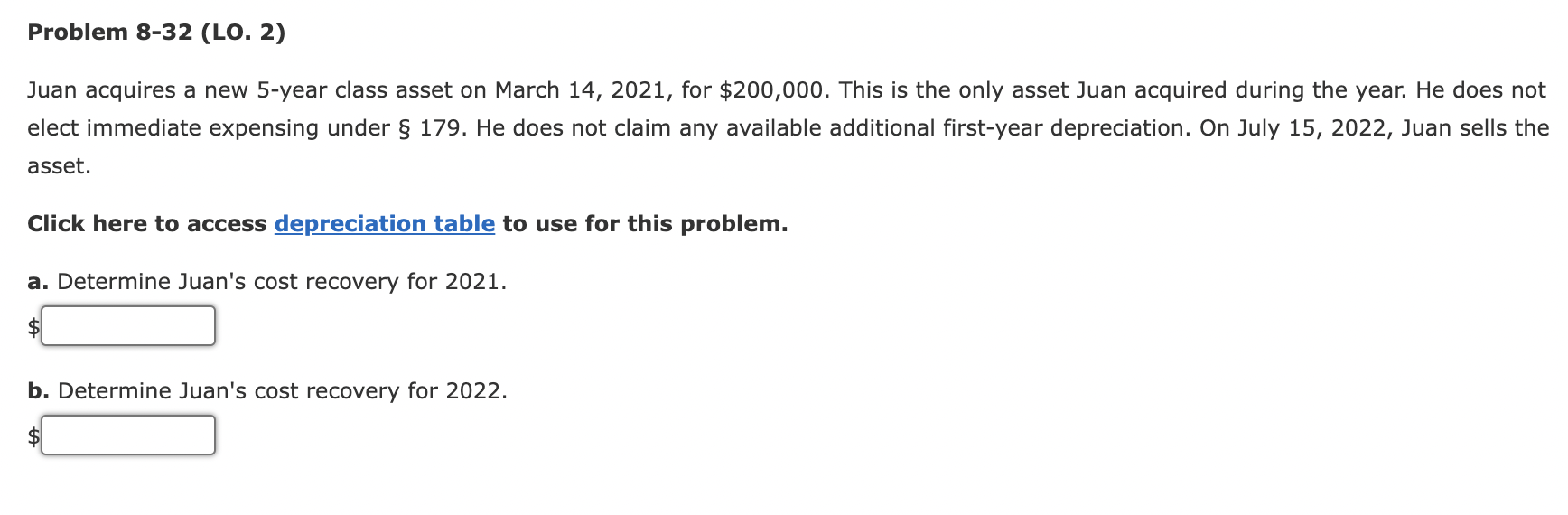

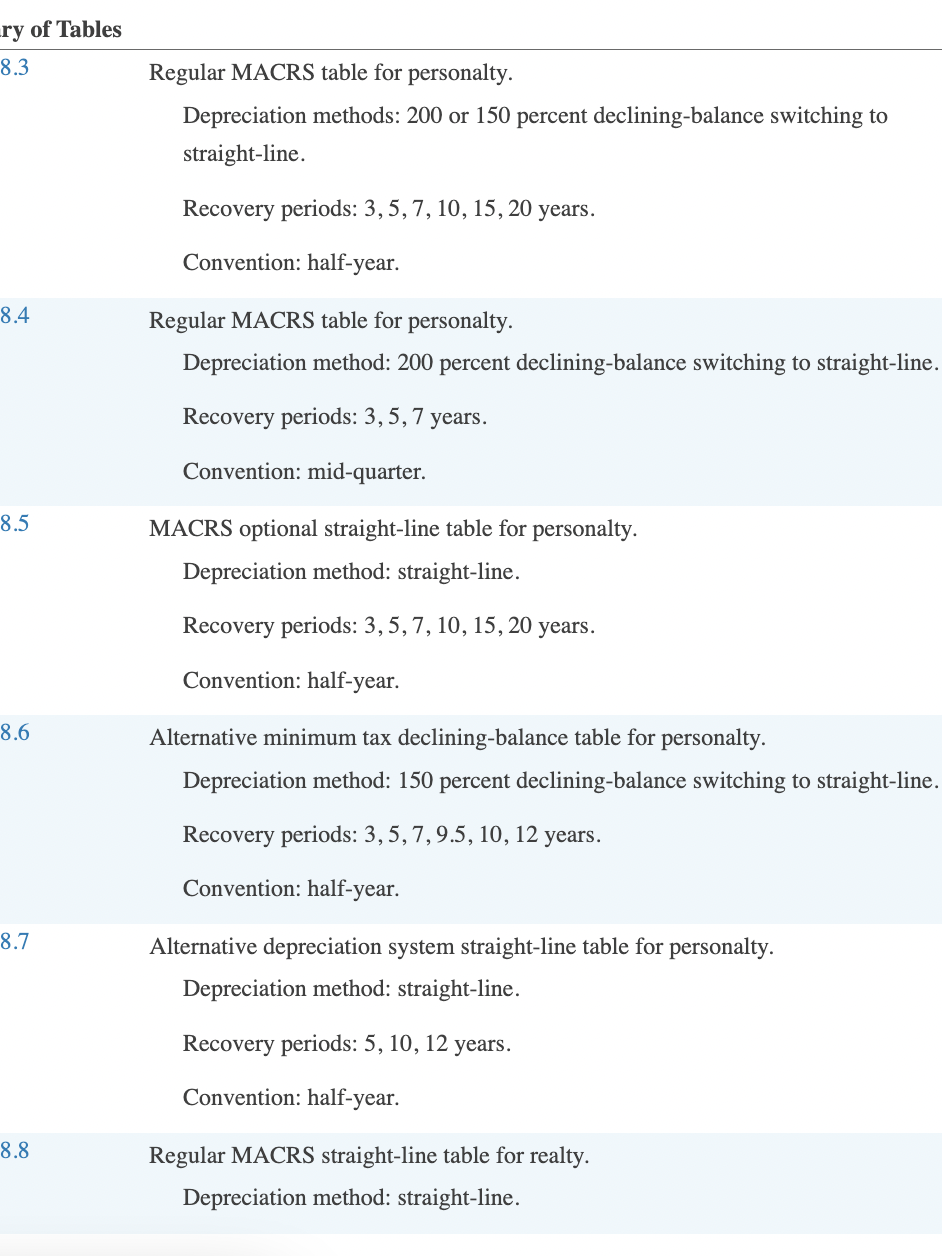

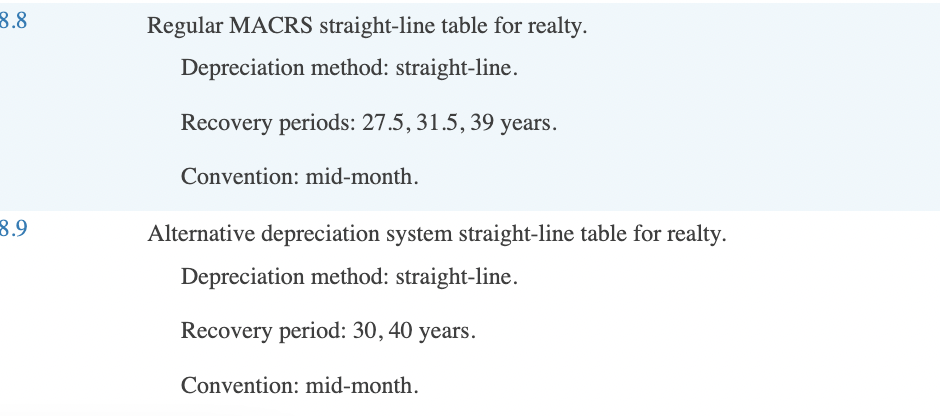

Problem 8-32 (LO. 2) Juan acquires a new 5-year class asset on March 14, 2021, for $200,000. This is the only asset Juan acquired during the year. He does not elect immediate expensing under 179. He does not claim any available additional first-year depreciation. On July 15, 2022, Juan sells the asset. Click here to access depreciation table to use for this problem. a. Determine Juan's cost recovery for 2021. b. Determine Juan's cost recovery for 2022. ry of Tables 8.3 Regular MACRS table for personalty. Depreciation methods: 200 or 150 percent declining-balance switching to straight-line. Recovery periods: 3,5,7, 10, 15, 20 years. Convention: half-year. 8.4 Regular MACRS table for personalty. Depreciation method: 200 percent declining-balance switching to straight-line. Recovery periods: 3,5,7 years. Convention: mid-quarter. 8.5 MACRS optional straight-line table for personalty. Depreciation method: straight-line. Recovery periods: 3,5,7, 10, 15, 20 years. Convention: half-year. 8.6 Alternative minimum tax declining-balance table for personalty. Depreciation method: 150 percent declining-balance switching to straight-line. Recovery periods: 3,5,7,9.5, 10, 12 years. Convention: half-year. 8.7 Alternative depreciation system straight-line table for personalty. Depreciation method: straight-line. Recovery periods: 5, 10, 12 years. Convention: half-year. 8.8 Regular MACRS straight-line table for realty. Depreciation method: straight-line. 8.8 Regular MACRS straight-line table for realty. Depreciation method: straight-line. Recovery periods: 27.5, 31.5, 39 years. Convention: mid-month. 8.9 Alternative depreciation system straight-line table for realty. Depreciation method: straight-line. Recovery period: 30, 40 years. Convention: mid-month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts