Question: Could you answer not using excel, thanks Q1.a) Estimate the risk-free rate of return if asset Y, with a beta of 1.5, has an expected

Could you answer not using excel, thanks

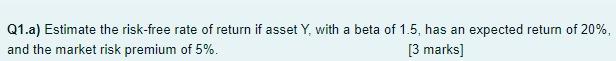

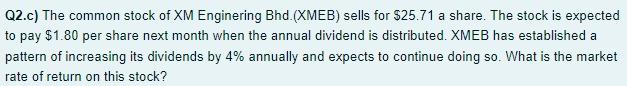

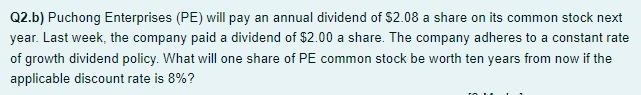

Q1.a) Estimate the risk-free rate of return if asset Y, with a beta of 1.5, has an expected return of 20%, and the market risk premium of 5%. [3 marks] Q2.c) The common stock of XM Enginering Bhd.(XMEB) sells for $25.71 a share. The stock is expected to pay $1.80 per share next month when the annual dividend is distributed. XMEB has established a pattern of increasing its dividends by 4% annually and expects to continue doing so. What is the market rate of return on this stock? Q2.b) Puchong Enterprises (PE) will pay an annual dividend of $2.08 a share on its common stock next year. Last week, the company paid a dividend of $2.00 a share. The company adheres to a constant rate of growth dividend policy. What will one share of PE common stock be worth ten years from now if the applicable discount rate is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts