Question: could you answer parts e,f and g? Problem 1 Suppose you are given the following information for two stocks, A and Expected Return on Expected

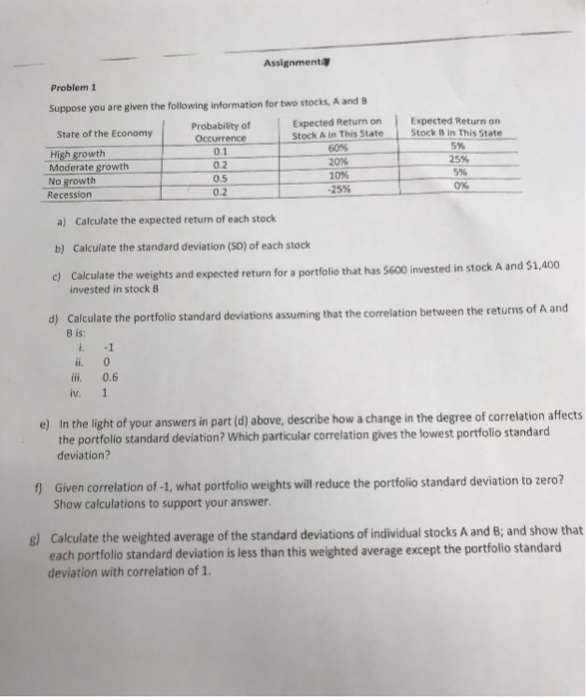

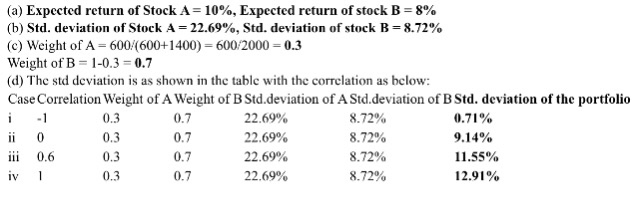

Problem 1 Suppose you are given the following information for two stocks, A and Expected Return on Expected Return on Stock A in This State Probability of State of the Economy 60% 20% 10% -25% Stock B in This State 5% 25% 5% 0% High growth Moderate growth 0.1 0.2 0.5 0.2 No growth Recession a) Calculate the expected return of each stock b) Calculate the standard deviation (SD) of each stock c) Calculate the weights and expected return for a portfolio that has $600 invested in stock A and $1,400 invested in stock B d) Calculate the portfolio standard deviations assuming that the correlation between the returns of A and B is: iv. 1 e) In the light of your answers in part (d) above, describe how a change in the degree of correlation affects the portfolio standard deviation? Which particular correlation gives the lowest portfolio standard deviation? Given correlation of -1, what portfolio weights will reduce the portfolio standard deviation to zero? Show calculations to support your answer g) Calculate the weighted average of the standard deviations of individual stocks A and 8, and show that each portfolio standard deviation is less than this weighted average except the portfolio standard deviation with correlation of 1. (a) Expected return of Stock A 10%, Expected return of stock B 8% (b) Std. deviation of Stock A-22.69%, Std. deviation of stock B-8.72% (c) Weight of A 600 (600+1400) 600 2000 0.3 Weight of B 1-0.3 0.7 (d) The std deviation is as shown in the table with the correlation as bclow: CaseCorrelation Weight of A Weight of B Std.deviation of A Std.deviation of B Std. deviation of the portfolio 0.3 0.3 0.3 0.3 22.69% 22.69% 22.69% 22.69% 8.72% 8.72% 8.72% 8.72% 0.71 % 9.14% 11.55% 12.91% 0.7 0.7 iv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts