Question: could you answer the Q one by one please 1. Fahad gets into a European call option to purchase one contract of stock X for

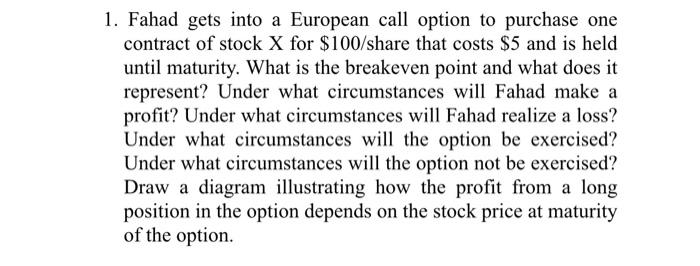

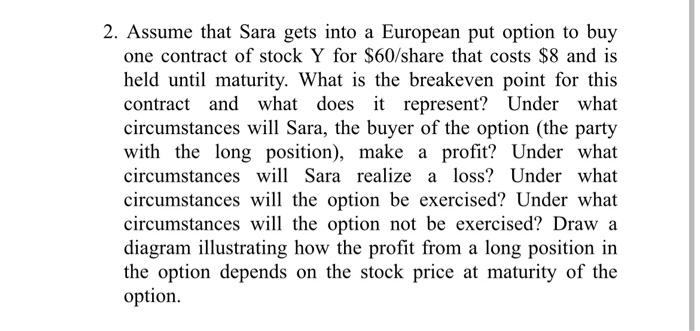

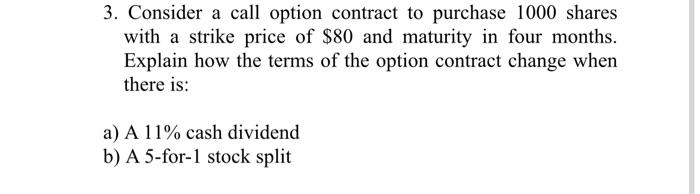

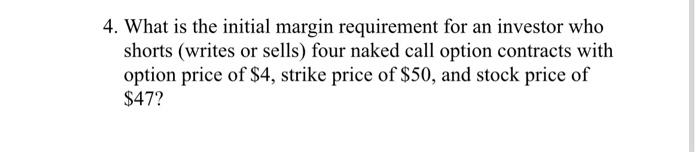

1. Fahad gets into a European call option to purchase one contract of stock X for $100/share that costs $5 and is held until maturity. What is the breakeven point and what does it represent? Under what circumstances will Fahad make a profit? Under what circumstances will Fahad realize a loss? Under what circumstances will the option be exercised? Under what circumstances will the option not be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option. 2. Assume that Sara gets into a European put option to buy one contract of stock Y for $60/share that costs $8 and is held until maturity. What is the breakeven point for this contract and what does it represent? Under what circumstances will Sara, the buyer of the option (the party with the long position), make a profit? Under what circumstances will Sara realize a loss? Under what circumstances will the option be exercised? Under what circumstances will the option not be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option. 3. Consider a call option contract to purchase 1000 shares with a strike price of $80 and maturity in four months. Explain how the terms of the option contract change when there is: a) A 11% cash dividend b) A 5-for-1 stock split 4. What is the initial margin requirement for an investor who shorts (writes or sells) four naked call option contracts with option price of $4, strike price of $50, and stock price of $47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts