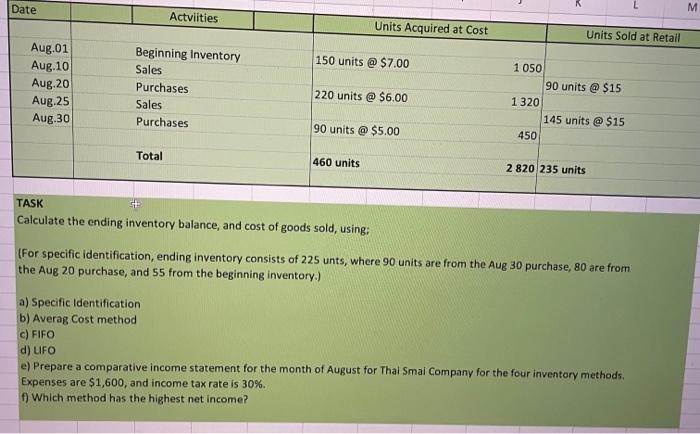

Question: Could you do it with explanations ? Date M Actviities Units Acquired at Cost Units Sold at Retail 150 units @ $7.00 Aug.01 Aug.10 Aug.20

Date M Actviities Units Acquired at Cost Units Sold at Retail 150 units @ $7.00 Aug.01 Aug.10 Aug.20 Aug. 25 Aug 30 Beginning Inventory Sales Purchases Sales Purchases 220 units @ $6.00 1 050 90 units @ $15 1 320 145 units @ $15 450 90 units @ $5.00 Total 460 units 2 820 235 units TASK Calculate the ending inventory balance, and cost of goods sold, using: (For specific identification, ending inventory consists of 225 unts, where 90 units are from the Aug 30 purchase, 80 are from the Aug 20 purchase, and 55 from the beginning inventory.) a) Specific identification b) Averag Cost method c) FIFO d) UFO e) Prepare a comparative income statement for the month of August for Thal Smal Company for the four inventory methods Expenses are $1,600, and income tax rate is 30%. f) Which method has the highest net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts