Question: could you double check question 2 Question 1 through Question 4 are based on the information on current spot and forward term structures (assume the

could you double check question 2

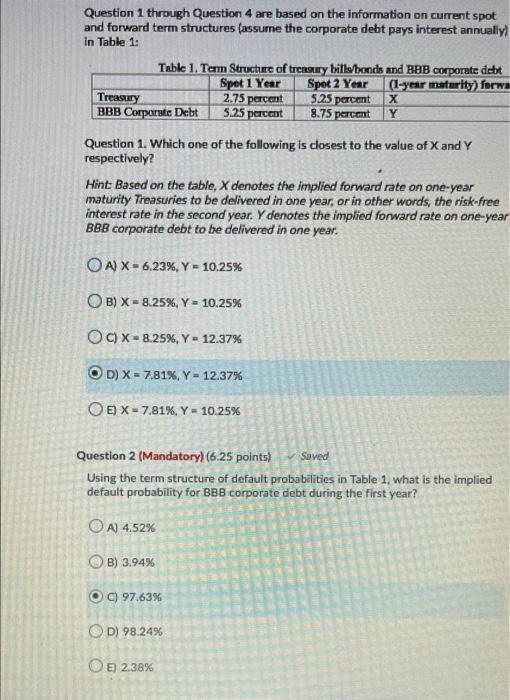

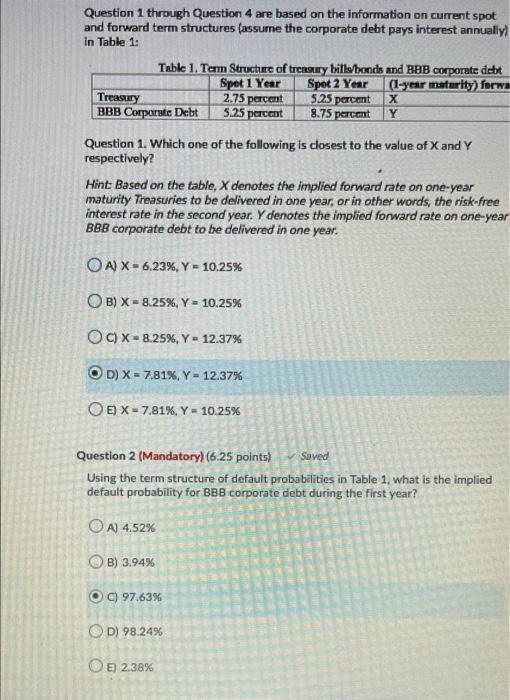

Question 1 through Question 4 are based on the information on current spot and forward term structures (assume the corporate debt pays interest annually) in Table 1: Table 1. Term Structure of treasury bills bonds and BOB corporate debt Spet 1 Year Spot 2 Year (1-year maturity) forwa Treasury 2.75 percent 525 percent BBB Corporate Debt 5.25 percent 8.75 percent Y Question 1. Which one of the following is dosest to the value of X and Y respectively? Hint: Based on the table, X denotes the implied forward rate on one-year maturity Treasuries to be delivered in one year, or in other words, the risk-free interest rate in the second year. Y denotes the implied forward rate on one-year BBB corporate debt to be delivered in one year. OA) X= 6.23%, Y - 10.25% OB) X-8.25%, Y = 10.25% OC) X = 8.25%, Y - 12.37% OD) X = 7,81%, Y = 12.37% O -7.81%, Y - 10.25% Question 2 (Mandatory) (6.25 points) Saved Using the term structure of default probabilities in Table 1. what is the implied default probability for BBB corporate debt during the first year? OA) 4.52% B) 3.94% OC) 97.63% OD) 98.24% O E) 2.38%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock