Question: Question 1 through Question 4 are based on the information on current spot and forward term structures (assume the corporate debt pays interest annually) in

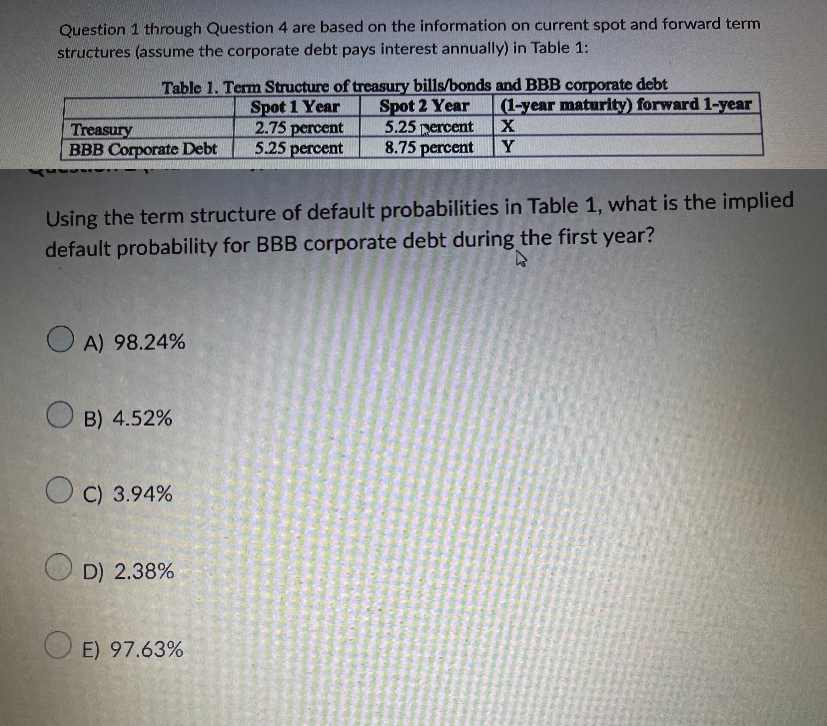

Question 1 through Question 4 are based on the information on current spot and forward term structures (assume the corporate debt pays interest annually) in Table 1: Table 1. Term Structure of treasury bills/bonds and BBB corporate debt (1-year maturity) forward 1-year Spot 1 Year 2.75 percent Spot 2 Year 5.25 percent X Treasury BBB Corporate Debt 5.25 percent 8.75 percent Y Using the term structure of default probabilities in Table 1, what is the implied default probability for BBB corporate debt during the first year? L OA) 98.24% B) 4.52% C) 3.94% D) 2.38% E) 97.63%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts