Question: Could you guys please help me with this question? using excel to explain it please, thank you so much. 3. (12 marks) Raymond wants to

Could you guys please help me with this question? using excel to explain it please, thank you so much.

Could you guys please help me with this question? using excel to explain it please, thank you so much.

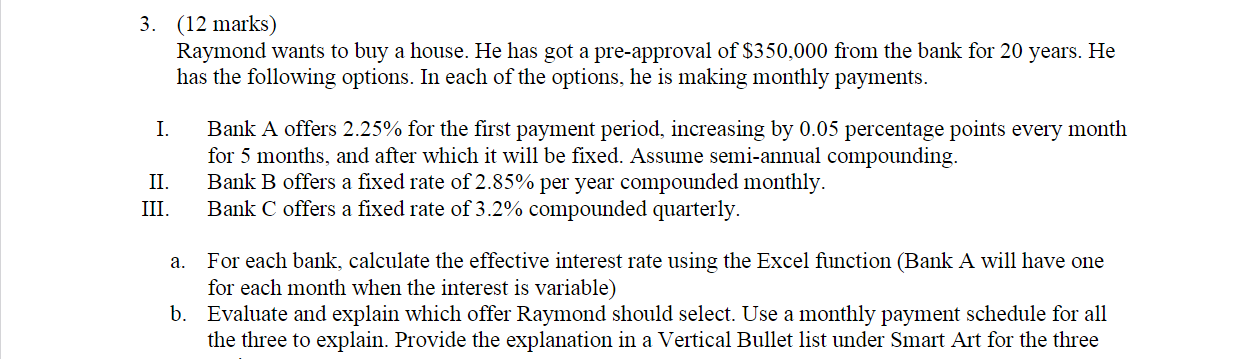

3. (12 marks) Raymond wants to buy a house. He has got a pre-approval of $350,000 from the bank for 20 years. He has the following options. In each of the options, he is making monthly payments. I. Bank A offers 2.25% for the first payment period, increasing by 0.05 percentage points every month for 5 months, and after which it will be fixed. Assume semi-annual compounding. II. Bank B offers a fixed rate of 2.85% per year compounded monthly. III. Bank C offers a fixed rate of 3.2% compounded quarterly. a. For each bank, calculate the effective interest rate using the Excel function (Bank A will have one for each month when the interest is variable) b. Evaluate and explain which offer Raymond should select. Use a monthly payment schedule for all the three to explain. Provide the explanation in a Vertical Bullet list under Smart Art for the three

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts