Question: Could you help me, please? It is in excel Problems with the IRR method. Acme Oscillators is considering an investment project that has the following

Could you help me, please? It is in excel

Could you help me, please? It is in excel

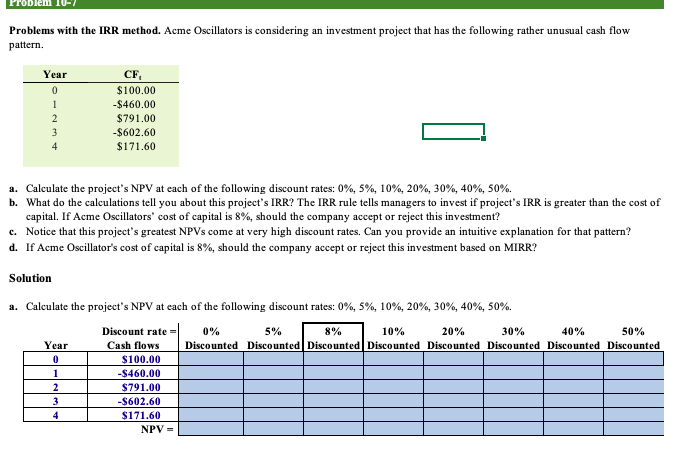

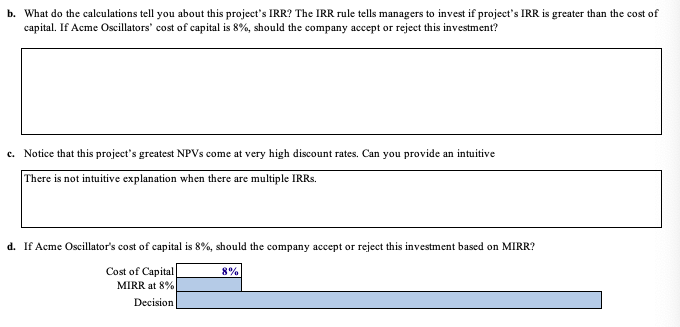

Problems with the IRR method. Acme Oscillators is considering an investment project that has the following rather unusual cash flow pattern. a. Calculate the project's NPV at each of the following discount rates: 0%,5%,10%,20%,30%,40%,50%. b. What do the calculations tell you about this project's IRR? The IRR rule tells managers to invest if project's IRR is greater than the cost of capital. If Acme Oscillators' cost of capital is 8%, should the company accept or reject this investment? c. Notice that this project's greatest NPVs come at very high discount rates. Can you provide an intuitive explanation for that pattern? d. If Acme Oscillator's cost of capital is 8%, should the company accept or reject this investment based on MIRR? Solution a. Calculate the project's NPV at each of the following discount rates: 0%,5%,10%,20%,30%,40%,50%. b. What do the calculations tell you about this project's IRR? The IRR rule tells managers to invest if project's IRR is greater than the cost of capital. If Acme Oscillators' cost of capital is 8%, should the company accept or reject this investment? c. Notice that this project's greatest NPVs come at very high discount rates. Can you provide an intuitive There is not intuitive explanation when there are multiple IRRs. d. If Acme Oscillator's cost of capital is 8%, should the company accept or reject this investment based on MIRR? Cost of Capital MIRR at 8% Decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts