Question: Problems with the IRR method Acme Oscillators is considering an imvestment project that has the following rather unusual cash flow pattem. IIIt a. Calculate the

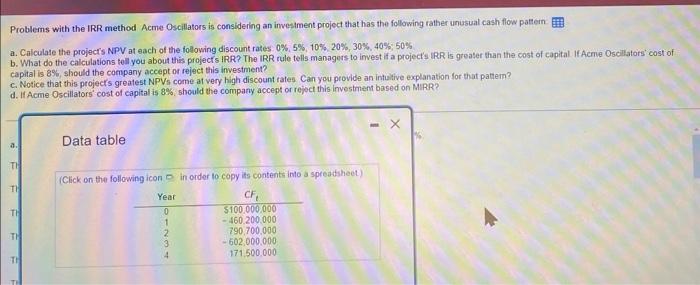

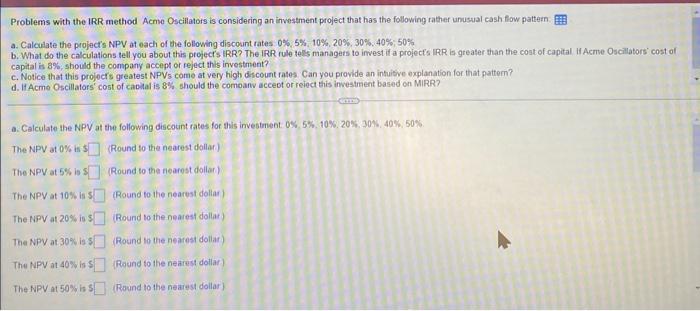

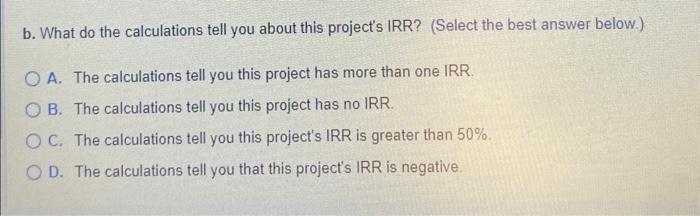

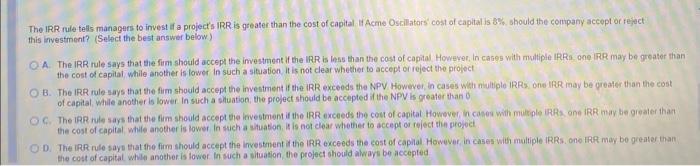

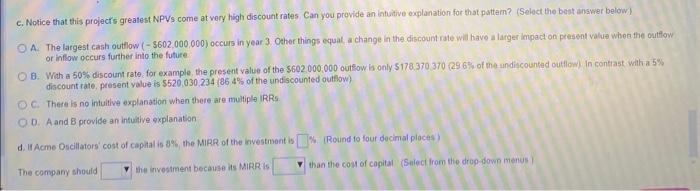

Problems with the IRR method Acme Oscillators is considering an imvestment project that has the following rather unusual cash flow pattem. IIIt a. Calculate the project's NPV at each of the following discount rates: 0%,5%,10%,20%,30%,40%;50%. a. Caiculate the projects NPV at each of the tolowing discount rates 0%,5%, Wo the calculations toll you about this project's IRR? The IRR rule tells managers to invest if a projects IRR is greater than the cost of capital If Acme Oscillators cost of capital is 8%, should the company accept or reject this investment? c. Notice that this project's greatest NPVs come at very high discount rates Can you provide an intulive explanation for thiat pattern? d. If Acme Oscillators cost of capital is 8%, should the company accept or reject this investment based on MIRR? a. Data table (Click on the following icon D in order to copy its contents into a spreatsheet. Problems with the IRR method Acme Oscillators is considering an investment project that has the following rather unusual cash flow pattern a. Calculate the project's NPV at each of the following discouint rates 0%,5%,10%,20%,30%,40%,50% b. What io the calculations tell you about this project' IRR? The IRR rule tells managets to imest if a project's IRR is greater than the coat of capital if Acmre Oscillators cost of capital is 8%, should the company accept or reject this investment? c. Notice that this projecrs greatest NPVs come at very high discount rates Can you provide an intuitive oxplanation for that pattern? d. IfAcme Oscillators' cost of caolal is 8% should the comoanv acceot or reiect this investment based on MIRR? b. What do the calculations tell you about this project's IRR? (Select the best answer below.) A. The calculations tell you this project has more than one IRR. B. The calculations tell you this project has no IRR. C. The calculations tell you this project's IRR is greater than 50%. D. The calculations tell you that this project's IRR is negative. The IRR rule telts managers to invest if a projects IRR is greater than the cost of capital it Acme Oscillatars cost of capital is b\%w. Bhould the company accept or reject this investment? (Select the best answer below) A. The IRR rule says that the firm should accept the imvestment if the IRR is less than the cost of capital However. In cases with mulliple IRRa. one IRR may be greater than the cost of capital while another is fower in such a situation it is not clear whether to accept or reject the project B. The IRR rule-says that the flim should accept the imventment if the IRR exceeds the NPV However, in cases with niultiple IRRs. one IRRR inay be greater than the cost of capital, While another is lower in such a shuation, the propect should be accepted if the NPN is greater than 0 . the cost of capital while another is lower In such a whatlion, it is not cleat whether to accept on reject tien progect 0. The IRR rule says that the fime should accept the investment it the IRR erceeds the cost of capilal However in cases with multiple IRRs. one IRR may be greater than the cost of capital while another is lower in such a situation, the project sheuld alwars be accepted c. Notice that this prolecrs greatest NPVs come at very high discount rates Can you provide an intuitive oxplanation for that pattern? (Select the best answer below) A. The largest cash outllow ($602,000,000) occurs in year 3 Oeher things equat a change in the discount rate will have al larger impact on present valua when the outflow or inflow occurs further into the future discount rate, present value is 5520,030.2341864% of the undiscounted outliow) C. There is no intulive explanation when there are multiple IRRs. 0. A and B provide an intuiltive explanation d. If Acme Oscillators' cost of caphal is 39 the MIRR of the investment is The company should the investment because its MIRR is than the com of capital (Sulect Irom the drog-down mengs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts