Question: could you help me solve this please? According to a payroll register summary of Lily Company, the amount of employees' gross pay in December was

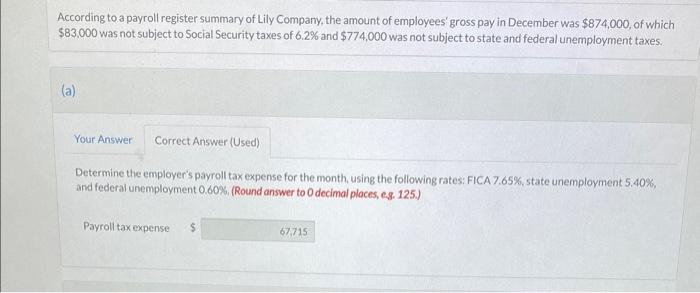

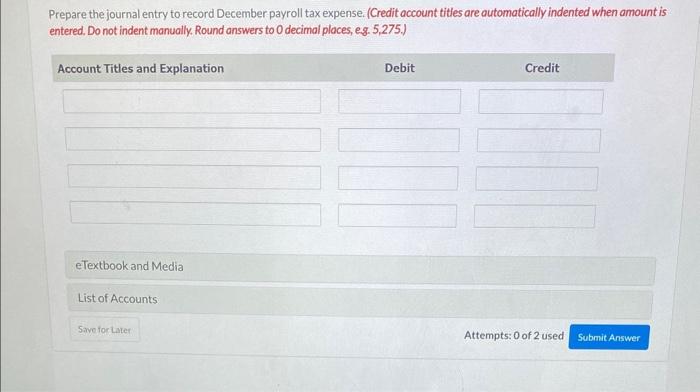

According to a payroll register summary of Lily Company, the amount of employees' gross pay in December was $874,000, of which $83.000 was not subject to Social Security taxes of 6.2% and $774,000 was not subject to state and federal unemployment taxes. (a) Determine the employer's payroll tax expense for the month, using the following rates: FICA 7.65%, state unemployment 5.40%, and federal unemployment 0.60%. (Round answer to 0 decimal places, e.s. 125.) Payroll tax expense $ Prepare the journal entry to record December payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal ploces, e. 5. 5.275.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts