Question: Help me prepare journal entry According to a payroll register summary of Cullumber Company, the amount of employees' gross pay in December was $1,071,000, o

Help me prepare journal entry

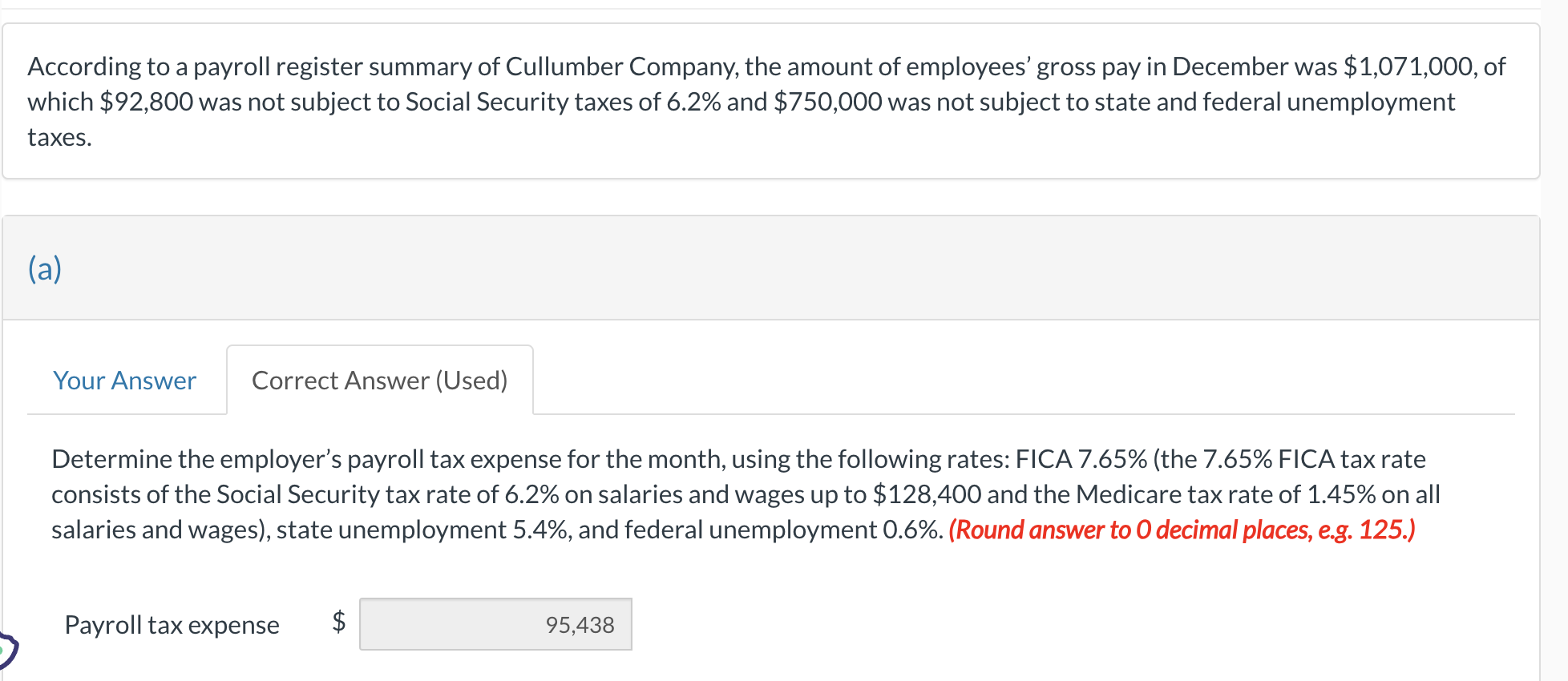

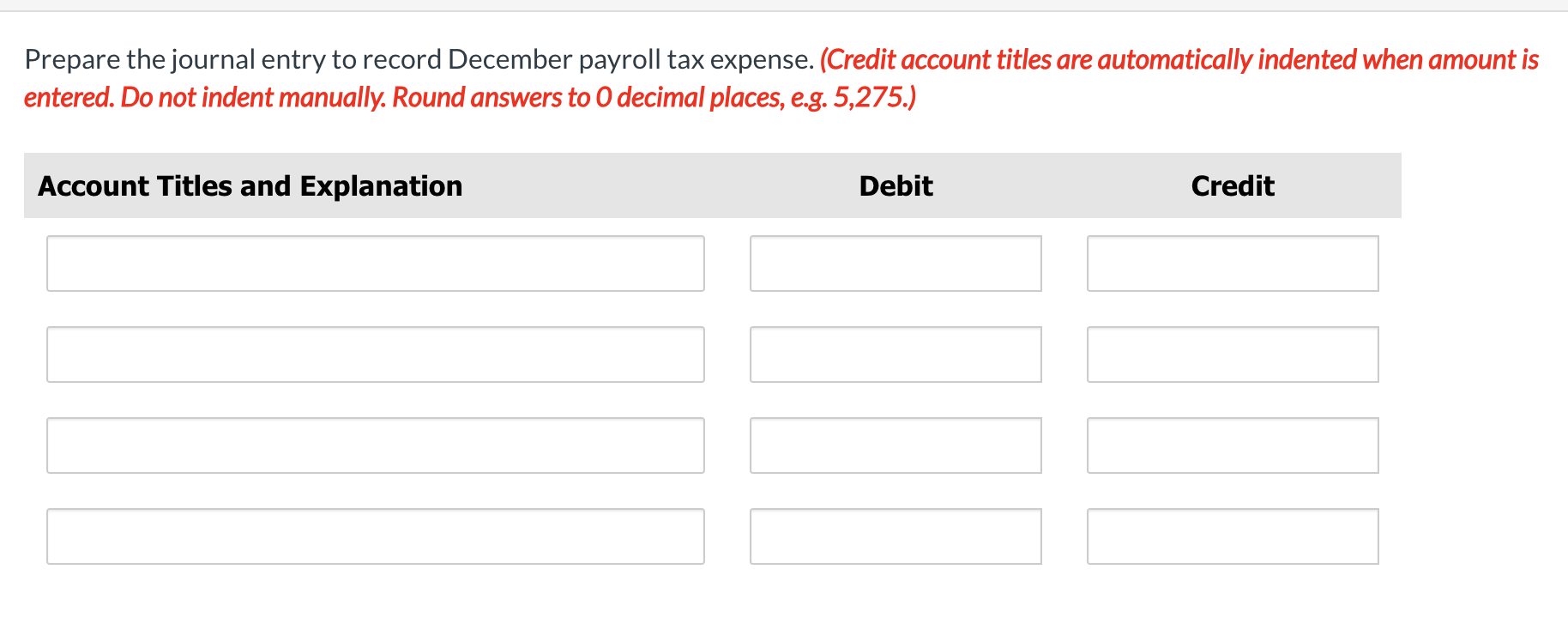

According to a payroll register summary of Cullumber Company, the amount of employees' gross pay in December was $1,071,000, o which $92,800 was not subject to Social Security taxes of 6.2% and $750,000 was not subject to state and federal unemployment taxes. (a) Determine the employer's payroll tax expense for the month, using the following rates: FICA 7.65\% (the 7.65\% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages), state unemployment 5.4%, and federal unemployment 0.6%. (Round answer to 0 decimal places, e.g. 125.) Payroll tax expense $ Prepare the journal entry to record December payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts