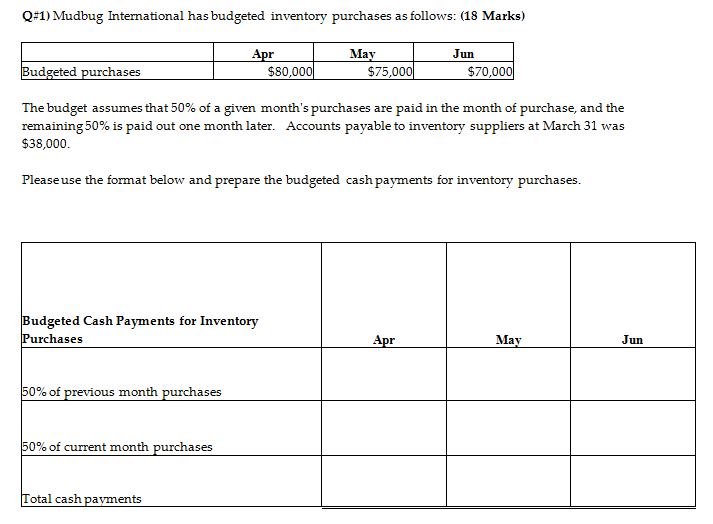

Question: COULD YOU PLEASE ANSWER ALL THE QUESTIONS USING THE IMAGES GIVEN AS REFERENCES ALSO, DO GIVE EXPLANATIONS WHILE ANSWERING EACH OF THE QUESTIONS. For Q1

COULD YOU PLEASE ANSWER ALL THE QUESTIONS USING THE IMAGES GIVEN AS REFERENCES

ALSO, DO GIVE EXPLANATIONS WHILE ANSWERING EACH OF THE QUESTIONS.

For Q1 shown in the image could also please show your calculations

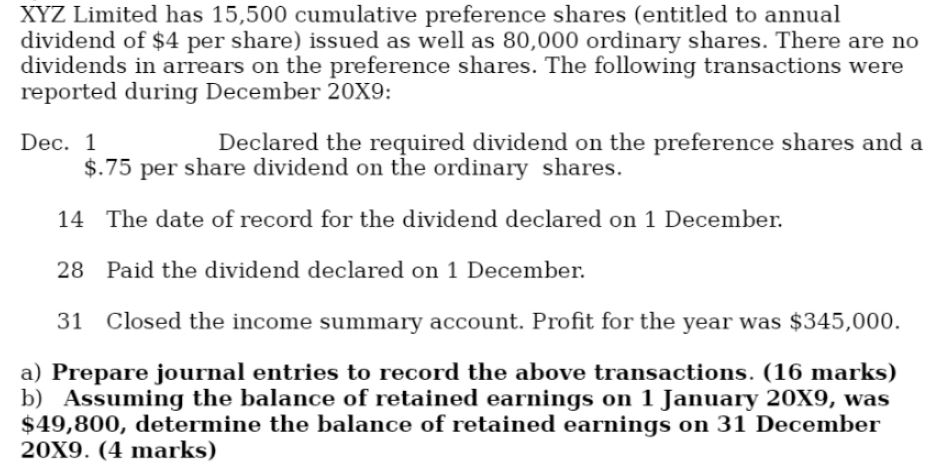

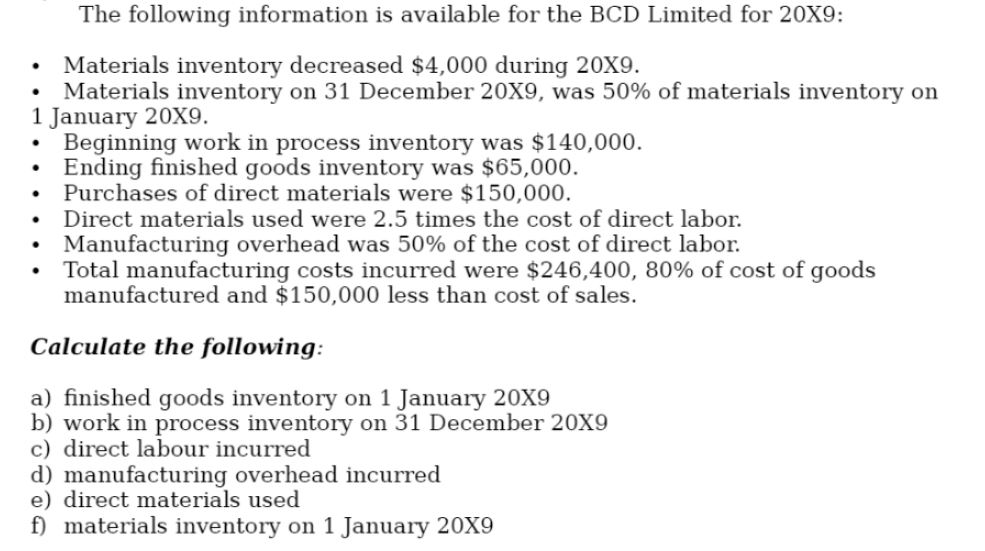

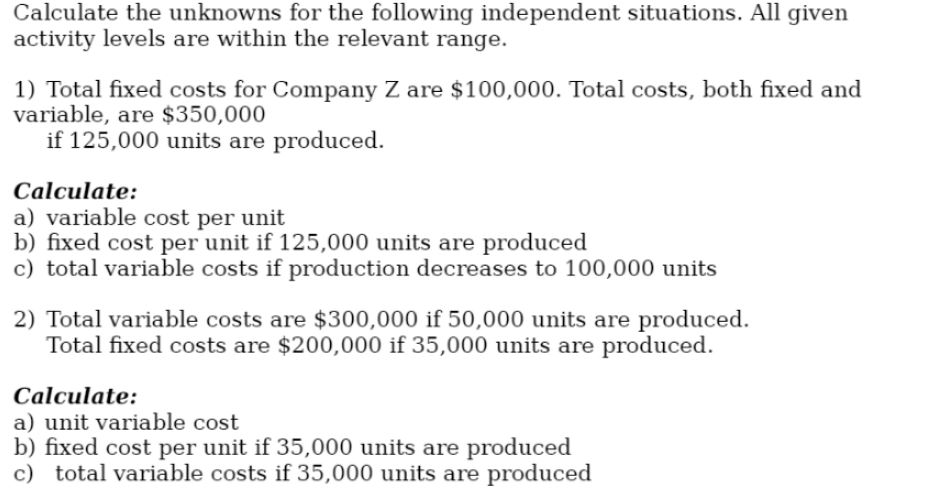

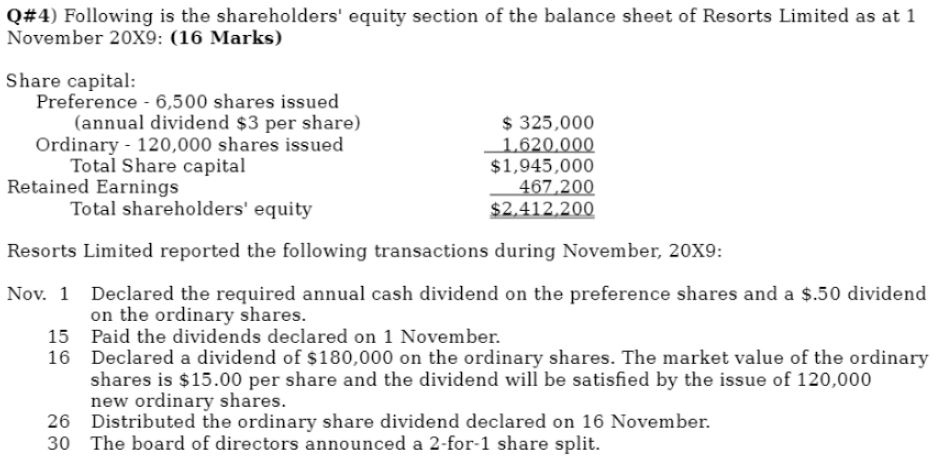

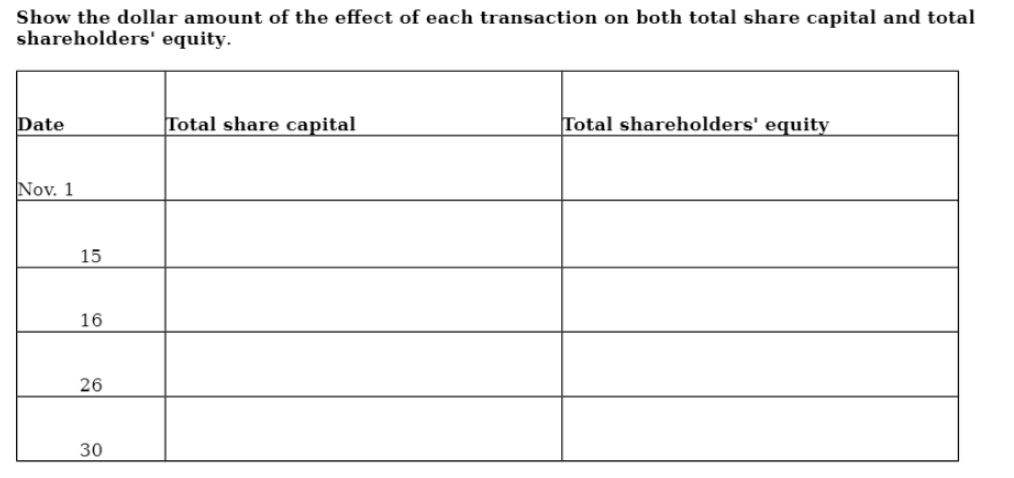

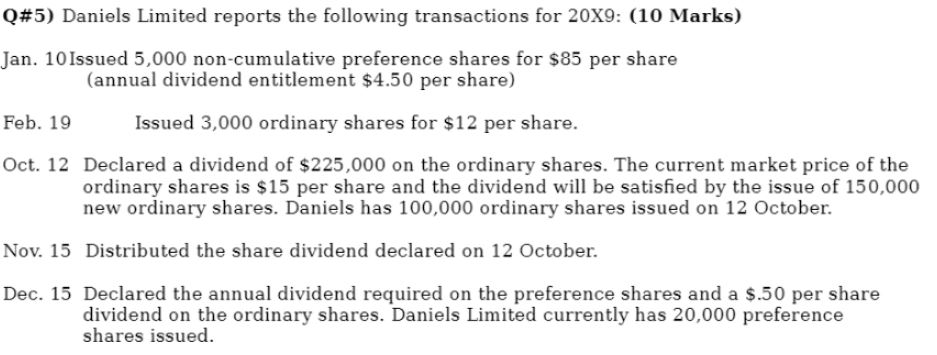

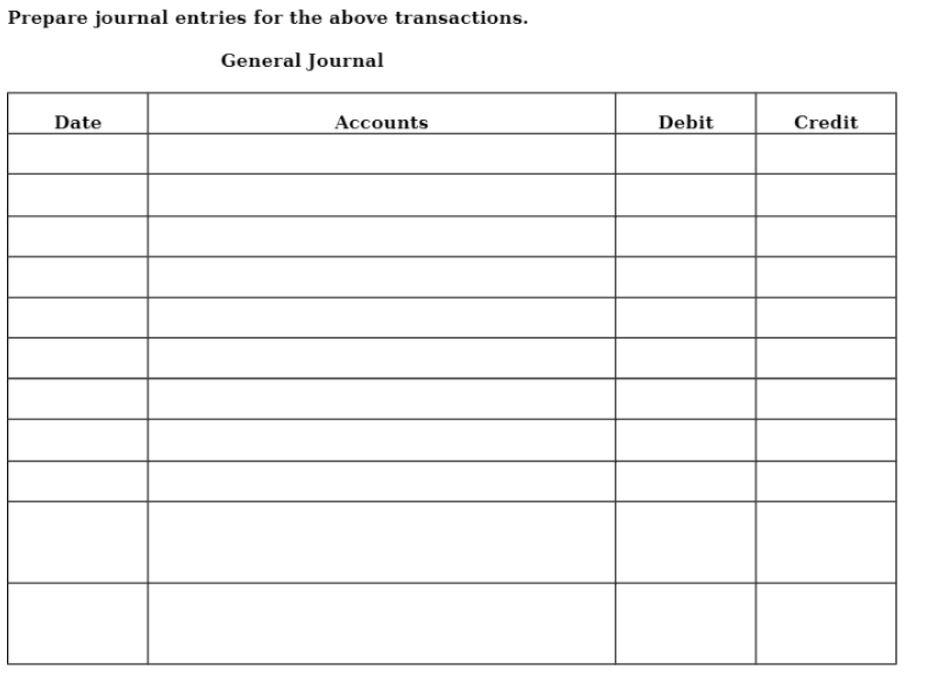

\fXYZ Limited has 15,500 cumulative preference shares (entitled to annual dividend of $4 per share] issued as well as 80,000 ordinary shares. There are no dividends in arrears on the preference shares. The following transactions were reported during December 20KB: Dec. 1 Declared the required dividend on the preference shares and a $.75 per share dividend on the ordinary shares. 14 The date of record for the dividend declared on 1 December: 28 Paid the dividend declared on 1 December. 31 Closed the income summaryr account. Prot for the year was $345,000. a) Prepare journal entries to record the above transactions. {16 marks) 1)) Assuming the balance of retained earnings on 1 january ZOXQ, was $49,800, determine the balance of retained earnings on 31 December 20X9. (4 marks) The following information is available for the BCD Limited for 20X9: - Materials invantory decreased $4,000 during 20X9. - Materials inventory on 31 December 20309, was 50% of materials inventory on 1 January 20X9. - Beginning work in process inventory was $140,000. - Ending nished goods inventory was $65,000. - Purchases of direct materials were $150,000. - Direct materials used were 2.5 times the cost of direct labor. . Manufacturing overhead was 50% of the cost of direct labor. Total manufacturing costs incurred were $246,400, 80% of cost of goods manufactured and $150,000 less than cost of sales. Calculate the following: a) nished goods inventory on 1 January 2010? 13) work in process inventory on 31 December 20XQ 0) direct labour incurred d) manufacturing overhead incurred 9) direct materials used I] materials inventory on 1 January 2039 Calculate the unknowns for the following independent situations. All given activity levels are within the relevant range. 1} Total xed costs for Company 2 are $100,000. Total costs, both xed and variable, are $350,000 if 125,000 units are produced. Calculate: a) variable cost per unit b) xed cost per unit if 125,000 units are produced 0) total variable costs if production decreases to 100,000 units 2} Total variable costs are $300,000 if 50,000 units are produced. Total xed costs are $200,000 if 35,000 units are produced. Calculate: a) unit variable cost b) xed cost per unit if 35,000 units are produced c) total variable costs if 35,000 units are produced Q#4) Foilo'Wing is the shareholders' equity section of the balance sheet of Resorts Limited as at 1 November 2039: {15 Marks) Share capital: Preference 6.500 shares issued (annual dividend $3 per share) 5 325.000 Ordinary 120.000 shares issued mm Total Share capital $1,945,000 Retained Earnings M Total shareholders' equity W Resorts Limited reported the following transactions during November, 2019: Nov 1 Declared the required annual cash dividend on the preference shares and a $.50 dividend on the ordinary shares. 15 Paid the dividends declared on 1 November. 16 Declared a dividend of $180,000 on the ordinary shares. The market value of the ordinary shares is $15.00 per share and the dividend will be satised by the issue of 120,000 new ordinary shares. 26 Distributed the ordinary share dividend declared on 16 November: 30 The board of directors announced a 2-for-1 share split. \f\f\f