Question: could you please answer question #7,8 Semlgor Problem #7 (2 points) In January, Gregory, a self-employed consultant, attended a conference in his area of specialty

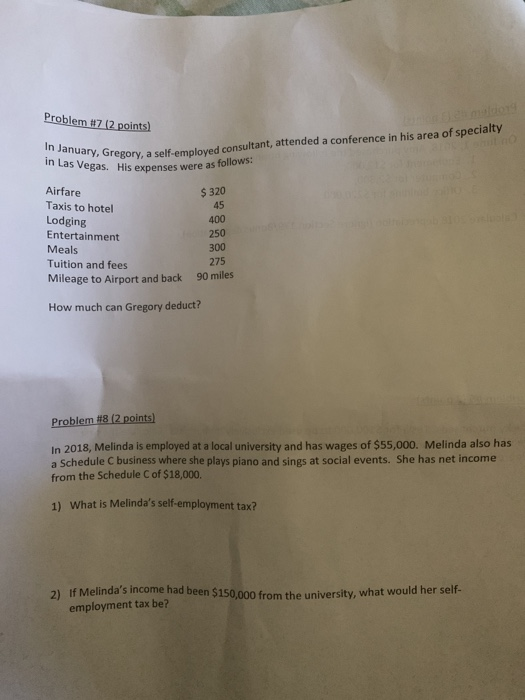

Semlgor Problem #7 (2 points) In January, Gregory, a self-employed consultant, attended a conference in his area of specialty in Las Vegas. His expenses were as follows: $320 45 Airfare Taxis to hotel Lodging Entertainment 400 250 300 Meals 275 Tuition and fees 90 miles Mileage to Airport and back How much can Gregory deduct? Problem #8 (2 points) In 2018, Melinda is employed at a local university and has wages of $55,000. Melinda also has a Schedule C business where she plays piano and sings at social events. She has net income from the Schedule C of $18,000. 1) What is Melinda's self-employment tax? 2) If Melinda's income had been $150,000 from the university, what would her self- employment tax be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts